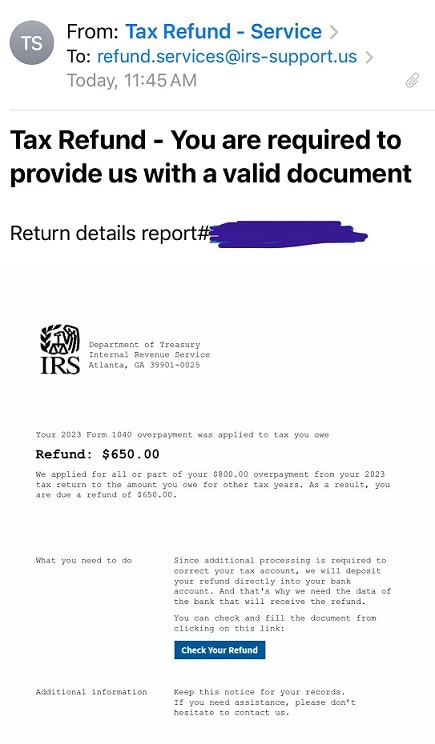

Tax season is prime time for scammers to take advantage of Americans anxiously awaiting their refunds. A questionable email claiming to be from the IRS has been making the rounds, and we’re breaking down if the IRS tax refund email from [email protected] legitimate or an attempt to steal your personal information and money.

Understanding the Email from [email protected]

The email in question comes from [email protected] and informs the recipient they are owed a tax refund of $650. It claims the IRS needs the recipient’s bank account information to deposit the refund.

Upon first glance, the email looks official. It’s signed by the “Department of Treasury” and “Internal Revenue Service” complete with a case number and IRS office address. However, further inspection reveals red flags.

Red Flags Reveals the Scam

While cleverly disguised, scrutiny exposes this is a scam attempt:

- The email address does not originate from an official IRS domain (irs.gov). The irs-support.us address is not legitimate.

- The IRS does not initiate contact about refunds or money owed via email, only through postal mail.

- The message contains grammatical errors and awkward phrasing, hinting that English is not the writer’s first language.

- Banks already have recipient account information for direct deposits, so the IRS would not need it from you to issue a refund.

- The email urges urgent action by asking to click a link to provide personal details. The IRS does not communicate or operate this way.

- Perhaps the biggest giveaway is the email references a 2023 tax return. It’s just start of 2024, so 2023 tax forms cannot be filed yet.

Protecting Yourself from Fake IRS Tax Refund Emails

While this particular email has telling signs it’s an attempted scam, phishing attempts are getting increasingly sophisticated. Here are some tips to avoid becoming a victim:

- Never click links or open attachments from unsolicited emails claiming to be from the IRS. Type irs.gov directly into your browser if you want to access the official website.

- Be wary of any correspondence demanding immediate action, threatening dire consequences, or requesting sensitive information over email.

- Review email addresses closely. Subtle character substitutions in addresses like irs-support.com instead of irs.gov are common tricks.

- Check for grammar/spelling errors which signal foreign scammers. The IRS corresponds professionally in English.

- Contact the IRS directly through irs.gov, if you receive a questionable notice and want to validate it.

- Forward scam emails to [email protected] to help identify and shut down fraudsters.

The bottom line is that [email protected] is a fraudulent email to steal your money. Don’t fall in the scammers trap. Always keep in mind that you should never provide personal or financial details via email, text, or social media. The IRS will always initiate contact by postal mail. With tax season coming up, be vigilant and protect yourself from scams aiming to cash in on Americans’ tax refunds.