Debt collection agencies routinely contact consumers by phone and text message to collect on outstanding debts. But how can you tell if a debt collector like MRS BPO, LLC is legitimate or a scam? This article will examine MRS BPO’s real practices and provide tips on protecting yourself from text message scams while resolving any valid debts.

With debt collectors everywhere, distinguishing scams from legitimate agencies is crucial. Read on to learn more about your rights and when you should take action against suspicious collectors.

Overview of MRS BPO Daily Spam Call / Text Message Scam

MRS BPO, LLC is a New Jersey-based collections agency that contacts consumers nationwide about unpaid debts via phone calls, letters, and text messages. They collect on behalf of original creditors across many industries including telecom, utilities, and financial services.

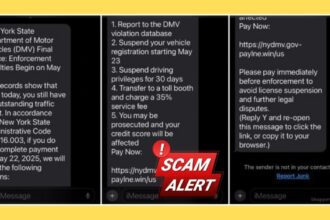

Many consumers have recently reported receiving frequent, repetitive text messages from MRS BPO, LLC claiming they owe money to various creditors. The texts direct them to call it’s toll-free number regarding an “urgent matter”.

Understandably, receiving such texts out of the blue can be alarming and confusing. Are they coming from a real debt collector or a scammer? Does the consumer actually owe the debt or is it a case of mistaken identity or identity theft?

Let’s look more closely at it’s background and collection practices to understand if their texts are legitimate or signs of a larger scam.

Company Details of MRS BPO, LLC

MRS BPO, LLC is a legitimate debt collection agency, not a scam operation. They have been in business for over 30 years since 1991 and are based in Cherry Hill, New Jersey. They collects on first-party debts owed directly to creditors and third-party debt accounts purchased from original creditors.

As an established company, they are an active, tax-paying business entity, not a fly-by-night scam. They employs over 500 debt collectors and support staff across multiple call center locations.

However, their long history and large size does not excuse any illegal or abusive collection conduct. Over the years, it has faced multiple lawsuits and complaints alleging violations of consumer protection laws, especially the Fair Debt Collection Practices Act (FDCPA).

User Reviews and Complaints

MRS BPO, LLC has an extremely poor reputation based on consumer complaints and reviews:

- 348 complaints against them in the last 3 years with the Consumer Financial Protection Bureau

- 366 BBB complaints over the past 3 years with a rating of just 1.08 out of 5 stars

Many complaints refer to frustrating issues like:

- Calling the wrong numbers over and over

- Failing to validate debts when requested

- Reporting debts inaccurately

- Using abusive language or harassing techniques

- Ignoring cease contact requests

These types of complaints raise red flags about the legitimacy of MRS BPO’s collection processes. While they are not a scam or fake company, their tactics show a lack of compliance with consumer protection laws.

Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act (FDCPA) regulates the behavior of third-party debt collectors. It aims to eliminate harassing, oppressive, or abusive collection conduct.

Under the FDCPA, you have rights including:

- Debt validation upon written request

- Limited contact hours and frequency

- Ceasing further contact upon request

- No false/misleading representations

- No profane/threatening language

If a collector like MRS BPO, LLC violates these rights, you can sue them for damages under the FDCPA. Numerous FDCPA lawsuits have been filed against MRS BPO over its lifetime.

Lawsuits

Given MRS BPO’s long history and complaints record, it’s no surprise that many lawsuits have been filed against them over illegal collection practices including FDCPA violations.

Some recent case details:

| Case Details | Filed Date | Case Number |

| FUTCH v. MRS BPO, LLC | December 18, 2023 | 1:2023cv02257 |

| White v. MRS BPO, LLC | December 15, 2023 | 3:2023cv01324 |

| BALLARD v. MRS BPO, LLC | November 3, 2023 | 1:2023cv01974 |

Many other individual FDCPA lawsuits against them can be found on Pacer.gov and justia.com.

Is MRS BPO LLC a Legitimate Debt Collection Agency or a Scam?

Based on the above research, MRS BPO, LLC is a real debt collection company, not an outright scam. However, many of their practices do seem unethical or illegal. Receiving a text from them warrants caution and scrutiny, but does not necessarily mean it’s fake.

When in doubt, remember to always request written debt validation as that will force them to prove you actually owe the specific debt. Never make a payment just because a random text tells you to.

In short, it is a legitimate agency being used questionably or abusively in many cases. Their mass texting approach appears to result in frequent contacts with the wrong consumers. Stay vigilant when contacted by them and know your rights!

Tips to Stay Safe from Spam Debt Text Messages or Phone Calls

Here are some tips on protecting yourself from unwanted calls/texts demanding payment:

- Ask for written debt validation before paying anything

- Research the company’s reputation and complaint record

- Dispute inaccurate debts or information with credit bureaus

- Don’t confirm personal details like your SSN/DOB

- Note dates/times/details of all contacts

- Request no further contact if messages continue

- Screen unknown calls and don’t answer spam texts

- Block numbers that repeatedly spam you

- Obtain your free annual credit reports to detect any identity theft

Avoiding scam debt collectors while still resolving any legitimate unpaid accounts takes diligence. But following these tips will help safeguard your rights.

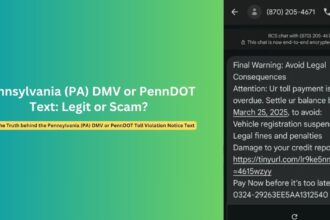

What to Do If You Get a Scam Text Demanding Payment

If you determine a text message demanding payment is a scam, here are some actions to take:

- Report it to the FTC and your state attorney general

- Alert your phone carrier of the scam text

- Block the phone number

- Screenshot the text details in case you do need to follow up later

- Contact law enforcement if you feel unsafe or threatened

- Check your credit reports for any signs of identity theft

- Consider changing your phone number if needed to end the contacts

Don’t engage directly with suspected scammers, but gather evidence in case authorities need it. And sign up for scam call/text blocking through your phone carrier if available.

Frequently Asked Questions

1. Is MRS BPO LLC a real debt collector?

Yes, it is a legit debt collector, not a scam company. However, they have built up an extremely poor reputation over decades due to abusive and potentially illegal collection tactics based on many consumer complaints.

2. Why is MRS BPO calling me?

If they are contacting you, it likely means they are trying to collect payment on a debt account placed with them by an original creditor. Third-party debt collectors like MRS BPO buy old debt accounts or get hired by creditors to collect past-due balances.

3. Who is the owner of this agency?

MRS BPO, LLC is owned by the Freedman family, originally founded by Saul Freedman in 1991. His sons Jeff Freedman and Craig Freedman currently run the company as CEO and President. Headquarters remain in Cherry Hill, New Jersey.

4. Who does MRS BPO LLC collect for?

They collects debts owed to various types of companies including credit card issuers, telecom providers, healthcare facilities, financial services firms, and more. Some of their major clients include AT&T, Verizon, and Discover.

5. How can I remove it from my credit report?

If they incorrectly reports a debt, you can dispute it with credit bureaus and request removal. Paying off a legitimate debt via settlement may also persuade them to delete it from your credit history. If they refuse, sue them.

The Bottom Line

MRS BPO, LLC is a real debt collector but their collection techniques often cross legal boundaries based on consumer complaints and lawsuits. If you receive a text from them, don’t ignore it but also don’t take any claims at face value.

Some key takeaways from the review:

- It is a legitimate collections agency, but often accused of illegal practices

- Their texts demanding payment should not be outright ignored

- Carefully validate any supposed debts before paying MRS BPO

- Know your FDCPA rights when dealing with debt collectors

- Don’t confirm personal/financial details if texts seem suspicious

- Report FDCPA violations to regulators; sue if needed

Verify any alleged debts in writing and watch for FDCPA violations. Report them if needed and block further unwanted contacts. While not an outright scam, many complaints indicate you should approach MRS BPO, LLC with extreme caution.