As cryptocurrency adoption surges, scammers deploy increasingly sophisticated tactics to separate investors from their digital assets. A recent phishing campaign targeting Gemini users exemplifies this dangerous trend.

The cryptocurrency world was briefly thrown into chaos when users of Gemini, one of the industry’s most trusted exchanges, began receiving alarming emails claiming the company had filed for bankruptcy. This sophisticated phishing campaign, timed around April Fools’ Day, represents the latest evolution in crypto scams that have already cost investors millions in 2025.

Overview of the Gemini Bankruptcy Scam

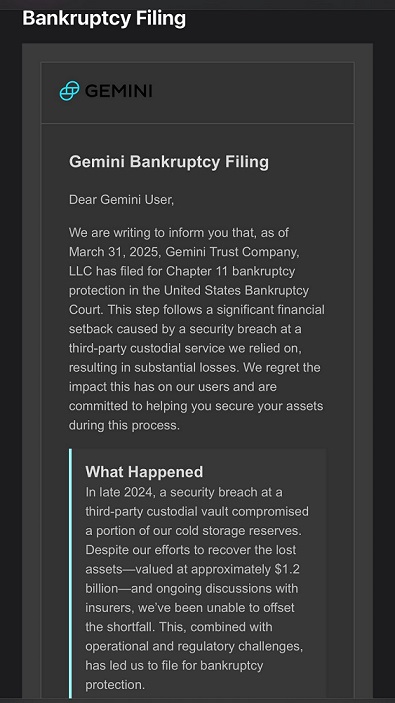

The fraudulent emails, first reported on April 1, 2025, claimed that Gemini Trust Company had filed for Chapter 11 bankruptcy protection following a catastrophic security breach. According to the scam email, a third-party custodial service breach in late 2024 had compromised approximately $1.2 billion in cold storage reserves, forcing the company into bankruptcy proceedings.

The message was crafted with remarkable attention to detail, mimicking official corporate communications with formal language, company branding, and specific financial details that gave it an air of legitimacy. The email even referenced “operational and regulatory challenges” as contributing factors—terminology frequently used in legitimate corporate bankruptcy announcements.

What made this scam particularly dangerous was its call to action: users were instructed to transfer their cryptocurrency holdings to an “Exodus wallet” using a provided seed phrase, ostensibly to protect their assets during the bankruptcy process. In reality, any funds transferred would immediately fall under the control of the scammers.

Jason Williams, a contributor to Fox Business who received the phishing email, quickly alerted the community on social media: “Do not follow these directions. Please retweet to protect those that may have been doxxed and sent this email.”

Red Flags and Warning Signs of Fake Gemini Crypto Phishing Email

Security experts have identified several telltale signs that could help users identify this and similar phishing attempts:

- Suspicious sender address – The emails did not originate from Gemini’s official domain, instead using slightly altered or completely unrelated email addresses.

- Typographical errors – Despite its professional appearance, the message contained subtle errors, including referring to a security “broach” rather than “breach” in some versions.

- Urgent action requirements – The scam created artificial urgency, pressuring recipients to take immediate action to “secure their assets.”

- Seed phrase provision – Legitimate cryptocurrency exchanges would never provide a seed phrase for users to transfer funds to. This is perhaps the most obvious red flag.

- Timing around April 1st – The scam’s timing created deliberate confusion, making it harder for recipients to verify the information’s authenticity amid the day’s pranks.

An anonymous cybersecurity researcher who analyzed the campaign noted: “What makes this attack sophisticated is the level of detail in the message. The scammers clearly researched Gemini’s communication style and included specific financial figures to enhance credibility.”

The Broader Crypto Scam Landscape

The Gemini bankruptcy scam is far from an isolated incident. According to blockchain investigator ZachXBT, Coinbase users alone lost over $65 million to social engineering scams between December 2024 and January 2025. Major exchanges across the industry have reported similar targeted campaigns against their users.

In a troubling parallel development, Coinbase recently acknowledged that a customer service employee had illegally accessed user account information. This breach has fueled speculation about how scammers are obtaining targeted email lists for their phishing campaigns.

Mike Dudas, crypto investor and co-founder of The Block, linked these incidents, stating: “That explains the fake Coinbase phishing emails and phone calls today,” after receiving Coinbase’s notification about the data breach.

Crypto analyst Cobie suggested similar vulnerabilities might exist at other exchanges: “Kraken also recently hit with this too. Maybe a new scheme from attackers (get a CS agent employee in, exfil data).”

These incidents point to an evolving threat landscape where external phishing attempts may be coordinated with insider threats to maximize effectiveness.

How Exchanges Are Responding about Gemini Bankruptcy Email?

As phishing attacks intensify, cryptocurrency exchanges are implementing stronger security measures and education campaigns:

Gemini issued an official warning in response to the bankruptcy scam: “We recently learned that some Gemini customers are being targeted with scam emails requesting users to transfer their crypto to outside wallets. Please be aware that Gemini will never request that you send crypto to outside wallets.”

Similarly, Coinbase has enhanced its security protocols following the employee data breach incident, though specific details of these measures remain undisclosed for security reasons.

Industry-wide, exchanges are promoting enhanced security measures for users:

| Security Measure | Purpose | Implementation |

|---|---|---|

| Two-Factor Authentication (2FA) | Prevent unauthorized account access | SMS, authentication apps, hardware keys |

| Whitelisted Withdrawal Addresses | Restrict transfers to pre-approved addresses | Account settings configuration |

| Email Confirmation Delays | Create verification window for suspicious activities | 24-48 hour holds on new withdrawal addresses |

| Biometric Authentication | Add physical verification layer | Fingerprint or facial recognition |

| Regular Security Audits | Identify vulnerabilities before they’re exploited | Third-party security firms |

Protecting Yourself in the Age of Crypto Scams

For cryptocurrency holders, the growing sophistication of phishing attacks necessitates a proactive security stance. Experts recommend:

- Verify through official channels – Always check exchange official websites or verified social media accounts before acting on significant announcements.

- Enable all available security features – Implement 2FA, address whitelisting, and withdrawal delays even if they add friction to the user experience.

- Use hardware wallets for significant holdings – Keep only trading amounts on exchanges and store long-term holdings in cold storage.

- Be skeptical of urgency – Legitimate companies rarely demand immediate action, especially regarding funds transfers.

- Check email headers carefully – Verify the actual sender address, not just the display name.

- Never share seed phrases – No legitimate crypto company will ever ask for your seed phrase or private keys.

- Use dedicated devices – Consider using a separate device exclusively for cryptocurrency transactions to minimize exposure to malware.

ZachXBT, the blockchain investigator who tracks cryptocurrency scams, emphasizes research before engaging with new protocols: “Conduct thorough research before engaging with new DeFi protocols, especially those forked from existing projects on newly launched EVM chains.”

The Future of Crypto Security

As cryptocurrency becomes increasingly mainstream, the sophistication of attacks is expected to grow proportionally. The industry faces a critical inflection point where security practices must evolve beyond their current state.

“What we’re seeing now is just the beginning,” warns a cybersecurity expert who specializes in blockchain security. “As institutional money flows into crypto, scammers will invest even more resources into creating convincing facades. The days of obvious scams with poor grammar are behind us.”

The targeting of specific exchange customers through what appear to be internal data breaches represents a particularly troubling evolution. It suggests scammers may be infiltrating exchanges through employment or compromising existing employees, creating multi-layered attack vectors that are difficult to defend against.

Industry leaders are calling for standardized security protocols across exchanges and greater collaboration in identifying and blocking known scam wallet addresses. Some have proposed a shared database of confirmed phishing attempts and compromised addresses that could help alert users across platforms.

Conclusion: Vigilance as the New Normal

For cryptocurrency users, the Gemini bankruptcy scam serves as a stark reminder that security requires constant vigilance. The days of casual cryptocurrency management are giving way to an era where sophisticated security practices are not optional but essential.

As one security researcher put it: “In traditional finance, your bank absorbs much of the security burden. In crypto, you are your own bank—with all the responsibility that entails.”

For now, the best defense remains education, skepticism toward unsolicited communications, and a multi-layered security approach. As the Gemini bankruptcy scam demonstrates, even the most trusted names in cryptocurrency can be weaponized against users through social engineering.

In an industry built on the promise of decentralization and personal financial sovereignty, the responsibility for security ultimately falls to individual users—making awareness of evolving scam techniques not just helpful but essential for survival in the cryptocurrency ecosystem.