Unwanted calls or texts from supposed debt collectors can induce anxiety. You may wonder – is this a legitimate attempt to recover money I owe? Or am I being targeted by scammers looking to exploit me?

Recent headlines about the Unifin debt collector’s text scam explore this exact dilemma. Consumers across America have reported receiving suspicious texts claiming to be from Unifin and demanding payment.

With debt collection scams on the rise, it’s crucial to educate yourself on how to verify real collectors and spot potential frauds. After reading this article, you’ll be better equipped to handle debt calls safely and guard against predatory schemes.

What is Unifin, Inc?

Unifin is a debt collection agency and business process outsourcing firm headquartered in Niles, Illinois. According to their website, they work on behalf of creditors and aim to find “solutions that work around [consumers’] capabilities, finances and current life situations.”

The company was founded in 2011 and is licensed to operate in multiple states. They service a range of industries including telecommunications, utilities, healthcare, financial services, and more.

They states that they are committed to following all applicable laws and regulations. Their website claims they want to ensure consumers are “treated fairly and with dignity.”

However, not all reports paint such a rosy picture of Unifin’s conduct (more on that shortly).

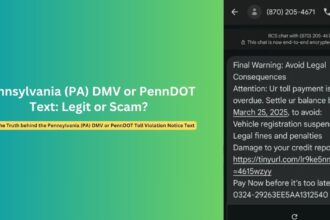

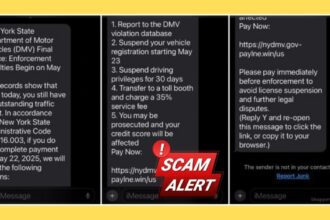

How Do Unifin’s Debt Collection Call, Texts, and Email Scams Work?

Numerous people have posted about receiving suspicious phone calls, text messages, or emails from individuals claiming to represent Unifin and demanding payment for an unpaid debt.

Often these messages:

- Contain threats about legal action or impacts to your credit if you don’t pay immediately.

- Provide links to websites for you to submit payment info.

- Use urgent language insisting you call back a provided number right away.

- May reference debts you don’t recall or accounts never in your name.

- Come from phone numbers that trace back to nowhere.

Unfortunately, some consumers have fallen for these tactics and ended up having their personal information or money stolen through these scams.

User Reviews & Complaints Reveals the Bitter Truth

Online reviews paint a very troubling picture of Unifin’s real-world conduct as a debt collector.

- Abusive Practices: Many reports of aggressive and abusive language, harassment, and threats used by Unifin representatives.

- Debts Not Owed: Numerous people contacted about debts already paid off long ago or never theirs to begin with.

- Lack of Validation: Failure to provide documentation validating debts when asked, as required by law.

- Identity Theft Risks: Requests for personal info that could expose people to fraud and identity theft.

- High Pressure Tactics: Attempts to intimidate and bully people into immediate payment without chance to verify debts first.

Consumer warning sites like the Better Business Bureau feature hundreds of concerning complaints about Unifin. Overall, a pattern of unethical behavior emerges.

Does Unifin Violate the Fair Debt Collection Practices Act?

The Fair Debt Collection Practices Act (FDCPA) is a federal law regulating debt collectors. It aims to eliminate abusive tactics and protect consumers.

Based on the available reviews and complaints, many experts contend the agency routinely violates FDCPA regulations prohibiting:

- Deceptive representations of debts.

- Threatening/harassing contacts.

- Publishing consumer debt info.

- Communicating at inconvenient times/places.

- Failure to verify disputed debts.

This certainly appears to be the case based on people’s reported experiences. Numerous recent lawsuits have also accused Unifin of breaching FDCPA rules.

Ongoing Lawsuits Further Dispute the Ethics

Dozens of lawsuits were filed against Unifin in 2022/2023 alleging FDCPA violations and abusive practices like:

- Attempting collections on invalid, disputed, or expired debts.

- Misrepresenting debt amounts or status.

- Failing to verify debts when requested.

- Harassing consumers with threatening calls.

- Illegally contacting third parties about debts.

- Continuing collections on disputed/unvalidated accounts.

These lawsuits clearly contend that Unifin engages in predatory conduct violating consumer rights and protections. The cases remain ongoing across multiple states.

So Is Unifin a Legitimate Debt Collector or a Scam Outfit?

Given the overarching pattern of apparent FDCPA breaches, fraudulent scams, and unverified harassment claims, Unifin exhibits many warning signs of an unethical, abusive debt collection operation.

While legally registered as a collector, their real-world tactics seemingly rely on bullying and deceit. The sheer volume of alarming complaints cannot be ignored.

The preponderance of evidence suggests avoiding engagement with Unifin until they address their lack of transparency and due diligence.

For people unfairly targeted, legal action may be the only recourse to stop the harassment.

How to Identify Fake Debt Collection Agencies

How can you determine if a supposed debt collector contacting you is a fraudulent operation? Watch out for:

- Aggressive demands for immediate payment without chance to verify the debt first. Legitimate collectors will allow time to confirm details.

- Refusal to provide physical company address and other validating information.

- Lack of a mailed notice formally outlining the debt details within 5 days of first contact.

- Odd payment methods like prepaid cards, wire transfers, etc. Most will accept more traditional payment options.

- Threats about arrest, lawsuits, or other consequences that seem exaggerated.

- Calling at very early/late hours outside the acceptable 8am-9pm window.

- Debts that you don’t recognize or find on your credit report at all.

- Requests for sensitive personal details like full SSN, bank account numbers, etc.

- Any indication they’ve contacted your employer or family about the debt.

Trust your instincts. If something feels suspicious or “off”, proceed cautiously until you can independently validate the collector and debt. Don’t let anyone pressure you into divulging information or submitting payments without proper verification first.

What to do if you get scammed by a fake debt collector

If you shared personal details or made any payments to a scammer posing as a debt collector, take these steps:

- Contact your bank if you paid by debit/credit card. Report the charges as fraudulent if possible. For other payment types, work to get the transactions reversed.

- Place a fraud alert on your credit files with Equifax, Experian and TransUnion to help prevent identity theft. Consider a credit freeze too.

- Monitor bank accounts and credit reports closely for any signs of misuse of your information.

- Change online account passwords, security questions, and PINs if the scammer may have accessed any of this information. Enable two-factor authentication where possible.

- File a complaint with the Consumer Financial Protection Bureau and Federal Trade Commission detailing the fake debt collector’s actions.

- Contact your state attorney general’s office to report the fraud. Your state may have additional resources or ability to investigate the fraud.

- Consider reporting it to your local police department as well to have an official record. This could help if your information is used to commit crimes later.

- Consult a consumer law attorney to understand if you may have legal recourse against the scammers or avenues to prevent them from victimizing others.

How to Report Fake Debt Collectors to the Authorities

To officially report scammers impersonating debt collectors, here are some key places to file complaints and provide details:

- Federal Trade Commission (FTC) – Online complaint form or call 877-FTC-HELP.

- Consumer Financial Protection Bureau (CFPB) – Submit a complaint online or call 855-411-CFPB.

- State Attorney General’s Office – Find state AG contact information via consumerresources.org or your state’s official website.

- Better Business Bureau (BBB) – File a scam report on BBB.org to expose fraudulent companies.

- Local Police – Call the non-emergency number for your city or visit the station in-person to file a report.

The more evidence collected by authorities on fake debt collection scams, the better the chances of bringing criminal charges against scammers and enacting protections for consumers. Do your part by promptly reporting any suspicious contacts or activities.

FAQs

1. What types of debts does Unifin attempt to collect on?

According to consumer complaints, they appears to collect on a range of past-due debts including credit cards, utilities, telecom bills, medical bills, and more. They seem to work for various creditors and industries.

2. What should I do if I get a text/call demanding payment for a debt I don’t recognize?

Do not provide any information or payment over the phone/text. Request written validation of the mysterious debt first and review your credit reports for clues. If it appears fraudulent, report the scammers.

3. How can I verify if a call from Unifin is Real or Fake?

Ask for a mailed validation notice outlining specifics of the debt, and independently confirm with the original creditor that they assigned collection rights to Unifin. Do not provide sensitive info or payment solely based on a phone call.

4. Can I sue a fake debt collector for contacting me?

If scammers violate certain consumer protection laws, you may be able to pursue legal action with the help of a consumer lawyer. Laws like the FDCPA allow damages for abusive collection practices.

5. Is it legal for Unifin to threaten me with arrest or other consequences?

No. Under the FDCPA, collectors cannot falsely threaten consumers with jail time or other unreasonable consequences. Any physically threatening language or excessive harassment should be reported.

The Bottom Line

In conclusion, debt collection scams are proliferating, making it crucial to separate legitimate recovery efforts from fraudulent schemes.

The Unifin text scam offers a sobering case revealing how consumers can be harassed and exploited through abusive tactics.

This article has provided essential facts and tips to hopefully prevent you from becoming the next victim. Scrutinize every call, text, and mailed notice carefully.

Arm yourself with knowledge of your rights and warning signs. And never let aggressive collectors intimidate you into payments without first independently confirming the debt’s authenticity.

Stay vigilant and exercise your consumer power.