“We are ready to fund your loan tomorrow, please confirm.” This seemingly innocent text message from LendBee is landing in thousands of Americans’ phones—often targeting individuals who never applied for such loans. The rise in these suspicious texts has prompted concern from regulatory authorities and consumer protection agencies alike. In 2024 alone, Americans lost over $10 billion to text message scams, with loan-related messages becoming increasingly prevalent.

This comprehensive guide examines the LendBee text message phenomenon, how these scams operate, and most importantly, how you can protect yourself from becoming the next victim.

The Rising Threat of LendBee Loan Text Message Scams

Text message scams, commonly known as “smishing” (SMS phishing), have reached unprecedented levels. According to recent data, scammers sent an astonishing 87.8 billion spam text messages last year alone. Among these, loan-related scams have emerged as a particularly troubling category, with LendBee being one of several company names frequently used by fraudsters.

“These loan funding texts represent a sophisticated evolution in scamming techniques,” says cybersecurity expert Miranda Chen. “They target financial vulnerability and create a false sense of opportunity, making them particularly effective at luring victims.”

The Federal Communications Commission (FCC) has recently taken specific actions against illegal robocall campaigns marketing lending services, highlighting the growing scale of the problem. In fact, the FCC has explicitly ordered voice service providers to cease illegal robocall campaigns targeting individuals with loan offers—a clear indication that this issue has caught regulatory attention.

How the LendBee Text Message Scam Works

The LendBee loan text scam follows a calculated playbook designed to extract personal information or money from unsuspecting victims. Here’s the typical process:

- Initial Contact: Victims receive an unsolicited text message appearing to come from “LendBee” or similar-sounding lending companies indicating that a loan is ready for funding or approval.

- False Familiarity: The message often implies an existing relationship (“your loan is ready”), creating confusion among recipients who may wonder if they’ve forgotten applying for a loan or if someone has stolen their identity.

- Creating Urgency: By indicating the loan is “ready for tomorrow” or needs “immediate confirmation,” scammers pressure victims into responding quickly without proper consideration.

- Data Collection: If the recipient responds, scammers begin collecting personal information—potentially including Social Security numbers, banking details, or other sensitive data—ostensibly to “verify identity” before releasing funds.

- Financial Extraction: In more advanced versions of the scam, victims may be asked to pay “processing fees,” “insurance,” or “taxes” to release the supposedly approved loan funds.

A Reddit user who fell victim to a similar scam reported: “After I responded to the text, they told me my $15,000 loan was approved but I needed to pay a $299 ‘processing fee’ first. Once I sent the money, they disappeared.”

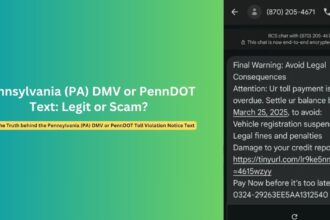

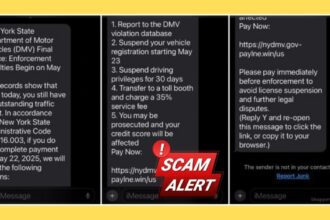

Common Text Patterns and Variations

LendBee loan scam messages often follow recognizable patterns, though they may vary in specific wording. Understanding these patterns can help you quickly identify and avoid potential scams. Here are some common message formats:

- “LendBee: Your loan application has been approved! We are ready to fund $X,XXX tomorrow. Reply YES to confirm.”

- “LENDBEE LOANS: Final notice – Your pre-approved loan of $X,XXX requires confirmation. Call [phone number] immediately.”

- “LendBee Financial: Congratulations! Your loan is APPROVED and ready for deposit. Confirm details at [suspicious link].”

- “URGENT: Your LendBee loan funding is pending. To avoid cancellation, verify your information at [link] within 24 hours.”

These messages may also include personalized elements to appear more legitimate, such as:

- Partial information about your bank

- The last four digits of your Social Security number (potentially obtained from data breaches)

- References to your location or state

According to the FCC, scammers are increasingly using “neighbor spoofing” techniques, where text messages appear to come from numbers similar to your own to increase the likelihood you’ll engage.

Red Flags That Signal a LendBee Text Message Scam

When receiving text messages about loan funding opportunities, several warning signs should immediately trigger your suspicion:

1. Unsolicited Communication

- You receive a text about a loan you never applied for

- The message comes from an unknown or unfamiliar company

- The text arrives at odd hours or on weekends when legitimate financial institutions typically don’t send notifications

2. Suspicious Content Indicators

- Grammatical errors or unusual phrasing

- Generic greetings like “Dear Customer” rather than your name

- Urgent time pressure to respond immediately

- Offers that seem too good to be true (extremely low interest rates or guaranteed approval)

3. Questionable Contact Methods

- Links with shortened URLs or unusual domains

- Instructions to call numbers that don’t match official company numbers

- Requests to respond via text with personal information

- Phone numbers with area codes from different states or countries

4. Unusual Requests

- Requests for upfront fees or payments

- Directions to purchase gift cards or use wire transfers

- Prompts to download apps or files to “verify your identity”

- Requests for your full Social Security number, complete banking information, or account passwords

“Legitimate lenders will never ask you to wire money or pay with gift cards,” explains consumer protection attorney James Wilson. “These payment methods are red flags because they’re difficult or impossible to trace or recover.”

How to Identify and Protect Yourself from Loan Funding Scams

Protecting yourself from loan text message scams requires vigilance and a proactive approach to digital security. Here are comprehensive strategies to keep your information and finances safe:

Immediate Actions When Receiving Suspicious Texts

- Don’t Engage: Never reply to suspicious texts—even with “STOP”—as this confirms your number is active to illegitimate scammers. For legitimate companies, “STOP” should work, but be cautious with unknown senders.

- Verify Independently: If you think a text might be legitimate, don’t use any links or phone numbers provided in the message. Instead:

- Look up the official company website or phone number separately

- Call their customer service directly using the official number

- Check your online accounts by typing the URL directly in your browser

- Report the Message:

- Forward suspicious texts to 7726 (SPAM) to alert your mobile carrier

- File a complaint with the FCC at fcc.gov/complaints

- Report to the FTC at ReportFraud.ftc.gov

- Document Everything: If you’ve already engaged with the scammer, document all communications for potential fraud reports.

Preventive Measures to Implement Now

- Register with the National Do Not Call Registry: Visit donotcall.gov or call 1-888-382-1222 to reduce telemarketing communications.

- Enable Spam Protection: Most carriers offer free spam protection services:

- AT&T: ActiveArmor

- T-Mobile: ScamShield

- Verizon: Call Filter

- US Cellular: Call Guardian

- Review Privacy Settings:

- Check privacy policies when sharing your phone number online

- Opt out of data sharing when possible with financial institutions

- Regularly review which apps have access to your phone number and contacts

- Set Up Alerts: Configure alerts on your financial accounts to notify you of any unusual activity or new applications made in your name.

“The most effective protection is skepticism,” says former FCC enforcement division attorney Sarah Michaels. “Legitimate lenders don’t conduct business primarily through text messages, especially for initial loan offers.”

What To Do If You’ve Already Responded

If you’ve already responded to a suspicious LendBee text message, take these steps immediately:

- Cut Contact: Stop all communication with the scammer immediately.

- Monitor Your Accounts: Check your bank and credit card statements for unauthorized transactions.

- Place a Fraud Alert: Contact one of the three major credit bureaus (Experian, TransUnion, or Equifax) to place a fraud alert on your credit report.

- Change Passwords: Update passwords for any financial accounts you may have shared information about.

- File Reports:

- File a police report with your local authorities

- Report to the FBI’s Internet Crime Complaint Center at IC3.gov

- Contact the Consumer Financial Protection Bureau at consumerfinance.gov/complaint

Frequently Asked Questions

1. Is LendBee a legitimate lending company?

While there may be legitimate lending companies with similar names, many recipients of these texts report never having applied for loans with LendBee. Always verify a lender’s legitimacy by checking if they’re registered in your state and have proper credentials from the NMLS (Nationwide Multistate Licensing System).

2. What if I actually did apply for a loan recently?

Legitimate lenders typically communicate through official channels like email or their secure platform. Even if you applied for a loan, be suspicious of unexpected text messages. Contact the lender through their official website or phone number to verify any communications.

3. Can replying “STOP” make the situation worse?

For legitimate businesses, replying “STOP” should opt you out of messages. However, when dealing with scammers, any response confirms your number is active and monitored. The safest approach with suspicious texts is to not respond at all.

4. What information should I never share via text?

Never share sensitive information via text messages, including:

- Social Security numbers

- Banking information or account numbers

- Credit card information

- Passwords or PINs

- Date of birth

- Home address

5. Can my phone be hacked just by receiving a text message?

Simply receiving a text message doesn’t typically compromise your phone. The danger comes from clicking links, downloading attachments, or responding with personal information. However, sophisticated smishing attacks can sometimes deliver malware if links are clicked.

Conclusion: Staying Vigilant in a Digital World

The LendBee loan text message scam represents just one variant in the evolving landscape of digital fraud. As technology advances, so do the tactics of those who seek to exploit it for financial gain. The best defense remains a combination of awareness, skepticism, and proactive security measures.

By understanding how these scams operate and implementing the protection strategies outlined in this article, you can significantly reduce your risk of falling victim to text message scams. Remember that legitimate financial institutions will never pressure you for immediate responses or request sensitive information through unsecured channels like text messages.

If you encounter suspicious loan funding text messages, take a moment to pause, verify, and when in doubt, report. Your vigilance not only protects your own financial well-being but also contributes to broader efforts to combat digital fraud.

This article is for informational purposes only and does not constitute legal or financial advice. If you believe you’ve been a victim of fraud, consult with appropriate professionals and report to relevant authorities.