A deceptive mail scheme targeting homeowners has been identified across multiple Tennessee counties, with scammers posing as a “Clerk’s Property Office” and demanding payment for property documents that are otherwise available for free or at minimal cost from legitimate county offices.

The sophisticated scam has already claimed numerous victims, particularly among senior citizens, as the fraudulent letters bear a striking resemblance to official government correspondence. County officials are now warning residents to exercise caution and verify any requests for payment related to property records.

How the Clerk’s Property Office Letter Scam Works

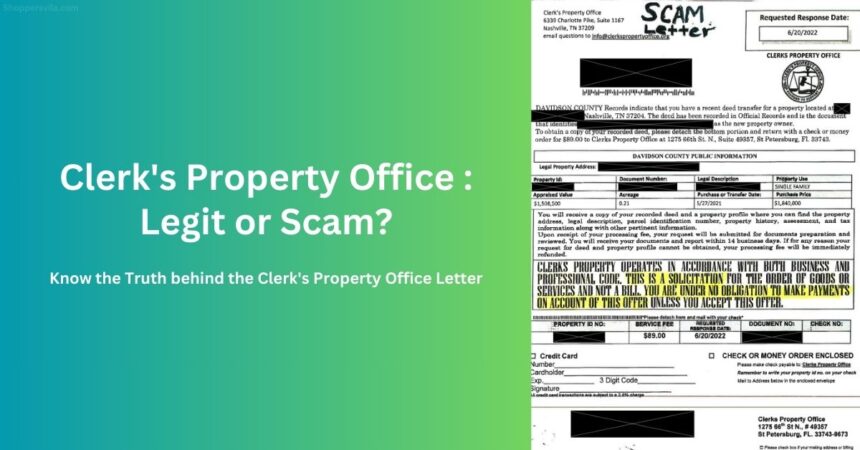

The operation follows a carefully crafted pattern designed to appear legitimate while extracting unnecessary fees from unsuspecting property owners. Homeowners receive official-looking letters with the header “Clerk’s Property Office,” complete with a seal that mimics government documentation.

These letters contain accurate information about the recipient’s property, including correct property details and county property ID numbers, lending an air of authenticity to the correspondence. Some versions of the scam even falsely claim that the recipient’s property has been transferred to a new owner, creating unnecessary alarm.

The core of the deception lies in the letter’s offer to provide copies of property deeds, legal descriptions, and other documentation for an $89 fee. Recipients are instructed to send payment via check, money order, or credit card information to a post office box in St. Petersburg, Florida.

“The scammers have clearly done their homework,” notes investigator Sarah Thompson, who specializes in document fraud. “They’ve accessed public property records to personalize each letter, making the correspondence appear tailored and legitimate. But the reality is they’re charging nearly $90 for documents that might cost $1 at your local Register of Deeds office—or even be available for free online or via email.”

Red Flags to Watch For

Officials have identified several warning signs that distinguish these fraudulent letters from legitimate county communications:

- Return addresses outside your county – The scam letters typically show a return address in Nashville, regardless of which county is being targeted

- Payment directed to Florida – Instructions to send payment to a St. Petersburg, Florida P.O. box is a clear indicator of fraud, as legitimate county offices would never direct payments out of state

- Urgent language or threats – Many scam letters create a false sense of urgency or suggest negative consequences if you don’t respond quickly

- Requests for credit card information by mail – Legitimate county offices don’t typically request sensitive payment information through postal mail

- Inflated fees – The $89 charge is significantly higher than what counties actually charge for document copies

- Mass mailings – County Register of Deeds offices don’t typically send unsolicited mass mailings about property documents

“What makes this scam particularly effective is its hybrid nature,” explains consumer protection attorney Michael Reynolds. “It’s not entirely false—they will likely send you some form of document if you pay. But they’re grossly overcharging for something you could obtain yourself directly from the county, often for free.”

Official Response from County Officials

Officials across multiple Tennessee counties have issued warnings about these deceptive practices.

In Hamilton County, Register of Deeds Marc Gravitt emphasized that these letters did not originate from any legitimate government office, stating: “I want Hamilton County citizens to know, this letter, while appearing to be official and containing correct information concerning their property, did not come from my office, nor any other Hamilton County office.”

Similarly, in Davidson County, Register Karen Johnson has alerted residents about the scam, noting that numerous senior citizens have already fallen victim. Johnson clarified that her office “would never ask for any credit card information to be sent in” and doesn’t coordinate with entities outside the state.

County offices are actively working with local law enforcement and the Better Business Bureau to investigate these fraudulent mailings.

What to Do If You Receive a Suspicious Clerk’s Property Office Letter

If you receive correspondence claiming to be from a “Clerk’s Property Office” requesting payment for property documents, officials recommend the following steps:

- Don’t send payment – Disregard any requests for payment until you’ve verified the legitimacy of the letter

- Contact your county’s Register of Deeds office directly – Use contact information from the official county website, not from the letter you received

- Report the scam – Share information about the fraudulent letter with your local Register of Deeds office, law enforcement, and the Better Business Bureau

- Alert vulnerable neighbors – If you have elderly neighbors or family members, make them aware of this scam as seniors are often specifically targeted

- Preserve the letter – Keep the original letter and envelope as potential evidence for investigators

“The most important thing is not to panic,” advises Johnson. “These scammers want you to act quickly without thinking. Take a breath and verify before sending any money.”

Protecting Yourself from Property Document Scams

Beyond responding to immediate threats, officials recommend several preventive measures to guard against property record scams:

1. Enroll in Property Fraud Alert Programs

Many Tennessee counties offer free property fraud alert services that notify property owners whenever a document is recorded against their name or property. Davidson County’s Property Alert Program, for example, allows users to monitor multiple names and receive immediate notifications of any filing activity.

“It’s the best way to know quickly and officially if any action has been taken on your property,” Johnson explained. County offices can assist residents who lack internet access or need help registering for these services.

2. Understand How to Obtain Property Records Legitimately

Knowing the proper channels for obtaining property documents can help you identify fraudulent requests:

- Most property records can be accessed for free through county websites

- Email requests for documents are typically fulfilled at no charge

- In-person or mailed copies may incur nominal fees, usually under $5 per page

- Your county’s Register of Deeds office is the authoritative source for property records

3. Verify Before You Pay

Before responding to any request related to property documents:

- Look up your county’s Register of Deeds office phone number independently (not from the letter)

- Call to verify whether the communication is legitimate

- Ask about the actual cost of obtaining the documents mentioned

- Confirm the proper procedure for requesting and paying for documents

“What I would recommend is call us first when it has something to do with your property and with the ownership of your property,” Johnson advised. “That’s what we’re here for—to ensure that integrity stays intact with your documents and the ownership for your property.”

If You’ve Already Fallen Victim

If you’ve already sent money or provided credit card information to the scammers, take immediate action:

- Contact your financial institution – Report the fraud and request to stop payment if possible

- Monitor your accounts – Watch for unauthorized charges beyond the initial payment

- File a police report – Provide all evidence, including the original letter and payment details

- Report to the Federal Trade Commission – File a complaint at ReportFraud.ftc.gov

- Consider credit monitoring – If you provided credit card information, watch for signs of identity theft

The Broader Concern: Rising Property Fraud

This “Clerk’s Property Office” scam is part of a growing trend in property and mortgage fraud. According to the FBI, property and mortgage fraud is among the fastest-growing white-collar crimes in the United States.

Beyond document fee scams, more serious property fraud can involve filing fraudulent deeds or other documents to steal ownership of property. This underscores the importance of monitoring property records and responding quickly to any suspicious activity.

“Property fraud is a significant concern because your home is likely your largest asset,” notes real estate attorney Jennifer Martinez. “These document fee scams may seem relatively minor in comparison, but they can be a gateway to more serious fraud if scammers obtain your financial information or personal details.”

By staying vigilant and verifying any communications related to property records, homeowners can protect themselves from becoming victims of these increasingly sophisticated scams.

For more information or to verify property records, contact your county’s Register of Deeds office directly using contact information from the official county website.