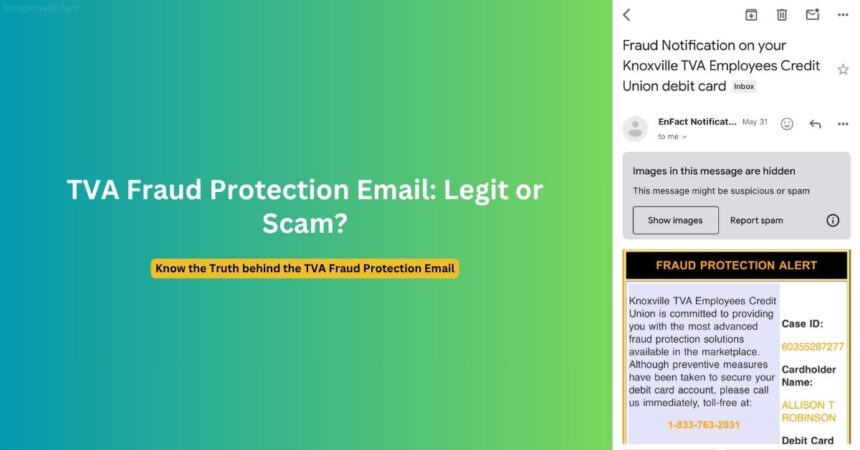

Recent reports from Morristown, TN residents have sparked widespread concern about suspicious emails claiming to be from Knoxville TVA Employees Credit Union. When Allison Robinson shared her experience on a local Facebook group, it triggered a heated debate among community members about whether these fraud protection alerts are legitimate or elaborate scams. This comprehensive investigation reveals the truth behind these controversial emails and provides essential guidance for protecting yourself from fraud.

Overview of the TVA Employees Credit Union Fraud Protection Email Alert

The email in question appeared to be a standard fraud protection alert from Knoxville TVA Employees Credit Union. It featured official-looking branding and urgent language warning recipients about potential fraudulent activity on their debit cards. The message included specific details such as a case ID number, cardholder name, and a toll-free number (1-833-763-2031) for immediate contact.

Key Elements of the Disputed Email:

- Subject Line: “Fraud Notification on your Knoxville TVA Employees Credit Union debit card”

- Sender: EnFact Notification system

- Contact Number: 1-833-763-2031

- Case ID: 60355287277

- Action Required: Immediate phone call to secure account

The email’s professional appearance and inclusion of personal information initially seemed legitimate, but several red flags caused recipients to question its authenticity.

Is Knoxville TVA Employees Credit Union Fraud Protection Alert Email Legit or Scam?

After extensive community discussion and official verification, the email appears to be legitimate. The Knoxville TVA Employees Credit Union’s official Facebook account directly confirmed the authenticity of these fraud alerts, stating: “That is a fraud message from us! It is apart of normal monitoring for your debit card.”

Official Confirmation Evidence:

- Direct response from TVA Credit Union’s official social media account

- Multiple community members confirmed similar legitimate fraud alerts

- Verified cases of actual account compromises requiring these alerts

- Consistent with TVA’s documented fraud protection procedures

However, the timing coincided with TVA’s major system upgrades (May 30 – June 2), creating confusion about whether fraud monitoring would continue during maintenance periods.

Email Patterns with Examples

Understanding the patterns of legitimate versus fraudulent emails is crucial for making informed decisions. Here’s a comparative analysis:

Legitimate TVA Fraud Alerts Include:

- Official TVA branding and logo

- Specific case ID numbers for tracking

- Personal information matching account records

- Consistent phone numbers used by their fraud detection partners

- No requests for sensitive information via email

- Professional grammar and formatting

Common Scam Email Patterns:

- Generic greetings without personal information

- Urgent threats of account closure

- Requests for passwords, PINs, or social security numbers

- Suspicious sender addresses

- Poor grammar and spelling errors

- Links to unofficial websites

Real Examples from Community Members:

Legitimate Alert Pattern (as described by Chasity Laney):

- Email and text message combination

- Specific transaction locations listed

- Account temporarily locked for protection

- Official fraud department contact information

Suspicious Pattern Indicators:

- Generic automated responses

- No TVA-specific identification in phone systems

- Mismatched contact information

- Pressure for immediate action without verification options

Legitimate Fraud Detection Practices

Knoxville TVA Employees Credit Union employs sophisticated fraud detection systems that operate continuously, even during system maintenance periods. Their legitimate practices include:

Multi-Channel Communication:

- Email alerts for documented fraud cases

- Text message notifications to registered phone numbers

- Phone calls for high-priority situations

- Account locks to prevent unauthorized transactions

Official Contact Methods:

- Primary fraud line: (865) 544-5400, option 1

- Third-party monitoring services: Various toll-free numbers

- Branch locations for in-person verification

- Secure online banking messages

Authentication Procedures:

- Case ID verification systems

- Personal information confirmation

- Account history review

- Transaction pattern analysis

Why People Were Suspicious

The community’s skepticism was well-founded for several legitimate reasons:

Timing Concerns:

- System maintenance period (May 30 – June 2) raised questions about operational capabilities

- Weekend timing when normal customer service was unavailable

- Unusual email sender (EnFact Notification) unfamiliar to most customers

Technical Red Flags:

- Unverified Facebook account lacking official verification badges

- Generic phone system responses without TVA-specific branding

- Third-party phone number (1-833-763-2031) not matching known TVA contacts

- Automated system requesting case IDs without human interaction

Security Awareness:

- Recent increase in sophisticated phishing attempts

- Known scammer tactics of exploiting system downtime

- Community education about fraud protection best practices

- Previous experiences with legitimate fraud alerts having different formats

The “Four P’s” Framework Explains the Confusion

The Federal Trade Commission’s “Four P’s” framework helps analyze why this situation created such uncertainty:

1. PRETEND

Scammer Tactic: Fraudsters impersonate trusted organizations

This Case: Email genuinely came from TVA’s fraud detection system

Confusion Factor: Professional appearance made verification difficult

2. PROBLEM

Scammer Tactic: Create urgency by claiming account issues

This Case: Legitimate fraud detection triggered by suspicious activity

Confusion Factor: Real fraud attempts were occurring simultaneously

3. PRESSURE

Scammer Tactic: Demand immediate action to prevent thinking

This Case: Standard fraud protocol requires quick response

Confusion Factor: Legitimate urgency mimicked scammer tactics

4. PAY

Scammer Tactic: Request specific payment methods over email, text or phone call.

This Case: No payment requests made

Confusion Factor: ✓ Passed this test – good indicator of legitimacy

How to Identify and Protect from These Scams

Verification Steps:

- Never call numbers provided in suspicious emails

- Use official contact information from your debit card or bank statements

- Visit branch locations for in-person verification when possible

- Check official websites for fraud alert confirmations

- Cross-reference information with known legitimate communications

Red Flag Checklist:

- ❌ Requests for passwords, PINs, or account numbers

- ❌ Urgent threats of immediate account closure

- ❌ Poor grammar or spelling errors

- ❌ Generic greetings without personal information

- ❌ Links to suspicious websites

- ❌ Unusual sender addresses

Protection Strategies:

- Enable account alerts through official banking channels

- Monitor accounts regularly for unauthorized transactions

- Use strong, unique passwords for all financial accounts

- Set up two-factor authentication where available

- Keep contact information updated with your financial institutions

What to Do If You Receive Suspicious Communications

Immediate Actions:

- Do not click any links in the email or message

- Do not call provided phone numbers without verification

- Do not provide personal information over unsolicited communications

- Save the suspicious message for reference and reporting

Verification Process:

- Contact your bank directly using official phone numbers

- Log into your account through official website or app

- Visit a branch location if possible

- Report suspicious communications to appropriate authorities

If Fraud is Confirmed:

- Change all passwords immediately

- Monitor credit reports for unauthorized activity

- File police reports if significant losses occur

- Document all communications with financial institutions

- Consider identity monitoring services

Best Practices Moving Forward

For Consumers:

- Establish verification protocols before acting on financial communications

- Maintain updated contact information with all financial institutions

- Regularly review account statements and transaction histories

- Stay informed about current scam tactics and trends

- Share information with family and community members

For Financial Institutions:

- Improve communication clarity about third-party monitoring services

- Provide consistent contact information across all communications

- Enhance customer education about legitimate fraud detection procedures

- Verify social media accounts to prevent impersonation

- Develop clear protocols for system maintenance communication

Community Awareness:

- Share experiences through appropriate channels

- Verify information before spreading panic or false information

- Support vulnerable community members who may be targeted

- Report suspicious activities to local authorities and financial institutions

Frequently Asked Questions (FAQs)

1. Is TVA Email Real or Fake?

Yes, the fraud protection emails from Knoxville TVA Employees Credit Union are legitimate. The credit union has confirmed these emails are part of their standard fraud monitoring procedures. However, always verify through official channels before taking action.

2. Why didn’t the phone number identify as TVA when I called?

TVA uses third-party fraud monitoring services that may not specifically identify as “TVA” in their automated systems. The generic “fraud protection” greeting is normal for these specialized services, though it understandably raises suspicion.

3. Should I trust fraud alerts during system maintenance?

Yes, fraud monitoring typically continues even during system upgrades. Fraudsters often exploit maintenance periods, making continuous monitoring essential. However, always verify through official channels when in doubt.

4. What’s the difference between the phone numbers mentioned?

- (865) 544-5400: TVA’s main fraud reporting line (press option 1)

- (1-833-763-2031): Third-party fraud monitoring service number Both are legitimate, but the 865 number connects directly to TVA staff.

5. How can I tell if future communications are legitimate?

Always verify through official channels by calling numbers from your debit card or bank statements. Never use contact information provided in suspicious emails. When in doubt, visit a branch location for in-person verification.

Conclusion

The TVA fraud alert email controversy highlights the complex challenges of modern fraud prevention. While the community’s skepticism was warranted and demonstrated excellent security awareness, the emails were ultimately legitimate fraud protection measures. This situation serves as a valuable reminder that even authentic communications can appear suspicious in today’s fraud-heavy environment.

The key takeaway is the importance of verification through official channels rather than relying solely on the appearance or content of electronic communications. Financial institutions must also improve their communication strategies to reduce confusion while maintaining effective fraud protection.

By understanding the patterns of legitimate versus fraudulent communications, employing proper verification procedures, and staying informed about current scam tactics, consumers can better protect themselves while still benefiting from essential fraud protection services.

Stay informed about the latest scam alerts and consumer protection tips with ShoppersVila.com – your trusted source for financial security information and community-driven safety insights.