In a concerning development for online payment users, cybercriminals have launched a sophisticated scam operation leveraging DocuSign’s trusted platform to send fraudulent PayPal invoices. The scam, which often presents itself as coming from “Grand Canyon Society,” has already targeted thousands of PayPal users worldwide, bypassing traditional email security filters and putting users’ financial information at risk.

Inside the Grand Canyon Society Scam Email

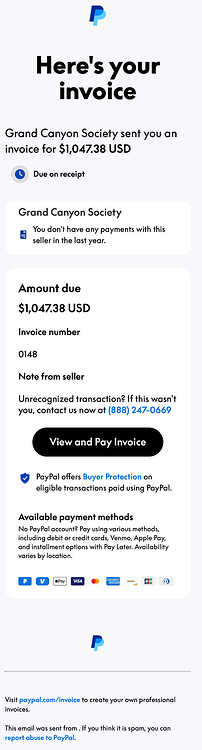

Recipients of this scam typically receive what appears to be an official DocuSign email notification regarding a PayPal invoice from “Grand Canyon Society.” The email looks legitimate because it actually comes from DocuSign’s servers, having been created through a fraudulent account on the platform.

The invoice typically contains:

- A PayPal header and branding that appears authentic

- An invoice amount ranging from $1,038.35 to $1,047.38 USD

- An invoice number (often a simple number like “0148” or “0173”)

- A “Due on receipt” payment timeline

- A note stating: “Unrecognized transaction? If this wasn’t you, contact us now at [phone number]”

- A “View and Pay Invoice” button that leads to a doctored payment page

The message often includes reassuring text about PayPal Buyer Protection and payment options to enhance legitimacy. Some versions even include statements about reporting spam to PayPal and a copyright notice with PayPal’s address in San Jose, CA.

Beware of Changing Phone Numbers

A particularly insidious aspect of this scam is the attackers’ practice of frequently changing their fraudulent customer service phone numbers. Recent reports have identified (888) 247-0669 as one commonly used number, but scammers rotate through various numbers to avoid detection and shutdown.

When investigating this scam, cybersecurity researchers discovered that many of these phone numbers trace back to:

- ViciDial (a contact center software) operations

- Locations in India (particularly Kolkata)

- Operations using Western names like “John” to appear legitimate

“This constant changing of phone numbers makes it harder for authorities and security firms to track and shut down these operations,” explains cybersecurity consultant David Ramos. “By the time a number is reported and blocked, the scammers have already moved on to new ones.”

If you call any of these numbers, operators typically:

- Claim to be PayPal security representatives

- Express concern about “unauthorized charges” on your account

- Request remote access to your computer to “resolve the issue”

- Ask for credit card details or online banking credentials to “confirm your identity”

- Sometimes direct you to purchase gift cards or cryptocurrency as part of a “security verification process”

How the Grand Canyon Society PayPal Scam Works

The scam employs a clever combination of legitimate services and social engineering tactics. Criminals create authentic DocuSign accounts and use the platform’s templates to generate official-looking PayPal invoices, typically claiming to be from an organization called “Grand Canyon Historical Society.”

These invoices typically demand payment of approximately $1,000-$1,050 and are distributed through DocuSign’s system, which lends them an air of legitimacy. What makes this attack particularly dangerous is that the emails genuinely come from DocuSign’s servers, allowing them to bypass many email security filters that would normally catch phishing attempts.

The invoice typically includes an urgent message in the “Note from seller” section, instructing recipients to call a specific phone number if they don’t recognize the transaction. This is where the real danger lies.

“The scammers aren’t actually after the invoice payment,” explains cybersecurity analyst Maria Chen. “They want you to call their fake customer service number, where they’ll attempt to extract your personal and financial information or convince you to install malware disguised as security software.”

How Scammers Trap Innocent Users

The success of this scam relies on several psychological triggers:

- Urgency: The invoices create immediate anxiety by showing a large sum due for immediate payment.

- Authority: By leveraging both PayPal’s and DocuSign’s trusted brands, scammers create a sense of legitimacy.

- Helpfulness: The “customer service” number appears to offer assistance, playing on people’s tendency to seek help when concerned.

When victims call the provided number, they’re connected to scammers posing as PayPal representatives. These fake agents use various tactics to extract valuable information:

- They may ask for login credentials to “verify your account”

- They might request credit card information to “cancel the transaction”

- Some ask victims to install remote access software so they can “help secure the account”

- Others direct victims to make cryptocurrency payments to “resolve the issue”

Once scammers have this information, they can take over PayPal accounts, make unauthorized transactions, or steal identities.

Red Flags to Watch For

Several warning signs can help you identify this scam:

- Unexpected invoices: If you receive an invoice from “Grand Canyon Society” or any organization you don’t recognize

- Suspicious email addresses: The DocuSign notification may come from a Gmail address rather than an official PayPal domain

- Unusual DocuSign usage: Invoice documents that don’t require signatures (unusual for DocuSign)

- Incorrect recipient information: The “To” address often doesn’t match your email or doesn’t exist

- Urgency in messaging: Notes emphasizing immediate action required

- Phone numbers in seller notes: Legitimate PayPal wouldn’t ask you to call a number in the invoice notes

- Round payment amounts: Scam invoices often request suspiciously round numbers like $1,000 or $1,047.38

What To Do If You Receive a Fake Grand Canyon Historical Society Invoice

If you receive a suspicious invoice supposedly from PayPal claiming any institution like ‘Grand Canyon Historical Society’ via DocuSign:

- Don’t panic: Receiving an invoice doesn’t mean your account has been compromised.

- Don’t click any links: Avoid clicking on any links in the email or document.

- Don’t call the number: Never call phone numbers provided in suspicious invoices.

- Verify the document: If you want to check if the DocuSign document is legitimate, go directly to DocuSign.com, click on “Access Documents” in the upper right corner, and enter the document security code from the email. If you receive an error message, the document is likely fraudulent.

- Check your actual PayPal account: Log into your PayPal account directly (not through any links in the email) to check for any unusual transactions.

- Report the scam: Report the suspicious invoice to both PayPal and DocuSign.

How to Stay Safe from PayPal Invoice Scams

Protecting yourself from these and similar scams requires ongoing vigilance:

- Use strong, unique passwords for your PayPal account and change them regularly

- Enable two-factor authentication on your PayPal account or use Passkeys for enhanced security

- Log in directly: Always access PayPal through the official website or app, never through links in emails

- Verify seller information: Before paying any invoice, verify the seller’s identity and reputation

- Be skeptical of urgency: Legitimate businesses rarely demand immediate payment through urgent messages

- Keep software updated: Ensure your devices and security software are up-to-date

- Use official channels: If you’re concerned about a transaction, contact PayPal through their official website or app

PayPal’s Response to the DocuSign Scam

PayPal has acknowledged the threat and is taking steps to protect users. In a statement, a PayPal spokesperson emphasized their commitment to user safety: “PayPal takes seriously our efforts to protect customers from evolving scams and fraud activity. We encourage customers to always remain mindful online and to visit PayPal.com for additional tips on how to protect themselves.”

The company has implemented several measures to combat these scams:

- Adding fraud reminder notices with advice for customers on all global invoice requests

- Enhancing fraud detection technologies to identify suspicious activities

- Taking proactive actions to limit scam accounts and decline risky transactions

- Partnering with consumer protection institutions like the Better Business Bureau and Federal Trade Commission

- Launching a “Smarter Than Scams” campaign to raise awareness about fraud trends

Security Experts Weigh In

Security experts emphasize that this scam represents a broader trend in cybercriminal tactics. Paul Walsh, founder and CEO of MetaCert, argues that traditional phishing advice is becoming outdated as attacks grow more sophisticated.

“Telling people to look for spelling mistakes is advice from the 2000s and is now counterproductive,” Walsh warns. “Today’s scammers use well-crafted messages that look legitimate in every way.”

Jamie Beckland, chief product officer at APIContext, explains that “this recent DocuSign scam relies on Application Programming Interfaces to bypass email security in order to steal login credentials. While DocuSign says their system identifies bad actors, that is no help if a user shares their email password inadvertently.”

Experts recommend that companies providing API services monitor for suspicious behavior and test APIs against security standards to prevent such exploits.

What To Do If You’ve Fallen Victim

If you’ve already interacted with one of these scams:

- Change your passwords immediately: Update your PayPal password and any other accounts that use the same password.

- Enable additional security measures: Turn on two-factor authentication for all your accounts.

- Contact PayPal: Report the unauthorized activity through PayPal’s Resolution Center:

- On the app: Navigate to the Resolution Center, click “Report a problem,” select the payment in question, and follow instructions

- On web browser: Select Wallet > Activity, select the payment, click “Report a Problem,” and follow instructions

- Monitor your accounts: Keep a close eye on your financial accounts for any suspicious activity.

- Report to authorities: File a report with your local police department and consider reporting to the FBI’s Internet Crime Complaint Center (IC3).

- Freeze your credit: If you’ve shared sensitive information, consider placing a freeze on your credit reports.

- Scan your devices: Run a comprehensive security scan on any devices you used during the interaction.

The Evolving Threat Landscape

This Grand Canyon Society DocuSign-based PayPal scam represents a new frontier in phishing attacks, where criminals leverage legitimate services to bypass traditional security measures. Security professionals predict that such sophisticated, multi-platform attacks will become increasingly common.

“As email security improves, scammers are adapting by using trusted platforms as stepping stones,” explains cybersecurity researcher Alex Thornton. “We’re seeing a shift from crude phishing emails to complex schemes that exploit the trust we place in established services.”

The best defense remains a combination of technological protection and human vigilance. By staying informed about emerging threats and following best security practices, users can significantly reduce their risk of falling victim to these increasingly sophisticated scams.

Remember that legitimate companies like PayPal will never ask for sensitive information via email or phone calls initiated through invoices. When in doubt, always contact the company directly through their official channels before taking any action on suspicious communications.