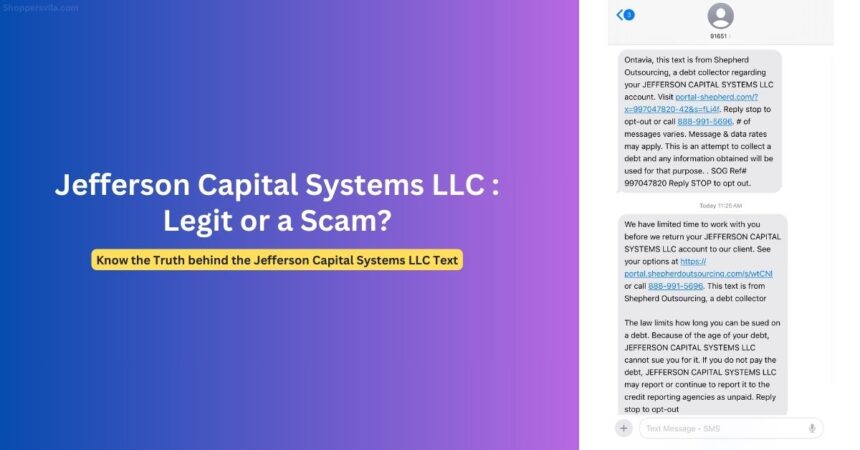

In recent months, consumers across the United States have reported receiving unexpected text messages, calls, and letters from Jefferson Capital Systems LLC demanding payment for debts they don’t recognize. While Jefferson Capital is a legitimate debt collection agency founded in 2002, the surge in complaints raises questions about their practices and highlights a growing concern about predatory debt collection tactics that blur the line between legitimate collection and outright scams.

“I’ve never even had an account with that company,” says one consumer who received a text claiming they owed over $2,000 to a wireless carrier they hadn’t used in years. “When I called to verify, the original company confirmed I didn’t owe them anything.”

This growing phenomenon has left many wondering: Is Jefferson Capital Systems running a scam, or are they simply aggressively pursuing debts they’ve legally purchased? The answer is complicated and varies depending on individual circumstances.

Understanding Jefferson Capital Systems LLC’s Business Model

Jefferson Capital Systems is a Minnesota-based debt collection agency that purchases charged-off consumer debts from original creditors at steep discounts—often pennies on the dollar. Once they own these debts, they attempt to collect the full amount from consumers through various means, including:

- Text messages and phone calls

- Collection letters

- Credit report listings

- Legal action in some cases

The company primarily collects on telecommunications debts (Verizon, Sprint), retail debts, banking debts, and even some pay-day loans. While their business model is legal, their aggressive collection tactics have generated numerous complaints to consumer protection agencies.

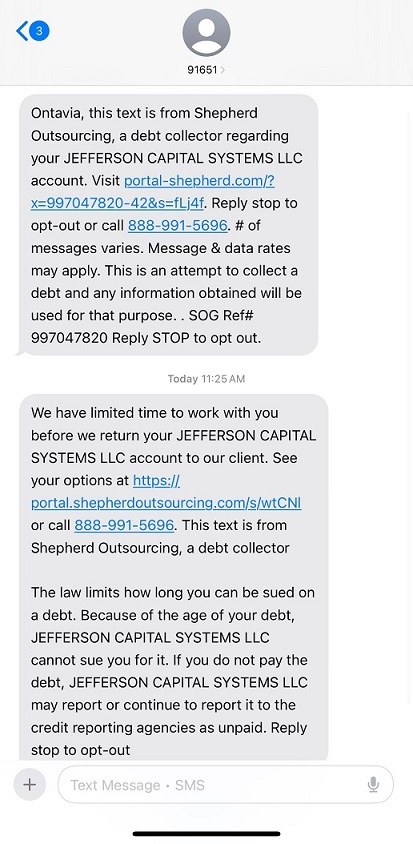

The Impersonation Problem: Understanding the Scam Text Pattern

A particularly troubling pattern that has emerged involves debt collectors contacting individuals using names that aren’t theirs – exemplified by the “Ontavia” case that has appeared in multiple consumer complaints. This specific scam pattern works as follows:

- Consumers receive texts addressing them as “Ontavia” (or another incorrect name)

- The texts claim they owe money to Jefferson Capital Systems LLC for debts they don’t recognize

- When investigated, these debts often connect to previous identity theft incidents

- Scammers may be leveraging data from past breaches where consumers’ information was compromised

In one documented case, a consumer who had fallen victim to a housing scam years earlier discovered that the scammer had used their information but under the name “Ontavia.” Years later, collection texts for “Ontavia” began arriving, suggesting the fraudsters were attempting a second wave of fraud using the same stolen information.

This type of impersonation creates multiple levels of confusion:

- The debt collector may be legitimate but pursuing a fraudulent debt

- The original “creditor” never had a legitimate relationship with the consumer

- The consumer’s identity has been compromised in ways that can re-emerge years later

Red Flags That Signal Potential Fraud

While Jefferson Capital Systems is technically a legitimate company, there are several red flags that could indicate fraudulent collection attempts:

- Wrong Name or Information: Messages addressed to someone else (like “Ontavia” in one consumer’s case) could indicate scammers using purchased data lists.

- Unverifiable Debts: When the original creditor confirms you don’t owe money or has no record of the debt.

- Immediate Requests for Personal Information: Legitimate collectors already have your information and won’t immediately ask for SSN or banking details.

- Pressure Tactics: Threats of immediate legal action or statements creating artificial urgency.

- Statute-Barred Debts: Acknowledging that the debt is “legally old” but still demanding payment.

- Suspicious Payment Methods: Requests for payment via gift cards, wire transfers, or cryptocurrency.

- No Proper Validation: Refusal or inability to provide detailed information about the debt when requested.

Consumer reports indicate that Jefferson Capital often refuses to provide detailed debt validation, changes dates of delinquency to make debts appear newer, and sometimes continues collection attempts even after debts are paid.

How to Identify Legitimate vs. Scam Jefferson Capital Systems LLC Debt Collection

Not all communications from Jefferson Capital are fraudulent. Here’s how to distinguish between legitimate collection attempts and potential scams:

Legitimate Collection Attempts:

- Can provide detailed information about the debt upon request

- Will send written validation within 30 days when requested

- Follow legal guidelines about collection times and methods

- Don’t demand immediate payment before validation

- Communicate professionally without threats or harassment

- Will work with you on verification and payment options

Potentially Fraudulent Collection:

- Cannot or will not provide detailed debt validation

- Pressures for immediate payment

- Addresses you by the wrong name

- Claims debts from companies that have no record of you owing money

- References extremely old debts as suddenly due

- Demands payment methods that aren’t traceable

- Appears suddenly on your credit report without prior notice

Protecting Yourself from Questionable Collection Attempts

If you receive a communication from Jefferson Capital Systems or any debt collector about a debt you don’t recognize, follow these steps:

1. Don’t Respond Immediately

Never acknowledge the debt, make a payment, or provide personal information before verifying the debt is legitimate. Even a small payment can restart the statute of limitations on an old debt.

2. Request Debt Validation in Writing

Within 30 days of the initial contact, send a debt validation letter requesting:

- Name of the original creditor

- Original debt amount and current balance

- Date of the original delinquency

- Documentation proving you owe the debt

- Proof they have the right to collect

Send this via certified mail with return receipt requested to create a paper trail.

3. Check Your Credit Reports

Review your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) through AnnualCreditReport.com. Look for the collection account and any other suspicious items.

4. Contact the Original Creditor

Reach out to the company that supposedly originated the debt to verify whether:

- You ever had an account with them

- The account went to collections

- They sold the debt to Jefferson Capital

5. Keep Detailed Records

Document all communications, including:

- Dates and times of calls

- Names of representatives

- Copies of all letters and texts

- Notes from all conversations

6. Know Your Rights Under the FDCPA

The Fair Debt Collection Practices Act prohibits collectors from:

- Calling before 8 a.m. or after 9 p.m.

- Contacting you at work if you’ve told them not to

- Using abusive language or threats

- Making false statements about consequences

- Discussing your debt with others

Removing Jefferson Capital Systems from Your Credit Report

If Jefferson Capital has placed an invalid debt on your credit report, you have options:

1. Dispute the Entry with Credit Bureaus

File a dispute with each credit bureau reporting the collection. You can do this online, by phone, or by mail. The bureaus must investigate within 30 days and remove inaccurate information.

2. Send a “Pay for Delete” Letter

If the debt is valid but you want it removed, you can try negotiating a “pay for delete” agreement where Jefferson Capital removes the negative entry in exchange for payment. Get any agreement in writing before making payment.

3. Wait it Out

Collection accounts typically remain on your credit report for seven years from the date of the first delinquency. However, their impact diminishes over time.

4. Consult a Consumer Protection Attorney

If Jefferson Capital Systems LLC is violating the FDCPA or attempting to collect a time-barred debt, a consumer protection attorney may be able to help you take legal action.

What Makes These Collection Attempts Concerning

What distinguishes legitimate debt collection from potentially fraudulent practices is often the approach. Several patterns emerge from consumer complaints about Jefferson Capital:

- Identity Confusion and Impersonation: Multiple consumers report debts associated with names not their own, suggesting possible identity theft or data breaches. The “Ontavia” pattern appears across multiple unrelated complaints, suggesting organized fraud.

- Timing Manipulation: Some consumers report debts suddenly appearing after the seven-year reporting period, with dates apparently manipulated to make old debts appear recent.

- Verification Issues: Even when debts are disputed, many consumers report that credit bureaus “verify” the debts despite evidence they don’t owe them.

- Zombie Debts: Collection of extremely old debts that have passed the statute of limitations—often called “zombie debts”—is a growing industry practice that raises ethical concerns.

- Original Creditor Conflicts: Multiple consumers report confirming with original creditors that they don’t owe money, yet Jefferson Capital continues collection efforts.

When to Seek Professional Help

Consider consulting a consumer protection attorney if:

- Jefferson Capital continues collection efforts after you’ve disputed the debt

- They’re attempting to collect a debt past the statute of limitations

- They’ve violated the FDCPA through harassment or misrepresentation

- You’ve suffered damage to your credit or financial well-being due to their actions

Consumer attorneys often take these cases on contingency, meaning you don’t pay unless they win your case.

The Bigger Picture: Industry-Wide Issues

The issues with Jefferson Capital Systems LLC highlight broader concerns in the debt collection industry:

- The buying and selling of old debt portfolios with minimal verification

- Limited requirements for debt buyers to authenticate debts before collection

- The impact of “re-aging” debts to extend collection timelines

- The burden on consumers to disprove dubious debts

- The ease with which companies can report negative information to credit bureaus

As one consumer attorney noted, “The system is designed to make it easier for collectors to claim debts than for consumers to disprove them.”

While regulatory agencies like the Consumer Financial Protection Bureau have increased oversight of debt collection practices, consumers must remain vigilant about protecting their financial information and credit standing.

By understanding how debt collection works, knowing the warning signs of questionable practices, and taking prompt action when approached about unfamiliar debts, consumers can better protect themselves from both legitimate but aggressive collectors and outright scammers operating in this challenging space.