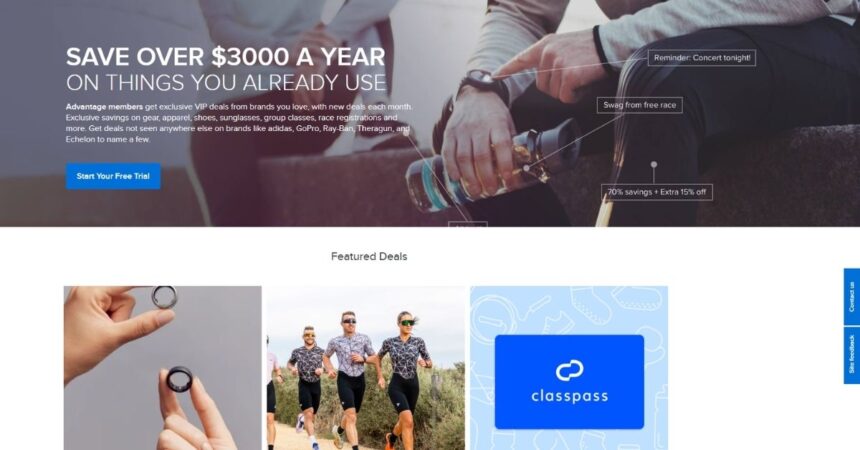

Thousands of consumers have been caught off guard by unexpected charges from ACTIVE Advantage, the premium membership program of event registration platform Active.com. For over eight years, users have reported mysterious annual charges appearing on their credit card statements. Moreover, many claim they never knowingly enrolled in this service. This growing controversy has not only sparked consumer outrage but has also attracted legal scrutiny from state and federal authorities.

Overview of ACTIVE Advantage Subscriptions Scam

Many consumers first discover their unwanted ACTIVE Advantage membership when they spot an unfamiliar charge on their credit card or bank statement. Initially, these charges started at $69.95 per year. However, they have gradually increased to $99.95 currently, representing a 43% price increase over time.

“I just noticed a $99.95 charge on my credit card that I didn’t recognize,” reports one Reddit user. “After investigating, I discovered that ACTIVE had been charging me annually for six years without my knowledge. It is a scam trap.”

This experience is not isolated. Hundreds of similar complaints have appeared across social media platforms, consumer forums, and the Better Business Bureau (BBB) website. Furthermore, many victims report only discovering multiple years of charges during a routine review of their financial statements.

The alleged enrollment method has followed a consistent pattern. Users typically sign up for legitimate services through Active.com, such as:

- Race registrations for marathons and triathlons

- Children’s sports league enrollments

- Summer camp registrations

- Music and coding classes

During this primary registration process, users apparently enroll in a “free trial” of ACTIVE Advantage. Nevertheless, many insist they never saw clear notification about this trial or its automatic conversion to a paid subscription.

“I read everything very carefully and never sign up for free trials,” stated one user who signed up for a race. “This is 100% scammy.”

Additionally, some users report even more troubling experiences. A few claim they were charged despite never even completing a purchase on the platform. As one user noted, “I literally just browsed events but didn’t register or purchase a thing.”

How the Scam Operated: Marketing Tactic or Deceptive Practice?

The enrollment practices used by ACTIVE Network have raised serious questions about ethical marketing boundaries. While some defenders claim the information is technically disclosed during registration, critics argue the presentation deliberately obscures important details.

The practice of hiding subscription terms within complicated checkout flows falls under what digital ethicists call “dark patterns” – user interface designs that trick people into making unintended choices. Furthermore, these tactics often exploit cognitive biases and attention limitations.

“I love how the popup on active appears at the end of filling out a bunch of forms and seems to flow seamlessly from the rest of the registration,” noted one Reddit user sarcastically. The placement of such offers at the end of lengthy processes takes advantage of decision fatigue.

Several users report that trial enrollment boxes appear pre-checked during registration. Consequently, users must actively opt out rather than affirmatively opt in. This practice reverses the normal consent model and relies on users missing the small print.

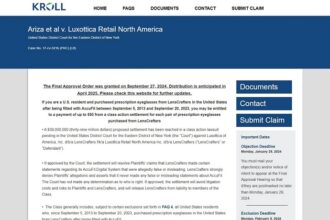

The controversy has attracted legal attention. The Consumer Financial Protection Bureau (CFPB) has sued ACTIVE Network for allegedly tricking people into enrolling in its annual subscription discount club. According to the CFPB, the company “used digital dark patterns and online trickery to generate more than $300 million in membership fees.”

Additionally, the CFPB alleges that ACTIVE violated the Electronic Fund Transfer Act by increasing membership fees without proper notification. Texas authorities have reportedly taken similar legal action against the company.

Even those defending the company acknowledge problems with their approach. “It might not be a scam, but it’s a bit sleazy. ‘Scam-adjacent,'” admitted one commenter who ultimately found value in the membership.

How to Cancel Unwanted Membership of ACTIVE Advantage

After discovering unwanted charges, many consumers report significant difficulties in canceling their memberships and obtaining refunds. Therefore, persistence often becomes necessary when dealing with these situations.

The most effective cancellation method, according to user reports, requires following these specific steps:

- Log into your Active.com account

- Navigate to “My Profile” then select “Advantage”

- Ignore the prominent link to active.advantage.com (described by users as “another trap”)

- Look for “CANCEL MY MEMBERSHIP” in small text at the bottom right of the benefits section

- Click this link and take a screenshot of the confirmation page

Many users report that contacting the company directly proves frustrating. Phone numbers listed for customer service frequently direct callers to leave email messages instead. As one user explained, “There are no phone numbers to reach this company; they only accept emails.”

When email responses do come, they typically offer partial solutions. Many users report the company will cancel future renewals and refund the most recent charge. However, they commonly refuse to refund charges from previous years, citing their refund policy.

Some consumers have found alternative strategies for addressing these charges:

- Disputing the charges with credit card companies as fraudulent transactions

- Canceling and replacing affected credit cards to prevent future charges

- Reaching out to company employees through professional networking sites

- Filing complaints with consumer protection agencies

For those seeking refunds for past charges, success rates vary. Some report receiving complete refunds after persistent efforts. Meanwhile, others have been limited to recovering only the most recent charge.

Protecting Yourself from Avoiding Scammy Subscription Traps

While ACTIVE Advantage has become a prominent example of subscription controversies, similar practices appear across many industries. Therefore, consumers need strategies to protect themselves from unwanted recurring charges.

First, always review checkout screens carefully when making online purchases. Pay special attention to pre-checked boxes, especially near the end of lengthy forms. Additionally, read the fine print around “free trial” offers, noting automatic renewal terms and cancellation deadlines.

Second, consider using dedicated payment methods for subscriptions. Options include:

- Virtual credit card numbers with spending limits

- Prepaid cards for one-time purchases

- PayPal or similar services that provide additional purchase protection

Third, regularly review all credit card and bank statements. Set calendar reminders to check for unfamiliar charges monthly. Moreover, consider using personal finance apps that flag recurring charges or notify you of unusual spending patterns.

When encountering unexpected charges, document everything. Take screenshots of cancellation confirmations and keep records of all communications with the company. This documentation becomes crucial for disputing charges if necessary.

Finally, report suspicious billing practices to appropriate authorities. File complaints with:

- Your state’s attorney general office

- The Federal Trade Commission (FTC)

- The Consumer Financial Protection Bureau (CFPB)

- The Better Business Bureau (BBB)

These reports not only help your individual case but also contribute to broader consumer protection efforts. Furthermore, they provide evidence for potential regulatory actions or class-action lawsuits.

The controversy surrounding ACTIVE Advantage highlights the importance of vigilance in our increasingly subscription-based economy. While companies rightfully seek recurring revenue, consumers deserve transparent terms and genuine consent before enrollment. As this case continues developing through regulatory actions, it may establish important precedents for subscription marketing practices across digital platforms.