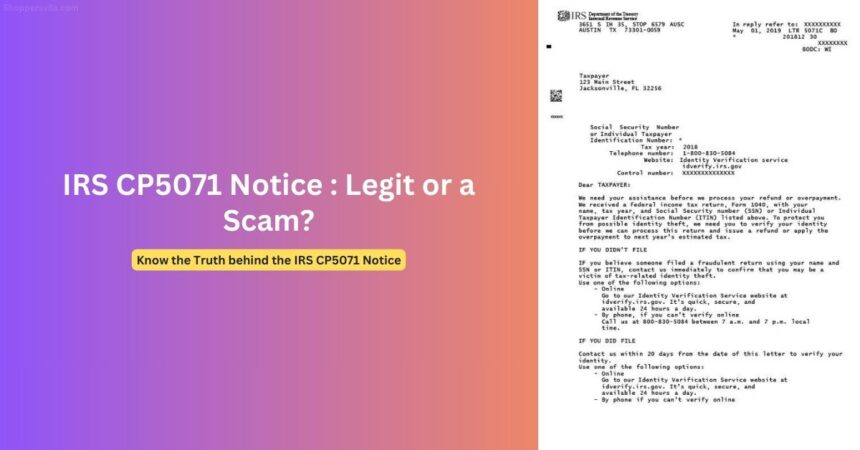

In an era where tax-related scams continue to proliferate, many taxpayers are receiving IRS Notice CP5071 letters and wondering: is this legitimate or just another elaborate scheme? With tax identity theft cases rising in 2025, understanding the difference between authentic IRS communications and fraudulent attempts has never been more crucial. This comprehensive guide will help you identify whether that CP5071 notice in your mailbox is genuine and what steps to take if it is.

Understanding the IRS CP5071 Notice: What It Really Means

The CP5071 notice (including variations CP5071C and CP5071F) is a legitimate IRS communication with a specific purpose: to verify your identity when the IRS suspects potential identity theft related to a tax return filed under your Social Security Number or Individual Taxpayer Identification Number (ITIN).

The IRS sends this notice when:

- They receive a tax return with your identifying information but have flagged it for potential fraud

- There are unusual patterns or discrepancies that trigger their identity theft screening systems

- Your return shows significant changes from previous years (such as a much larger refund)

It’s important to understand that receiving this notice doesn’t automatically mean someone has stolen your identity. If you recently filed a tax return, the IRS may simply need additional verification before processing it. However, if you haven’t filed a return and receive this notice, it likely indicates that someone has attempted to file fraudulently using your information.

Red Flags: How to Spot IRS Notice CP5071 Scams

While the CP5071 is a legitimate IRS notice, scammers frequently impersonate the IRS to steal personal information. Here’s how to distinguish between real IRS communications and fraudulent attempts:

Legitimate IRS CP5071 notices will:

- Arrive via U.S. Postal Service mail (never by email, text, or phone call)

- Include your correct name and full address

- Direct you to the official IRS website (irs.gov) or an official IRS phone number

- Never demand immediate payment or specific payment methods

- Provide detailed instructions for identity verification

- Include official IRS letterhead and a notice number

Warning signs of a CP5071 scam:

- Communication arrives via email, text message, or phone call

- Contains spelling or grammatical errors

- Threatens immediate legal action, arrest, or deportation

- Requests payment via gift cards, wire transfers, or cryptocurrency

- Uses high-pressure tactics demanding immediate action

- Directs you to suspicious websites (not ending in .gov)

- Requests more information than necessary for verification

Remember: The IRS will never initiate contact with taxpayers about their tax accounts through text messages, social media, or email. Initial contact is almost always made through official mail delivered by the U.S. Postal Service.

Legitimate Response Options: What to Do with a Real CP5071

If you’ve confirmed your CP5071 notice is legitimate, you have several options for responding. The IRS provides three main methods to verify your identity:

1. Online Verification

The fastest and most convenient method is using the IRS Identity and Tax Return Verification Service online:

- Visit the official website mentioned in your notice

- Create an account or sign in with ID.me (if you’re a new user)

- Have your government-issued photo ID ready (driver’s license, state ID, passport)

- Keep a copy of your CP5071 notice handy

- Have a copy of the tax return mentioned in the notice (if you filed it)

- Be prepared to answer questions about your tax return or prior tax filings

- Indicate whether you did or did not file the return in question

For successful verification, you’ll also need personal account information from one of the following:

- Credit card

- Mortgage

- Student loan

- Home equity loan or line of credit

- Car loan

- Mobile phone associated with your name

2. Phone Verification

If you prefer speaking with a representative or have trouble with online verification:

- Call the Taxpayer Protection Program hotline number listed on your notice

- Have your CP5071 notice available

- Have the tax return referenced in the notice (if you filed it)

- Have a prior year tax return (if available)

- Have supporting documents ready (W-2, 1099, Schedule C, etc.)

- Be prepared to answer verification questions

Due to high call volumes in 2025, the best times to call are typically early morning or approximately 30 minutes before closing time.

3. In-Person Verification

If online and phone verification methods are unsuccessful:

- The IRS will invite you to schedule an appointment at a local IRS office

- Bring all the documentation mentioned above to your appointment

- Be prepared to present government-issued photo identification

If You’re a Victim: Steps After Confirming Identity Theft

If you discover that someone has filed a fraudulent tax return using your information, taking swift action is critical:

- Inform the IRS immediately during the verification process that you did not file the return in question

- File a paper tax return if you haven’t already filed for the year (follow IRS instructions for victims of tax identity theft)

- Visit IdentityTheft.gov to report the identity theft and create a recovery plan

- Place a fraud alert with one of the three major credit bureaus (Equifax, Experian, or TransUnion)

- Consider a credit freeze to prevent new accounts from being opened in your name

- Check with your state tax agency to see if a fraudulent state return was also filed

- Continue to file tax returns as required, even if issues with your tax account are being resolved

The IRS will add an identity theft indicator to your account and automatically enroll you in the Identity Protection PIN (IP PIN) program, providing an additional layer of security for future tax filings.

Timeline Expectations: What Happens After Verification

After verifying your identity with the IRS, you may wonder about next steps and timing:

If you filed the return in question:

- The IRS will continue processing your return

- It may take up to 9 weeks to receive your refund or have overpayments credited to your account

- You can check your refund status using the “Where’s My Refund?” tool after 2-3 weeks

- If other issues are identified with your return, the IRS will contact you again

If you did not file the return (identity theft victim):

- The IRS will remove the fraudulent return from your records

- You will receive additional instructions for filing your legitimate return

- Your account will be flagged with an identity theft indicator for future protection

- You will be enrolled in the IP PIN program for additional security

- Future returns may receive additional scrutiny, which could delay processing

If you don’t respond to the notice:

- The IRS cannot process any return filed under your number

- No refunds will be issued

- No overpayments will be credited to your account

- Your tax situation will remain unresolved

Future Protection: Preventing Tax Identity Theft

Whether you’ve been a victim of tax identity theft or simply want to protect yourself, these preventative measures can help secure your tax information:

- Request an Identity Protection PIN (IP PIN) from the IRS, which provides an additional verification layer when filing returns

- File your tax return early to reduce the window of opportunity for identity thieves

- Protect your Social Security Number by only providing it when absolutely necessary

- Use strong, unique passwords for all tax-related online accounts

- Enable multi-factor authentication whenever available

- Review your credit reports regularly for unauthorized activity

- Secure your personal computers with anti-virus software and firewalls

- Be wary of phishing attempts claiming to be from the IRS

- Shred documents containing personal information before disposal

- Check your Social Security earnings record annually for discrepancies

Frequently Asked Questions

1. How can I tell if an IRS CP5071 notice is legitimate?

Legitimate IRS notices arrive by U.S. mail (never by email, text, or phone), contain your correct personal information, direct you to official IRS websites (irs.gov) or phone numbers, and never demand immediate payment through specific methods like gift cards or cryptocurrency.

2. Will the IRS ever call or email me about a CP5071 notice?

No. The IRS initiates contact about tax matters through regular mail delivered by the U.S. Postal Service. They will never initiate contact through email, text messages, or social media to request personal or financial information.

3. How long will it take to get my refund after verifying my identity?

After successful verification, it typically takes up to 9 weeks for the IRS to complete processing and issue your refund. However, if additional issues are discovered with your return, this timeline may be extended.

4. What happens if I ignore the CP5071 notice?

If you don’t respond to verify your identity, the IRS will not be able to process any tax return filed under your Social Security Number, issue refunds, or credit overpayments to your account. Your tax situation will remain unresolved.

5. Can a tax professional help me respond to a CP5071 notice?

Yes. A tax professional can contact the IRS on your behalf, but you must provide authorization by filing Form 2848 (Power of Attorney and Declaration of Representative). Alternatively, you can call the IRS together with your tax professional and provide verbal authorization.

In an environment where tax scams continue to evolve in sophistication, being able to distinguish between legitimate IRS communications and fraudulent attempts is essential. The CP5071 notice represents the IRS’s efforts to protect taxpayers from identity theft, but it’s also important to remain vigilant against scammers who may try to exploit this legitimate process for their own gain.

Remember that the real IRS will never pressure you for immediate action, threaten legal consequences, or demand specific payment methods. When in doubt about any tax communication you receive, contact the IRS directly using the official contact information on their website (irs.gov), not the information provided in a suspicious communication.

By understanding the legitimate CP5071 process and recognizing the warning signs of scams, you can protect yourself from becoming a victim of tax-related identity theft while properly addressing any legitimate concerns the IRS may have about your tax return.