Borrowers report $300 loans ballooning to $3,000 as tribal lender sidesteps state regulations

In May 2023, Jessica borrowed $800 from tribal lender Spotloan to cover emergency car repairs. Nearly a year later, after making over $1,500 in payments, she was shocked to discover she still owed more than her original loan amount. “I’ve paid almost double what I borrowed and somehow my balance barely moved,” she told consumer advocates. “It’s like being caught in quicksand – the more you struggle, the deeper you sink.”

Jessica’s experience mirrors thousands of Spotloan customers who have found themselves trapped in what consumer advocates call a “debt spiral” – where extraordinarily high interest rates make it nearly impossible to escape the debt cycle. While Spotloan markets itself as “better than payday loans,” a comprehensive examination of customer reviews, complaints, and company practices reveals a troubling pattern of high-cost lending that leaves many borrowers worse off than before.

What is Spotloan and How Does It Work?

Spotloan is an online installment lender owned by BlueChip Financial, a tribal entity organized under the Turtle Mountain Band of Chippewa Indians in North Dakota. Founded in 2012, the company positions itself as an alternative to payday loans, offering installment loans between $300-$800 (up to $1,500 for “preferred customers” with 10+ loans).

The application process is straightforward:

- Apply online by providing personal and banking information

- Receive approval decision (often within minutes)

- Accept loan terms (including repayment schedule)

- Receive funds in your bank account (as soon as same day)

- Repay through scheduled payments (up to 10 months)

What distinguishes Spotloan from traditional payday lenders is the extended repayment period. While payday loans typically require full repayment within 2-4 weeks, Spotloan allows customers to pay over several months. However, this extended term comes with a critical caveat: extraordinarily high interest rates.

The Interest Rate Reality: 490% APR

Spotloan’s maximum APR is 490% – meaning a $500 loan could end up costing over $2,000 if paid according to their standard schedule. The company is transparent about this rate on their website, but many customers report not fully understanding the implications until they’re deep into repayment.

According to Spotloan’s own examples, borrowing $600 with bi-weekly payments over 5 months would result in $775 in finance charges, for a total repayment of $1,375. However, customer complaints reveal the reality can be much worse, particularly when payments are missed or rescheduled.

Sample cost breakdown for a $500 loan:

- Original loan amount: $500

- APR: 490%

- Daily interest: Approximately $6.70

- Bi-weekly payment: Approximately $93

- Total repayment (10 payments): $930

- Total interest paid: $430 (86% of the original loan)

The company does offer lower rates to repeat customers – down to 99% APR after completing 10 loans. This structure incentivizes repeat borrowing, which critics argue traps customers in a long-term cycle of high-interest debt.

Customer Reviews: A Mixed Picture

Spotloan maintains a surprisingly high 4.4/5 star rating on Trustpilot based on nearly 29,000 reviews, with 79% being 5-star ratings. Positive reviews consistently mention:

- Fast and easy application process

- Quick funding (often same-day)

- Accessibility for those with poor credit

- Reliable service for emergencies

One satisfied customer wrote: “When I was starving for food, they were the only ones to send money the next day. Beautiful people!”

However, the picture changes dramatically when examining Better Business Bureau (BBB) reviews, where Spotloan holds a dismal 1.1/5 star average. The BBB has recorded 184 complaints against Spotloan in the past three years, with recurring themes of exorbitant interest rates and repayment problems.

Major Consumer Complaints

Analysis of hundreds of customer complaints reveals five primary issues with Spotloan:

1. Minimal Principal Reduction

Many customers report making payments for months only to discover nearly all their money goes toward interest, not principal. One customer described making a $66 payment and having only $0.63 applied to principal. Another reported making five payments of $161 on an $800 loan, only to find their balance had actually increased to $807.

2. Debt Multiplication

The most common complaint involves small loans ballooning to several times their original amount. Examples include:

- $300 loan → over $1,000 repayment

- $400 loan → $1,554 total repayment

- $500 loan → nearly $3,000 total repayment

- $700 loan → made $1,084 in payments, still owed $522

3. Hardship Inflexibility

Despite claiming to help people in financial emergencies, many customers report Spotloan offers minimal assistance when they experience hardship. The standard response to hardship requests is a 30-day interest freeze – after which full payments resume with accumulating interest.

One longtime customer with 14 successful loans reported: “I hung up crying. Company claims to want to be helpful but is harsh. I need this loan gone and closed… They are destroying me.”

4. Account Access and Service Issues

Numerous complaints mention difficulties accessing online accounts, viewing payment histories, or getting clear information about balances. Customer service experiences vary widely, with some reporting helpful representatives and others describing rude or dismissive treatment.

5. Tribal Lending Regulatory Questions

Several complaints question Spotloan’s legal status and interest rates. One customer noted: “It’s a class 3 felony in [my state] to charge interest over 45%,” while another called the 490% APR “criminal interest rates that violate state law.”

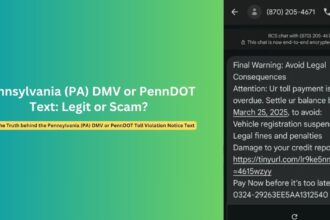

Is Spotloan Legitimate or a Scam?

Spotloan is a legitimate registered business operating under tribal sovereignty, not an outright scam. They do provide the loans they advertise and disclose their interest rates and terms in their loan agreements. However, their legitimacy doesn’t necessarily mean they offer a beneficial financial product.

The company operates in a legal gray area by using tribal sovereignty to potentially circumvent state usury laws that cap interest rates. While this practice is currently legal, several court cases have challenged similar tribal lending operations, and some states have taken legal action against high-interest tribal lenders.

Consumer advocates argue that while technically legal, Spotloan’s interest rates and lending practices are designed to profit from vulnerable borrowers who have limited alternatives, creating what many consider a predatory lending situation.

Red Flags of Predatory Lending

Whether considering Spotloan or any short-term lender, watch for these warning signs:

- Extraordinarily high interest rates – APRs over 36% are generally considered high; Spotloan’s 490% is exceptionally high

- No credit check emphasis – Lenders that heavily advertise “no credit check” often compensate with extremely high interest

- Payment structure that barely reduces principal – Early payments should meaningfully reduce your balance

- Incentives for repeat borrowing – Lower rates only after multiple loans can trap borrowers in cycles

- Tribal affiliation with limited state regulation – This structure often indicates an attempt to avoid state lending laws

- Pressure to borrow more than needed – Some lenders encourage maximum borrowing regardless of actual need

- Unclear or complicated terms – Legitimate lenders should clearly explain all costs and terms

How to Protect Yourself from High-Cost Loans

If you’re considering a high-interest loan like Spotloan, consider these alternatives and protections:

Explore Alternative Options

- Credit union payday alternative loans (PALs) – Regulated small loans with capped 28% APR

- Community assistance programs – Many localities offer emergency bill assistance

- Payment plans with creditors – Utility companies and medical providers often offer hardship arrangements

- Credit card cash advances – While not ideal (typically 25-30% APR), still far lower than 490%

- Family or friend loans – Consider formal agreements to maintain relationships

- Local credit unions or community banks – Often offer small personal loans at reasonable rates

If You Already Have a High-Interest Loan

If you’re already in a high-interest loan situation:

- Pay more than the minimum whenever possible

- Prioritize early payoff to minimize interest

- Consider debt consolidation through a lower-interest personal loan

- Check if your state has interest rate caps that might apply despite tribal claims

- File complaints with regulatory bodies if you believe lending practices violated laws

Frequently Asked Questions

Is Spotloan Safe?

Spotloan is safe in terms of website security and legitimate funding – they do provide the loans they promise. However, their extremely high interest rates (up to 490% APR) make them financially unsafe for many borrowers, potentially creating long-term financial hardship through debt cycles.

How Does Spotloan Compare to Traditional Payday Loans?

Spotloan differs from traditional payday loans by offering longer repayment terms (up to 10 months versus 2-4 weeks) and installment payments rather than a single lump sum. However, with APRs up to 490%, the overall cost may be comparable or even higher than traditional payday loans.

Does Spotloan Report to Credit Bureaus?

According to their website, Spotloan “may report loan activity to non-traditional credit reporting agencies such as DataX and Clarity.” They typically do not report to major credit bureaus (Experian, Equifax, TransUnion) unless accounts go to collections.

What Happens If I Can’t Repay My Spotloan?

If you miss payments, Spotloan may charge additional interest on the balance due and report late/unpaid amounts to credit agencies. Your account may eventually be transferred to a collection agency, which could impact your credit and lead to persistent collection attempts.

Does Tribal Lending Mean State Laws Don’t Apply?

This is a complex legal question still being resolved in courts. Tribal lenders claim sovereign immunity from state regulations, but some courts have ruled that certain state consumer protection laws may still apply, particularly when the borrower resides off tribal land. The legal landscape continues to evolve in this area.

Conclusion: Proceed with Extreme Caution

While Spotloan provides a service for those with limited credit options facing emergencies, the extraordinary cost makes it a risky financial solution. A $600 emergency loan can easily become a $2,000+ financial burden through their interest structure.

The company’s legitimacy as a registered business doesn’t necessarily make it a beneficial financial choice. With interest rates far exceeding what most financial advisors would consider reasonable (typically 36% APR maximum for high-risk lending), Spotloan and similar high-cost lenders should be considered only as a last resort after exhausting all other options.

If you’re considering a Spotloan, be absolutely certain you can repay quickly to minimize interest charges, understand exactly how much you’ll pay in total, and have a clear plan to escape the potential debt cycle that traps many customers.

Remember that short-term financial relief can lead to long-term financial hardship when interest rates approach 500% – a reality reflected in hundreds of consumer complaints about this lender.