In the wake of Bittrex’s bankruptcy proceedings, opportunistic scammers have launched a sophisticated phishing campaign targeting former customers of the cryptocurrency exchange. These deceptive emails promise access to supposedly unclaimed funds, creating a sense of urgency while harvesting sensitive information from unsuspecting victims. Here’s what you need to know to protect yourself from this growing threat.

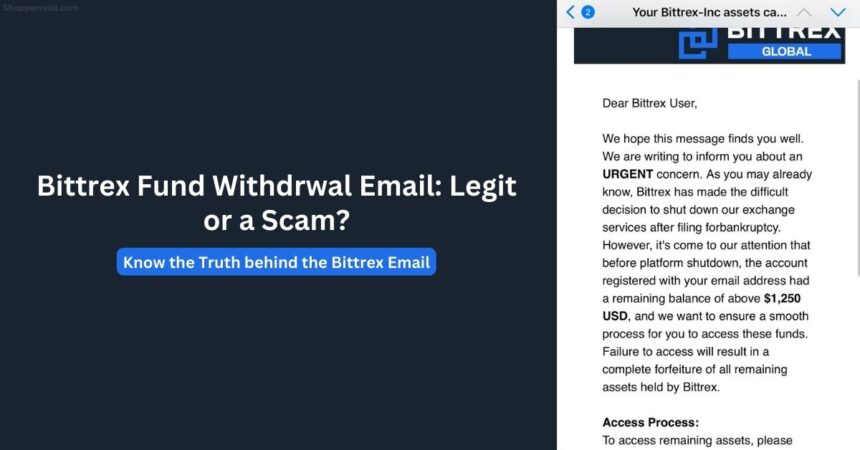

The Overview of the Bittrex Scam Email

The Bittrex email scam capitalizes on the cryptocurrency exchange’s genuine bankruptcy situation. In April 2023, Bittrex ceased operations in the United States following accusations from the SEC that it was operating as an unregistered securities exchange. Three weeks later, the company filed for Chapter 11 bankruptcy, freezing customer funds in the process.

While legitimate communications were sent to customers about fund withdrawals (with an August 31, 2023 deadline), scammers have exploited this situation by sending fraudulent emails months after the official withdrawal period closed. These emails falsely claim that recipients have substantial unclaimed balances—typically over $1,000—that must be withdrawn within an extremely tight timeframe to avoid forfeiture.

The scam works by directing recipients to click on a link purportedly leading to the “Bittrex withdrawal portal.” In reality, this link redirects to a fraudulent website designed to steal sensitive information. Depending on the variation of the scam, victims may be asked to provide:

- Bittrex login credentials

- Personal identification information through a fake KYC process

- Private keys or recovery phrases for crypto wallets

- Bank account details for supposed fund transfers

These phishing attempts are particularly dangerous because they can lead to both identity theft and direct financial losses as scammers gain access to victims’ cryptocurrency wallets or financial accounts.

How Scammers Perfect Their Trap

What makes these Bittrex phishing emails particularly convincing is their attention to detail and sophisticated execution:

- Impeccable timing: Scammers deliberately time their attacks to coincide with real events, such as court-approved shutdown dates or bankruptcy proceedings, making the urgency seem legitimate.

- Authentic appearance: The emails often incorporate actual Bittrex branding, legitimate bankruptcy information, and even real contact details from Omni Agent Solutions (the bankruptcy case administrator).

- Technical sophistication: To bypass email security systems, scammers use:

- Legitimate sender domains with proper authentication

- URL shorteners to mask malicious links

- Clean, professional formatting with minimal grammar errors

- Psychological manipulation: The emails create artificial urgency by claiming:

- Recipients have substantial unclaimed funds (typically $1,250 to $5,750)

- Assets will be permanently forfeited if not withdrawn within days

- The withdrawal period is about to expire permanently

- Targeted approach: Rather than mass-spamming, scammers specifically target former Bittrex users, especially those with email addresses at higher education institutions, increasing the perceived relevance of the message.

The combination of these tactics creates a highly convincing scam that can fool even tech-savvy individuals, particularly those who may have forgotten about small balances left in their Bittrex accounts.

Red Flags That Expose the Scam

Despite their sophistication, these phishing emails contain several telltale signs that can help you identify them as fraudulent:

1. Inconsistent Amounts

Multiple victims report receiving identical emails claiming the exact same dollar amount (often $1,250 or $5,750), which is highly unlikely to be accurate for every recipient.

2. Generic Greetings

Legitimate financial communications typically address you by name. Phishing emails often use generic greetings like “Dear Bittrex User” or “Dear Valued Customer.”

3. Grammatical Errors

While generally well-written, these emails often contain subtle errors. A common mistake is the term “forbankruptcy” instead of “for bankruptcy.”

4. Mismatched Information

The withdrawal deadlines mentioned in these emails often contradict official information. The legitimate Bittrex withdrawal deadline was August 31, 2023, but scam emails claim various dates in 2024 or 2025.

5. Suspicious Links

Hovering over links in these emails typically reveals URL shorteners or domains unrelated to Bittrex’s official website.

6. Unusual Urgency

The extremely short timeframes given (often just 3-5 days) are designed to pressure recipients into acting quickly without proper verification.

What to Do If You Receive a Suspicious Bittrex Email

If you receive an email claiming to be from Bittrex about unclaimed funds, follow these steps to protect yourself:

- Don’t click any links in the email, even if they appear legitimate.

- Verify independently by visiting the official Bittrex website directly by typing the URL in your browser (not through any links in the email).

- Check official sources for accurate information about Bittrex’s bankruptcy proceedings and withdrawal deadlines.

- Report the email as phishing to your email provider and forward it to relevant authorities:

- Anti-Phishing Working Group ([email protected])

- FBI’s Internet Crime Complaint Center (IC3.gov)

- Federal Trade Commission (ReportFraud.ftc.gov)

- Alert others by sharing information about the scam with friends or colleagues who may have used Bittrex.

- Delete the email after reporting it to prevent accidental interaction with it later.

Remember that legitimate companies will never ask you to provide sensitive information like private keys or recovery phrases through email links.

How to Stay Safe from Bittrex Crypto Phishing Scams

To protect yourself from Bittrex-related and other cryptocurrency phishing attempts, implement these security practices:

1. Practice Email Vigilance

- Always verify the sender’s email address by hovering over the “from” field

- Be suspicious of emails creating artificial urgency or fear

- Check for inconsistencies in branding, formatting, or language

2. Use Multi-Factor Authentication

- Enable 2FA on all cryptocurrency exchanges and wallets

- Consider using an authenticator app rather than SMS-based verification

- Use hardware security keys for maximum protection

3. Adopt Proper Wallet Security

- Never share your private keys or recovery phrases with anyone

- Store seed phrases offline in secure, physical locations

- Consider using hardware wallets for significant cryptocurrency holdings

4. Stay Informed

- Follow official bankruptcy proceedings through court documents

- Only trust information from verified company channels

- Be aware that legitimate bankruptcy claims typically have longer timeframes and formal processes

5. Implement Technical Safeguards

- Use email services with built-in phishing protection

- Install browser extensions that warn against suspicious websites

- Keep your operating system and security software updated

By implementing these practices, you can significantly reduce your risk of falling victim to crypto-related phishing scams.

What to Do If You’ve Been Scammed

If you’ve already interacted with a phishing email or website, take these immediate steps to minimize damage:

For Compromised Credentials

- Change passwords immediately for all accounts that used the same or similar credentials

- Enable multi-factor authentication where available

- Monitor account activity for unauthorized transactions

For Exposed Financial Information

- Contact your bank or credit card company to freeze accounts or issue new cards

- Place a fraud alert on your credit reports with the major credit bureaus

- Monitor your accounts closely for unauthorized transactions

For Cryptocurrency Wallet Compromise

- If possible, immediately transfer remaining funds to a new, secure wallet

- Create a new wallet with fresh private keys

- Document the incident with timestamps and transaction IDs

For Identity Theft Concerns

- File a report with the Federal Trade Commission at IdentityTheft.gov

- Consider placing a credit freeze with the major credit bureaus

- File a police report, especially if you’ve experienced financial losses

For Financial Losses

- Document all communications and transactions related to the scam

- Report the incident to your local law enforcement

- File a complaint with the FBI’s Internet Crime Complaint Center (IC3)

While recovery of stolen cryptocurrency can be difficult due to the irreversible nature of blockchain transactions, prompt action can help prevent further losses and protect your digital identity.

Conclusion

The Bittrex email scam represents a new evolution in phishing attacks, combining social engineering with sophisticated technical methods and timely exploitation of real-world events. As cryptocurrency adoption continues to grow, these types of targeted phishing campaigns are likely to become more common and increasingly convincing.

By understanding how these scams work, recognizing the warning signs, and implementing proper security practices, you can protect yourself from becoming a victim. Remember that legitimate financial institutions and cryptocurrency exchanges will never pressure you to act immediately or request sensitive information through email links.

Stay vigilant, verify independently, and when in doubt, contact companies directly through their official channels rather than responding to unexpected emails—even those that appear legitimate at first glance.