In recent months, Spokane Teachers Credit Union (STCU) members and non-members alike have reported an alarming increase in sophisticated scam attempts. These fraudulent communications—through texts, phone calls, and emails—have become more convincing, leaving many vulnerable to financial theft and identity fraud. This comprehensive guide examines the current landscape of STCU-related scams, how to identify them, and most importantly, how to protect yourself and your finances.

The Rising Tide of Financial Institution Scams

Financial institutions across the country are experiencing a sharp uptick in impersonation scams, with local credit unions like STCU becoming particular targets. According to STCU’s own reports, both members and non-members are receiving deceptive communications claiming to be from the credit union. These scammers cast wide nets, sending thousands of phony “STCU” texts to random phone numbers in the 509 area code, knowing that a certain percentage will reach actual members.

The timing of these attacks often isn’t coincidental. Many scammers deliberately contact potential victims during weekends when bank branches are closed, making it more difficult for recipients to verify the legitimacy of the communication. This strategy creates a perfect storm where urgency meets limited verification options.

Overview of the Spokane Teachers Credit Union (STCU) Text and Call Scam

The mechanics behind these scams follow a consistent pattern designed to bypass your natural skepticism. First, the scammer establishes credibility by impersonating STCU through a spoofed caller ID, text message, or professional-looking email. The message typically creates a false emergency—an account restriction, suspicious transaction, or security breach—that requires immediate action.

Once engaged, the scammer attempts to extract valuable personal information through various social engineering techniques. They might ask you to “verify” your identity by providing your date of birth, Social Security number, account number, or online banking credentials. Some scammers take an additional step by directing victims to counterfeit websites that look remarkably similar to STCU’s legitimate site, complete with login pages designed to capture your credentials.

The most insidious aspect of these scams is their psychological manipulation. By triggering fear about account security or financial loss, scammers override rational thinking and push victims toward hasty actions they would normally avoid.

Common Types of STCU Scams

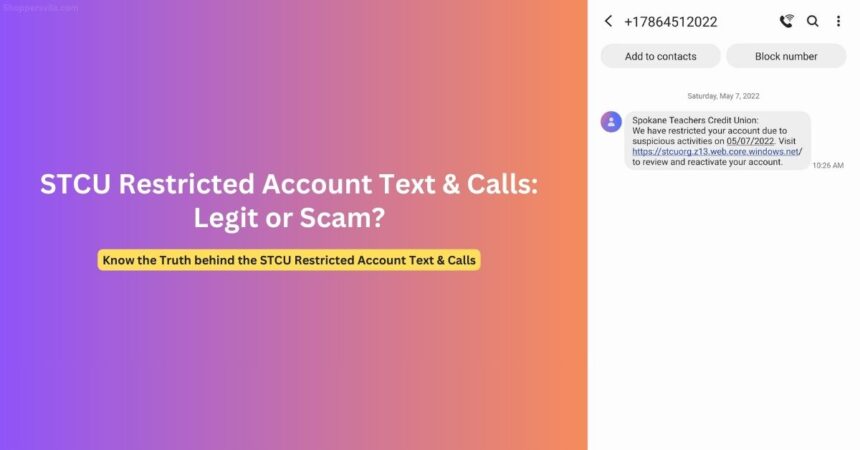

1. Account Restriction Texts

These messages claim your account has been restricted due to “suspicious activities.” A typical message might read:

Spokane Teachers Credit Union: We have restricted your account due to suspicious activities. Visit [fraudulent link] to review and reactivate your account.

The link typically leads to a convincing but fake STCU login page.

2. Unauthorized Transaction Alerts

Scammers send texts or make calls claiming to be from STCU’s fraud department about suspicious purchases, often citing specific amounts like “$499 on Amazon” or “$700 on eBay.” They create urgency by suggesting your money is actively being stolen and ask you to “verify” your card details to stop the transactions.

3. Security Verification Calls

These involve direct phone calls from individuals claiming to be STCU representatives who need to verify your identity. The caller ID is spoofed to display STCU’s customer service number, making it appear legitimate. The scammer typically has some basic information about you already (like your name) and uses this to build trust before requesting more sensitive details.

4. Password Reset Scams

You might receive an email or text claiming someone attempted to access your STCU account, requiring an immediate password reset. The message includes a link to a fake site designed to capture your current credentials and other personal information.

Red Flags: Text and Call Patterns of Fake STCU

Understanding common patterns in these scam attempts can help you identify them before becoming a victim. Here are the telltale signs to watch for:

Textual Red Flags:

- Messages containing urgent, threatening language demanding immediate action

- Links to suspicious URLs (often containing random strings of characters or unusual domains)

- References to “web.core.windows.net” or other non-STCU domains

- Requests to “reactivate” accounts or “cancel” transactions you don’t recognize

- Poor grammar, spelling errors, or awkward phrasing

- Texts sent from regular phone numbers rather than short codes typically used by financial institutions

Call Pattern Red Flags:

- Calls occurring on weekends or after business hours

- Callers with foreign accents claiming to be local credit union representatives

- Requests for your full card number, PIN, online banking credentials, or one-time verification codes

- Resistance when you attempt to verify their identity or suggest calling back on the official number

- Use of your maiden name or outdated personal information

- Multiple follow-up calls creating a sense of urgency

How to Identify and Protect Yourself from Fraudulent STCU Texts and Calls

Immediate Verification Steps

When you receive a suspicious communication claiming to be from STCU:

- Never click links in unexpected texts or emails. Instead, manually type stcu.org into your browser or use the official STCU mobile app.

- Don’t return calls to the number that called you. Find STCU’s official number on your card, account statement, or the official website.

- Verify the communication independently. Contact STCU through official channels to confirm whether they actually tried to reach you.

- Be especially cautious of weekend communications. Remember that scammers often time their attacks when verification is most difficult.

Preventative Measures

Take these proactive steps to shield yourself from potential scams:

- Set up transaction alerts through the official STCU app. This allows you to monitor account activity in real-time.

- Use two-factor authentication for all financial accounts when available.

- Regularly monitor your accounts for unauthorized transactions, even small ones that scammers might use to test access.

- Never share one-time verification codes sent to your phone or email with anyone, even someone claiming to be from the bank.

- Consider using a password manager to generate and store strong, unique passwords for each financial account.

- Pause before acting on urgent financial messages. Ask yourself these questions:

- Was I expecting this communication?

- Does this request make logical sense?

- Is this how my credit union would normally contact me?

- Would my banker, family, or friends think this is legitimate?

If You Think You’ve Been Scammed

If you suspect you’ve fallen victim to an STCU scam:

- Discontinue contact with the suspected scammer immediately.

- Contact STCU directly through verified channels (in-branch or official phone numbers).

- Change your online banking credentials immediately if you’ve shared them.

- Monitor your accounts closely for unauthorized activity.

- Consider placing a fraud alert on your credit report.

- Report the scam to the Federal Trade Commission at reportfraud.ftc.gov.

Official Warning from STCU

STCU has issued formal warnings about these scam attempts, noting a significant increase in fraudulent communications targeting their members. According to their March 2025 update, the credit union emphasizes:

“We never send scary, ominous, threatening, or unexpected texts or emails asking you for private information. We’ll also never send you a code for logging in and then ask you to verbally tell us what that code is.”

The credit union reports that fraudsters are becoming increasingly sophisticated, creating counterfeit websites that can look remarkably similar to STCU’s legitimate site. These scammers also employ number-spoofing technology to make calls appear to come from official STCU phone lines.

STCU strongly encourages members to report any suspicious communications. This information helps their cybersecurity team track and shut down fraudulent operations more quickly. They emphasize: “If you’re not sure it’s real, please contact us. We’ll never be offended you want to verify the contact with us. When in doubt, reach out.”

Frequently Asked Questions

1. Is the “STCU Restricted Account” text legitimate?

No. STCU has confirmed they do not send texts about account restrictions with links to click. If you receive such a message, it is a scam. STCU will not send threatening or urgent texts asking you to click links to resolve account issues.

2. Should I respond when STCU calls to confirm my credit card number?

No. This is almost certainly a scam. STCU will never call you to ask for your full credit card number, as they already have this information. If you receive such a call, hang up and contact STCU directly using the number on your card or their website.

3. Why am I getting STCU scam texts when I don’t even have an account with them?

Scammers send these messages to thousands of random phone numbers, particularly targeting area codes like 509 where many STCU members live. They know that even with a low success rate, they can reach enough actual members to make their scam profitable.

4. What should I do if I already clicked a link in a scam text?

Contact STCU immediately through official channels. Change your online banking password right away, and consider requesting a new card if you entered your card information. Monitor your accounts closely for unauthorized activity.

5. How can I tell if a call really is from STCU?

If you receive an unexpected call claiming to be from STCU, tell the caller you’ll call back through the official number. A legitimate STCU representative will understand and encourage this caution. Hang up and call STCU directly using the number from their website or the back of your card.

Beyond Technology: The Human Element in Scam Prevention

While technical safeguards are essential, understanding the psychological tactics used by scammers is equally important. Most financial scams rely on emotional triggers—fear, urgency, authority, or opportunity—to circumvent rational thinking. By recognizing when these emotions are being manipulated, you can step back and evaluate the situation more objectively.

STCU emphasizes that they will never be offended if you want to verify a communication’s legitimacy. In fact, they encourage members to be skeptical and take the time to confirm the authenticity of any communication before sharing personal information or clicking links.

Remember that legitimate financial institutions never need to “verify” information they already have. If someone claiming to be from your bank or credit union asks for your account number, Social Security number, or online banking credentials, it’s almost certainly a scam.

Conclusion

As scammers continue to evolve their tactics, community awareness becomes our strongest defense. STCU encourages members to report suspicious communications promptly, as this information helps their cybersecurity team identify and shut down fraudulent operations more quickly.

The credit union also recommends that members, especially those with elderly or less tech-savvy family members, have conversations about these scams and establish verification protocols. A simple agreement like “we’ll always discuss unexpected financial communications in person” can prevent many successful scams.

By staying informed, skeptical, and proactive, Spokane residents can protect themselves and their community from these increasingly sophisticated financial predators. Remember the golden rule of financial security: when in doubt, reach out—through official, verified channels only.

If you’ve received a suspicious communication claiming to be from STCU, report it immediately by contacting their member services through official channels listed on stcu.org.