Americans lost over $12.5 billion to fraud and scams in 2024, with loan scams representing a significant portion of these losses. As financial pressures mount for many households, predatory actors have intensified their efforts to exploit vulnerable consumers through increasingly sophisticated loan scams. This comprehensive guide examines the current landscape of loan scams in America, how to identify them, and the steps you can take to protect yourself.

The Rising Tide of American Loan Service Scams

Loan scams have evolved beyond simple advance fee frauds to complex operations that mimic legitimate financial institutions. With professional-looking websites, official-sounding company names, and sophisticated targeting techniques, today’s scammers are more difficult to spot than ever before.

“As with a number of online fraud schemes, the offers that seem too good to be true usually are just that,” warns Celia Winslow, executive vice president of the American Financial Services Association.

The Federal Trade Commission (FTC) reports that loan scams typically peak during periods of economic uncertainty, with thousands of Americans filing complaints about fraudulent lending practices each month. Common targets include:

- Individuals with poor credit histories

- People facing imminent foreclosure

- Those struggling with student loan debt

- Consumers seeking emergency funds

- Individuals unfamiliar with financial systems

These scams don’t just cause immediate financial harm—they can damage credit scores, lead to identity theft, and even result in the loss of homes in severe cases.

Red Flags: How to Spot a US Loan Agent Scam

Learning to identify the warning signs of loan scams is your first line of defense. Here are the key red flags that should immediately raise suspicion:

1. Guaranteed Approval Claims

Legitimate lenders never guarantee loan approval before reviewing your financial information. Scammers often advertise “guaranteed approval” or “no credit check required” to attract those with poor credit who have been rejected by traditional lenders.

2. Upfront Fee Requirements

One of the most common tactics is demanding payment before providing any services. These might be labeled as:

- Processing fees

- Insurance fees

- Application fees

- First and last month payments

- Document preparation fees

Legitimate lenders typically deduct their fees from the loan amount after approval or include them in your repayment terms—they don’t collect them upfront.

3. Pressure Tactics and False Urgency

Scammers create artificial time pressure to prevent you from researching their company or considering alternatives. Watch out for phrases like:

- “This offer expires today”

- “Act now or lose this opportunity”

- “Limited spots available”

- “Due to high demand, we can only guarantee this rate for 24 hours”

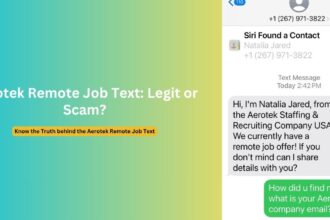

4. Unsolicited Contact

Receiving unexpected loan offers through calls, texts, emails, or even physical mail is a significant warning sign. Legitimate lenders rarely reach out first—consumers typically initiate contact after seeing advertisements or conducting research.

Phone calls offering loans are particularly suspicious, as the Telemarketing Sales Rule makes it illegal for companies to promise loans over the phone while demanding upfront payment.

5. Suspicious Communication Methods

Be wary of lenders who:

- Have no physical address (or only a P.O. Box)

- Provide limited contact information

- Use free email domains (Gmail, Yahoo, etc.) rather than company emails

- Communicate through messaging apps rather than official channels

- Have websites lacking proper security measures (no “https” in the URL)

6. Too-Good-To-Be-True Terms

Offers significantly better than what traditional lenders provide should raise immediate concern. This includes interest rates far below market average, unusually high loan amounts, or approval despite serious credit issues.

Types of US Loan Service Scams to Watch For

Different loan scams target specific vulnerabilities. Understanding these variations can help you avoid falling victim.

1. Payday Loan Scams

Though illegal in many states (including New York), payday loan scams remain prevalent. They promise quick cash with minimal paperwork but come with astronomical interest rates—often exceeding 400% APR—and hidden fees designed to trap borrowers in cycles of debt.

2. Mortgage Relief Scams

These target homeowners struggling with mortgage payments. Scammers promise to:

- Renegotiate loan terms

- Eliminate mortgage debt

- Stop foreclosure proceedings

- Secure loan modifications

The HUD anti-scam campaign warns homeowners to be suspicious if asked to:

- Pay upfront fees for mortgage help

- Sign over property titles

- Redirect mortgage payments

- Stop paying your lender directly

3. Student Loan Forgiveness Scams

With many Americans struggling under student loan debt, forgiveness scams have proliferated. These operations claim special relationships with the Department of Education or advertise “new laws” enabling immediate loan forgiveness—for a fee, of course.

Warning signs include:

- Claims of immediate and total loan forgiveness

- Requests for your FSA ID and password

- High-pressure tactics citing “limited enrollment”

- Messages containing poor grammar or spelling errors

4. Advance Fee Loan Scams

These classic scams promise guaranteed loans regardless of credit history—after you pay an upfront fee. Once paid, the scammer disappears, or continues requesting additional payments for “insurance,” “processing,” or other fabricated charges.

Real-Life Impact: The Persistent Calling Scam

Many victims report experiences similar to this user’s experience:

I’ve been receiving calls from either the same number or different numbers with the same area code regarding a loan that I never applied for… they start the call without saying my name.

This approach, sometimes called “phantom debt collection,” combines elements of both loan scams and aggressive collection tactics. Scammers call repeatedly, claiming you’ve applied for a loan or owe money, hoping you’ll either:

- Provide personal information to “verify your application”

- Make payments to resolve the supposed debt

- Pay a fee to stop the harassment

As another user shared: “I keep receiving calls from Elite lending. Several times a day from different numbers for 3 months now.”

These operations use number-spoofing technology to make blocking ineffective and often leave vague voicemails designed to provoke a callback.

Protecting Yourself From Loan Scams

Taking proactive steps can significantly reduce your risk of falling victim to loan scams:

1. Research Before Engaging

- Verify any lender’s legitimacy through the Better Business Bureau

- Check if they’re registered to operate in your state through your state attorney general’s office

- Search the company name online along with terms like “scam,” “complaint,” or “review”

- Confirm they have a physical business address and professional website

2. Safeguard Your Information

- Never share personal financial information with unsolicited contacts

- Protect your Social Security number, bank account details, and credit card information

- Be especially cautious with your FSA ID if you have student loans

- Use secure, unique passwords for financial accounts

3. Know Where to Find Legitimate Help

- For student loans: Contact your loan servicer directly or visit StudentAid.gov

- For mortgage issues: Consult HUD-approved counselors at (888) 995-HOPE

- For personal loans: Work with established banks, credit unions, or verified online lenders

- For debt management: Seek nonprofit credit counseling agencies

4. Freeze Your Credit Reports

One of our expert advised: “I’ve had my credit reports frozen for years. There were a couple of attempts to open accounts with my information… but both attempts clearly named the bank involved and provided call-back information.”

A credit freeze prevents scammers from opening new accounts in your name, even if they obtain your personal information.

What to Do If You’ve Been Scammed

If you believe you’ve fallen victim to a loan scam:

- Stop all communication with the suspected scammer

- Contact your financial institutions to freeze accounts or stop payments

- Report the scam to:

- The Federal Trade Commission (FTC) at ReportFraud.ftc.gov

- The Consumer Financial Protection Bureau (CFPB)

- Your state attorney general’s office

- The FBI’s Internet Crime Complaint Center (IC3) for online scams

- Document everything including:

- Communications with the scammer

- Payment records

- Names and contact information used

- Websites visited

- Advertisements received

- Monitor your credit reports for suspicious activity through AnnualCreditReport.com

The Road Ahead

As loan scammers continue to evolve their tactics, staying informed remains your best defense. Government agencies are working to strengthen enforcement against these operations, but the most effective protection starts with vigilant consumers who know how to recognize and avoid potential scams.

Remember that legitimate financial help is available without upfront fees or guaranteed promises. By approaching loan offers with healthy skepticism and conducting proper research, you can protect yourself and your financial future from those who seek to exploit vulnerability for profit.

As the Federal Trade Commission advises: if something sounds too good to be true, it probably is.