Nowofloan has been gaining attention lately, but is this financial services company legit or a scam? With confusing claims and mixed reviews, it’s hard to tell if Nowofloan is fake or real. This article takes a deep dive into Nowofloan, analyzing user complaints, business practices, and regulatory status to uncover the truth.

What is Nowofloan?

Nowofloan markets itself as an online financial consultation and services company based in India. Their website states that they provide memberships that offer access to financial experts, loan applications through partner NBFCs (non-banking financial companies), and other benefits.

The two main membership options on Nowofloan are:

- Premium Membership: For personal loans

- Platinum Membership: For business loans

According to Nowofloan, these memberships allow customers to get pre-approved loan offers from multiple partner lenders through a 100% digital process.

Exploring Nowofloan’s Offerings and Claims

Nowofloan claims their memberships provide the following key features:

- Access to financial consultation from experts

- Ability to apply for loans through tied-up NBFC partners

- Personalized portal to track loan application status

- Referral program to earn commissions

The website states Nowofloan has served over 225K customers and many channel partners. It displays logos of various NBFCs and banks that it claims to be partnered with.

Nowofloan emphasizes that membership fees paid to them are the only payments customers make. The final loan approval and disbursement happens directly through the partner NBFCs.

How Does Nowofloan’s Loan Process Work?

Nowofloan outlines a 6-step loan application process for its members:

- Quick registration

- Check eligibility

- Purchase membership

- Submit documents

- Bank verification

- Final approval by bank

They position themselves as an intermediary that facilitates the application and lending process through their NBFC partners.

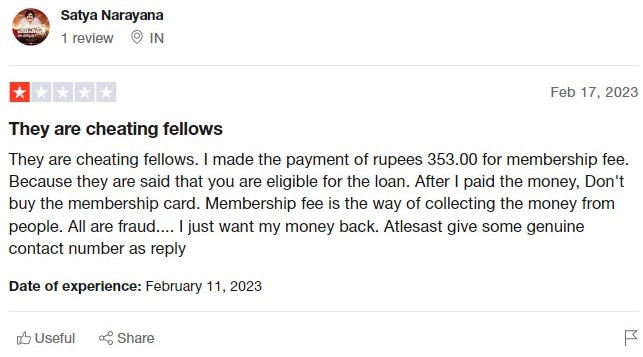

Analyzing Nowofloan User Reviews and Complaints in TrustPilot

Nowofloan currently has a 3.1 rating on Trustpilot based on 6 reviews. But a concerning 67% of the reviews are 1-star complaints from customers alleging fraud.

Many reviewers state Nowofloan charged them membership fees but did not provide the promised loans. Others call them out for blocking users after taking payments. There are also accusations about the company using fake 5-star reviews to mislead people..

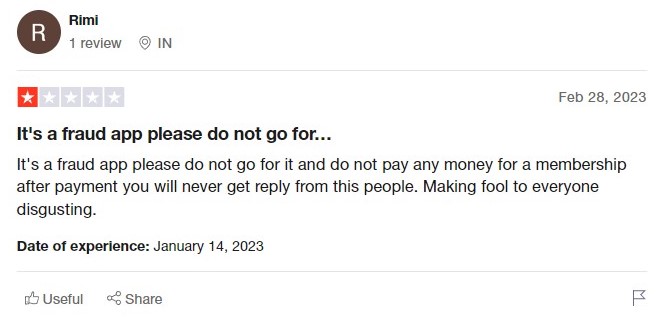

Exploring Customer Complaints on Complaint Sites

Complaints on sites like consumercomplaints tell similar stories – customers report paying fees but never getting loans approved. People label Nowofloan as a scam and demand legal action against their allegedly fraudulent practices.

Many also warn others not to pay any fees or purchase membership cards from Nowofloan. There are also accusations that the company does not reveal details about their office, staff, and promoters.

Is Nowofloan Operating Legally?

Nowofloan is registered as Nowofln Service India Pvt. Ltd. under the Ministry of Corporate Affairs with a listed address in Gujarat.

However, they are not registered officially as an NBFC which means they likely work through third-party regulated lenders instead of providing direct lending services. This makes their business model and practices questionable and risky for customers.

Their website and advertorial content also display visibility tactics like bank logos and optimistic language but lack key details about their financial services and regulatory status.

Red Flags Around Nowofloan’s Claims and Practices

Looking closely, several red flags stand out:

- Upfront fee collection – Legitimate lenders don’t ask for upfront fees before loan approval.

- Exaggerated claims – Nowofloan’s promises of “instant”, “superfast” loans are exaggerated. Real personal and business loans take 1-2 weeks at minimum.

- No direct lending – Nowofloan is not an NBFC, so cannot lend directly. Dependent on unknown third-party lenders.

- No customer reviews – No credible customer reviews vouching for loan disbursals. Just complaints.

- Obscured processes – Loan application and lending process lacks transparency.

These signals an unreliable and risky company model.

Expert Advice: Avoid Nowofloan

Financial advisors strongly recommend avoiding companies like Nowofloan that offer too-good-to-be-true instant loans. Their services come with risky terms, hidden costs, and potential fraud.

Instead, experts suggest working only with legitimate banks, NBFCs or fintech firms with solid track records. Though their process is rigorous, it is safer and more transparent.

Personal loans should also be considered carefully based on factors like eligibility, interest rates, and repayment capacity before applying.

The Verdict: Nowofloan Appears Real or a Fake Scam?

In summary, Nowofloan shows several suspicious signs like lack of transparency, exaggerated claims, upfront fees, and multiple customer complaints alleging non-disbursement of loans.

The company is not registered as an NBFC and has obscure processes and third-party lending dependencies. Experts advise against such financial services providers.

While not definitively proven fraudulent yet, Nowofloan’s practices raise enough red flags to warrant extreme caution by consumers.

The risks and downsides of engaging with Nowofloan seem to outweigh any benefits their services claim to offer. Overall, it appears wisest to consider Nowofloan as a risky company and avoid its membership plans for now.

Let us know your experience with Nowofloan in the comments below. Sharing reviews helps warn others.

Key Takeaways: Protect Yourself from Loan Scams

- Research lenders extensively and read reviews before applying for loans.

- Avoid companies asking for upfront fees or requiring membership plans.

- Do not pay any advance payments or processing fees before loan approval.

- Check for NBFC registration and regulatory licenses before engagement.

- Understand all terms and conditions fully before accepting a loan offer.

- Work only with reputable banks, NBFCs or fintech firms with proven track records.

Making prudent choices is key to avoiding financial scams and ensuring loan benefits outweigh risks. Be an informed and vigilant customer.

Frequently Asked Questions (FAQs)

1. Is Nowofloan legit or a scam?

Nowofloan is registered as a company with the Ministry of Corporate Affairs (MCA). However, there are several red flags raised by experts and multiple customer complaints alleging non-disbursement of loans. While not conclusively proven fraudulent yet, users are advised to exercise extreme caution.

2. Is Nowofloan RBI approved?

No, Nowofloan is not registered as an NBFC with RBI. They provide services through tie-ups with third-party NBFCs instead of direct lending. This makes their services risky.

3. What is Nowofloan’s customer care number?

The customer care number listed on Nowofloan’s website is +91 74860 19373. However, many customers complain of lack of response even after contacting this number.

Tags: Nowofloan personal loan customer review, real or fake, complaints, is Nowofloan fraud, owner name, legit, address, membership card, scam, customer helpline number, elligibility.

It’s a fraud company… they will not respond you after getting membership fees… scammers…