Withu Loans has been making waves in the personal loan space with its promises of quick cash. However, despite flashy advertising, numerous borrowers allege predatory lending practices. This investigative report will analyze real customer complaints and reviews to determine if Withu Loans is legit or a scam.

Why This Report Matters

Choosing the wrong lender can spiral borrowers into endless debt. Withu Loans markets loans from $100 to $5,000, with minimal eligibility requirements. But is it too good to be true? By studying actual customer experiences, this report aims to uncover the real lending practices behind the Withu Loans brand.

Understanding the true costs and risks can help consumers make informed decisions when selecting personal loan companies. If Withu Loans’ practices prove detrimental, this report’s findings could prevent financial disaster for vulnerable borrowers.

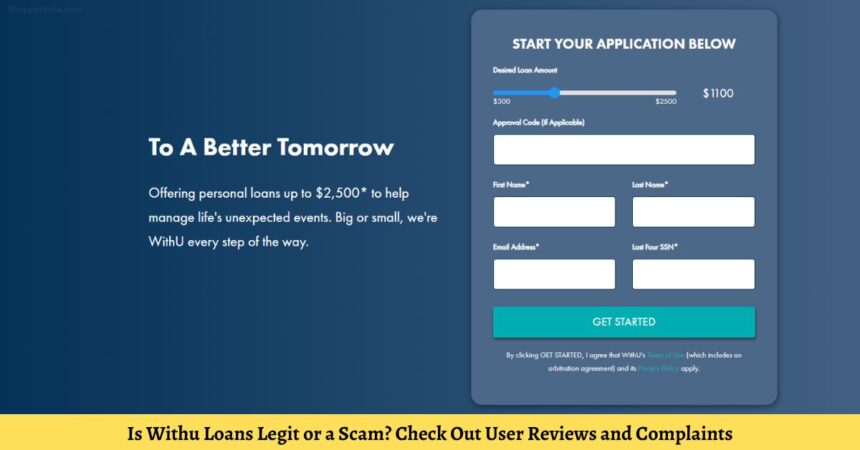

An Overview of Withu Loans

Withu Loans offers high-interest personal loans primarily marketed for emergency expenses. The company promises convenient access to funds from $300 to $2,500 for qualifying borrowers.

Loans have payback terms from 3 to 18 months, with reasonable interest rates. However, as we’ll explore, the real rates are often much higher.

Withu Loans operates online and is owned by the Otoe-Missouria Tribe based in Oklahoma. The tribe claims sovereignty exempts them from state lending laws.

But does tribal ownership justify predatory lending? Further investigation into real customer experiences will uncover the truth.

Analyzing User Reviews and Complaints of Withu Loans On Trustpilot

Trustpilot hosts dozens of Withu Loans customer reviews. What do actual borrowers have to say?

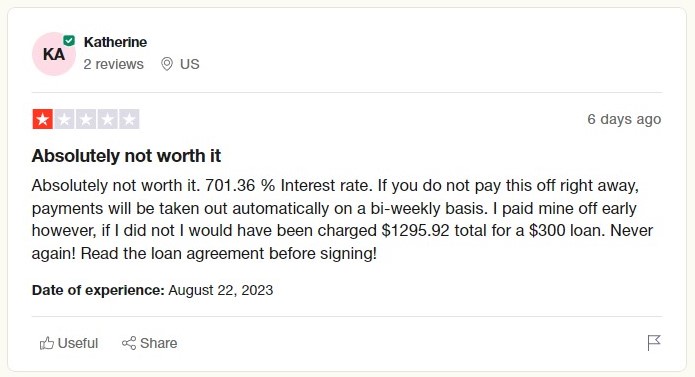

Exorbitant Interest Rates the Norm

A common theme is shock at the real interest rates, often 500-700% APR. As one 1-star review states:

“They flatout lie on their advertisement. Read every review. Interest rates are over 400% if you borrow $300 you’ll pay triple that back.”

Many share stories of repaying double or triple the original loan amount due to astronomical interest fees. This contradicts the reasonable rates advertised.

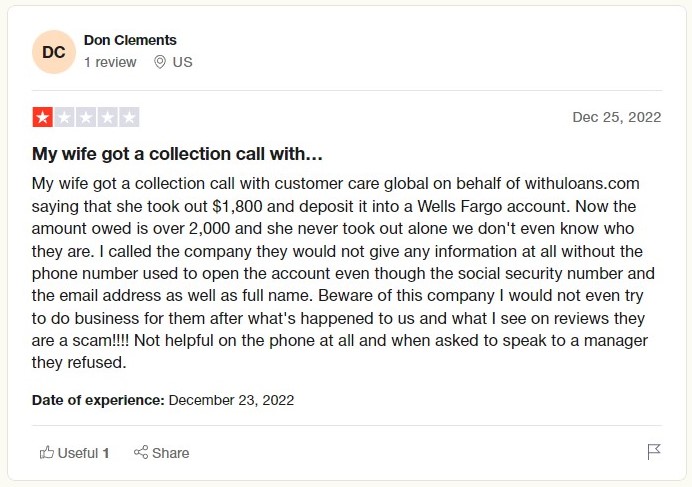

Accounts Opened Fraudulently

Numerous complaints allege Withu Loans opened accounts without consent and deposited unsolicited loans.

For example:

“I received text messages from WithU Loans stating that I had been accepted for a loan. The only problem is that I did not execute a loan with WithU Loans, nor did I receive any funds from them.”

This potentially fraudulent practice burdens victims with unwanted loans.

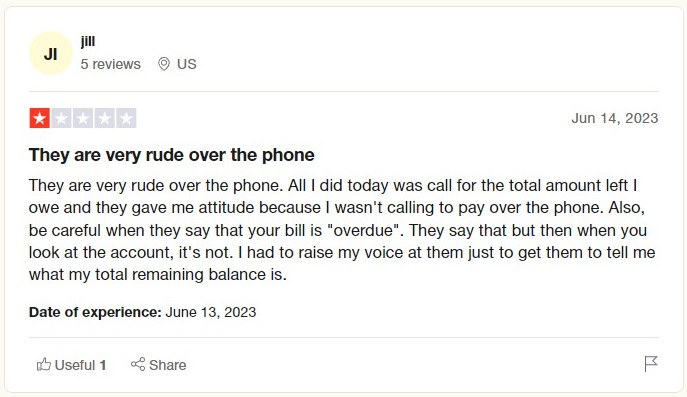

Aggressive Collections and Harassment Complaints

Reviews frequently reference aggressive collections efforts even when payments are on time. As one reviewer explains:

“They are very rude over the phone. All I did today was call for the total amount left I owe and they gave me attitude…”

Such harassment is unacceptable from lenders.

Based on these Trustpilot reviews, Withu Loans exhibits some serious red flags. But are customer complaints on other sites similar?

BBB Complaints Confirm Abusive Practices of Withu

The Better Business Bureau (BBB) has processed numerous official complaints against Withu Loans. And the experiences echo Trustpilot.

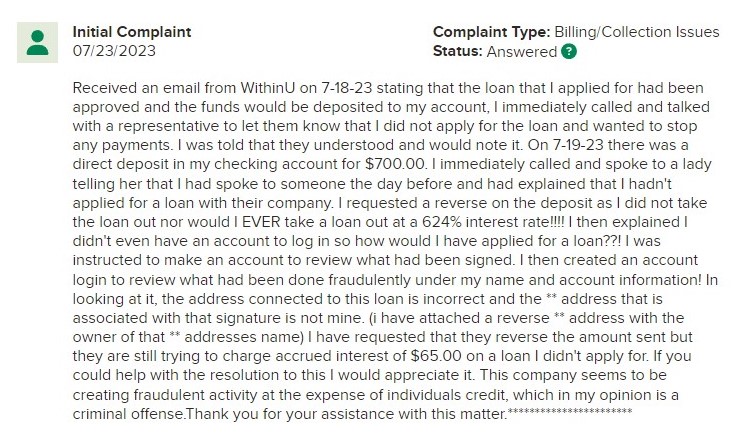

Loans Issued Without Authorization

Many BBB complaints state Withu Loans deposited money into accounts without approval. Like this example:

“I immediately called and talked with a representative to let them know that I did not apply for the loan and wanted to stop any payments.”

Yet Withu Loans still expected repayment.

Interest Rates Far Exceed Disclosure

BBB complainants, like Trustpilot reviewers, share shock at actual interest charged versus marketed rates. For instance:

“They completely lied about the program. I will be paying $5000 after borrowing $1,000 after I did the math of what they have been fraudulently taking!!!”

Such usury violates ethical lending.

Failure to Resolve Fraudulent Accounts

Victims describe Withu Loans as “difficult to work with” and unhelpful in resolving fraudulently opened accounts. As one complainant explains:

“They are so difficult to work with to resolve the issue. All emails they use and phone numbers are generic…”

This lack of accountability is unacceptable.

The BBB has warned Withu Loans about complaints, with minimal response. The problems clearly persist.

Federal Lawsuit Exposes Predatory Lending Practices

A recently filed federal class action lawsuit provides insight into Withu Loans’ potentially illegal lending activities.

On April 18, 2023, plaintiff Ashley Cochran filed suit against Withu Loans (W6LS Inc.) and partners in the U.S. District Court for the Middle District of Florida. The complaint alleges racketeering and usury violations.

Specifically, it asserts Withu Loans conspires to ensnare borrowers in loans with unlawful interest rates exceeding 520%. This violates the federal Racketeer Influenced and Corrupt Organizations (RICO) Act.

The lawsuit claims Withu Loans’ predatory practices constitute an illegal enterprise designed to generate massive profits through usury. Plaintiffs seek justice under RICO statutes targeting such corrupt organizations.

Defendants were served in late April and early May. The case remains active, with some settlements pending.

This suit provides legal confirmation that Withu Loans potentially operates a systematic racketeering scheme nationwide. The serious allegations warrant intense scrutiny of Withu Loans and associated companies.

Overall, the newly filed RICO class action highlights Withu Loans’ potentially abusive and fraudulent lending practices that require immediate investigation and reform.

Red Flags: What to Watch For

Based on consistent borrower complaints and legal action, Withu Loans exhibits multiple red flags:

- Deceptive marketing promising reasonable interest rates when reality is 3-5x higher

- Unsolicited loans deposited without applying

- Aggressive collections and harassment over repayment

- Lack of accountability and assistance for fraud victims

- Potentially illegal interest rates in the 500-700% range

Consumers should avoid lenders demonstrating such characteristics. Legitimate personal loans exist without these predatory practices.

The Verdict: Withu Loans a High-Risk Lender

Considering actual customer reviews and complaints, Withu Loans acts questionably at best, illegally at worst. Their lending tactics appear predatory and designed to trap borrowers in debt cycles.

Consumers are wise to explore alternatives for personal loans. If you still wish to proceed with caution, be sure to document all interactions and contracts in case you become victimized.

Weighing all evidence, Withu Loans currently seems a high-risk lender best avoided. Far too many borrowers report being deceived and financially devastated to recommend otherwise. Proceed with extreme caution and avoid if possible.

Key Takeaways: Protecting Yourself as a Borrower

- Research lenders thoroughly before applying – don’t trust advertisements.

- Document everything in writing throughout the lending process.

- Understand the real interest rates and total repayment costs before accepting loans.

- Don’t provide personal information or bank access unless certain you understand the loan terms.

- Report any unsolicited loan deposits or account openings as fraud immediately.

- Consult an attorney if you suspect predatory lending practices or usury.

Stay vigilant and don’t become another victim. For safe personal loans, trust but verify through real customer reviews. Avoid lenders like Withu Loans exhibiting multiple red flags. Protect yourself and your financial future.

Frequently Asked Questions (FAQs)

1. Is Withu Loans Real or Fake Site?

Based on numerous customer complaints and a pending federal lawsuit, Withu Loans exhibits many warning signs of a predatory lender and potential scam operation. Consumers should approach with extreme caution.

2. What interest rates does Withu Loans charge?

There is not much clarification on interest rates from Withu Loans but they advertises interest rate is reasonable. But, customer reports reveal actual interest charged is often in the 500-700% APR range. This results in repaying 2-5x the loan amount.

3. Does Withu Loans deposit loans without consent?

Yes, many customers have reported accounts being opened and loans deposited without their authorization. This is a major red flag for fraudulent activity.

4. How can I cancel a Withu Loans account?

Immediately contact Withu Loans and your bank to report the unauthorized account and stop payments. File complaints with regulatory agencies. However, Withu Loans often continues collections even on disputed loans.

5. What should I do if Withu Loans opened an account in my name?

Report it as identity fraud to Withu Loans, credit bureaus, the FTC, and your local law enforcement. Submit an affidavit. Consult a lawyer regarding legal options. Act quickly before the damage worsens.

6. Are Withu Loans’ practices legal?

No. While they claim tribal immunity, the illegally high interest rates over 500% violate federal lending laws. Withu Loans is facing a federal racketeering lawsuit regarding its predatory lending.

Compared to other companies, WithU Loans’ interest rates are sky-high. I won’t use or recommend their services.

I requested to cancel my loan three times, but they ignored it, causing overdraft fees due to withdrawals on inconvenient dates. This company is a nightmare.

customer service is horrendous. They messed up my loan due date and didn’t fix it, even after sending them documentation. I won’t recommend or return as a customer.

Taking a loan from withu loans turned into a disaster. I borrowed $1,000, and they want $5,000 in return. Never dealing with this company again!

The APR is exorbitant, and I couldn’t review the documents until after receiving the loan. I returned it immediately.

Terrible experience with with u Loan! I was just inquiring about a loan, and they pushed me to apply online. They estimated a 47.95% APR for a $2,100 loan. Paying back $900 a month plus interest is ridiculous!