In the current challenging job market, vulnerable job seekers are falling prey to an increasingly sophisticated scam orchestrated by fraudsters operating under the guise of NextGen Growth Consulting. This comprehensive investigation reveals the intricate methods used by scammers to exploit job applicants’ hopes and financial vulnerabilities.

How the NextGen Growth Consulting Scam Works?

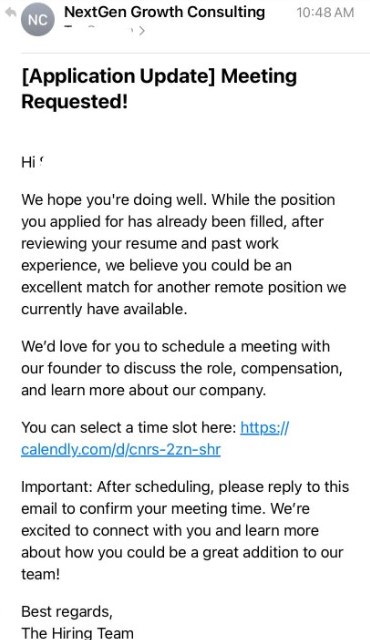

The NextGen Growth Consulting scam follows a meticulously crafted playbook designed to manipulate job seekers:

- Initial Contact Strategy

- Unsolicited emails claiming a position you applied for has been filled

- Vague promises of an “alternative” or “higher-level” position

- Urgent request to schedule an immediate meeting

- Communication Tactics

- Generic email templates with nearly identical wording

- Follow-up text messages from a person named “Mark”

- Multiple contact attempts via phone and email

- Use of spoofed email addresses and area codes

Red Flags: Identifying the Scam Before It’s Too Late

Warning Signs of the NextGen Growth Consulting Fraud

| Red Flag | Explanation | Risk Level |

|---|---|---|

| Vague Job Description | No specific role details provided | High |

| Immediate Founder Meeting | Unusual hiring process | Critical |

| Unsolicited Contact | Unrequested job “opportunity” | High |

| Pressure to Schedule Quickly | Creates artificial urgency | Critical |

| Generic Communication | Templated, non-personalized messages | High |

The Scammer’s Playbook: Manipulation Techniques

Psychological Exploitation of Job Seekers

Scammers leverage several psychological tactics to trap unsuspecting victims:

- Emotional Manipulation

- Targeting individuals in vulnerable job search periods

- Creating false hope of immediate employment

- Exploiting economic uncertainties

- Social Engineering Methods

- Impersonating legitimate recruitment processes

- Using professional-sounding language

- Creating fake LinkedIn profiles and company websites

Protecting Yourself: Comprehensive Defense Strategies

Safeguarding Against Remote Job Scams

Immediate Action Steps:

- Never click unsolicited meeting links

- Verify company information independently

- Report suspicious communications

- Block unknown phone numbers and email addresses

Verification Checklist:

- Confirm company’s official website

- Check LinkedIn company page

- Verify contact information through official channels

- Research company registration details

Technical Risks: Beyond the Initial Scam

Potential Data Breach and Information Theft

The NextGen Growth Consulting scam potentially involves:

- Collecting personal identification information

- Harvesting email addresses for future phishing attempts

- Potential credit card fraud through “certification” fees

- Risk of identity theft

Financial Exploitation Techniques

Scammers typically progress through multiple stages:

- Initial contact and trust-building

- Invitation to a mass video conference

- Pitch for paid “certification” (typically $97)

- Promising unrealistic weekly earnings ($2,000-$3,000)

What to Do If You’ve Been Targeted by Fake Recruiting Group

Comprehensive Response Protocol

Immediate Steps:

- Do not engage further with the contact

- Screenshot all communications

- Report to:

- Local law enforcement

- Federal Trade Commission (FTC)

- Internet Crime Complaint Center (IC3)

- Email provider’s fraud department

Advanced Protection Measures:

- Monitor credit reports

- Place fraud alerts with credit bureaus

- Change passwords for critical accounts

- Consider identity theft protection services

Legal and Technological Countermeasures

Preventing Future Scam Attempts

Technological Defenses:

- Use advanced email filtering

- Install reputable antivirus software

- Enable two-factor authentication

- Use virtual phone numbers for job applications

Legal Recommendations:

- Document all interactions

- Preserve communication evidence

- Consult legal professionals if significant financial loss occurs

Conclusion: Staying Vigilant in a Digital Job Market

The NextGen Growth Consulting scam represents a sophisticated threat to job seekers. By understanding their tactics, maintaining vigilance, and following comprehensive protection strategies, individuals can significantly reduce their risk of falling victim to such fraudulent schemes.

Final Warning: Your safety and financial security are paramount. Always prioritize thorough verification over immediate opportunities.