Sidney Federal Credit Union warns of widespread phishing attempts as members and non-members alike report fraudulent messages

In recent days, Sidney Federal Credit Union (SFCU) members have been the target of a sophisticated text messaging scam. The financial institution has issued warnings through their social media channels and website as reports continue to pour in about deceptive messages claiming to be from SFCU. The scam, which attempts to trick recipients into sharing account information through fraudulent websites, has reached both current members and individuals who previously held accounts with the credit union.

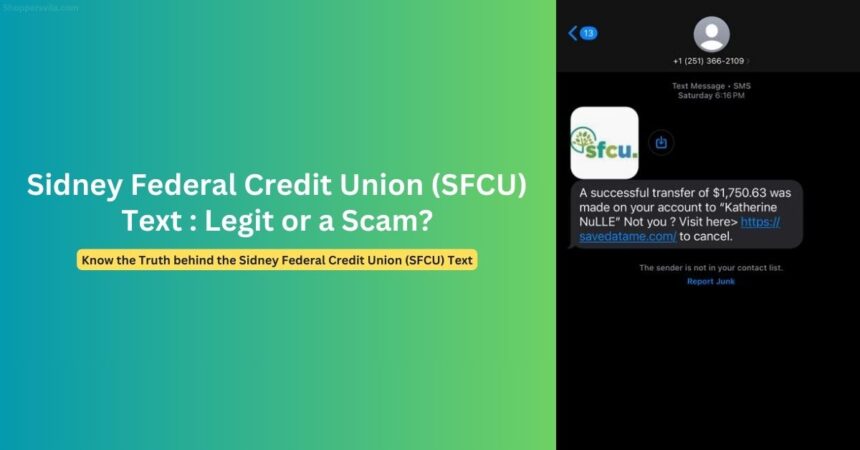

Overview of the Sidney Federal Credit Union (SFCU) Text Scam

The ongoing phishing campaign uses urgent messaging about unauthorized transactions to create panic and prompt immediate action. Victims receive text messages claiming that a transfer has been initiated from their account, typically featuring specific dollar amounts to enhance credibility. The messages direct recipients to click on suspicious links, purportedly to “cancel” these transactions or “reactivate” their accounts.

“These scammers are employing social engineering tactics that exploit people’s natural concern about their finances,” explains cybersecurity expert Jane Reynolds. “When someone sees a message about money leaving their account, their first instinct is to act quickly rather than verify the communication’s legitimacy.”

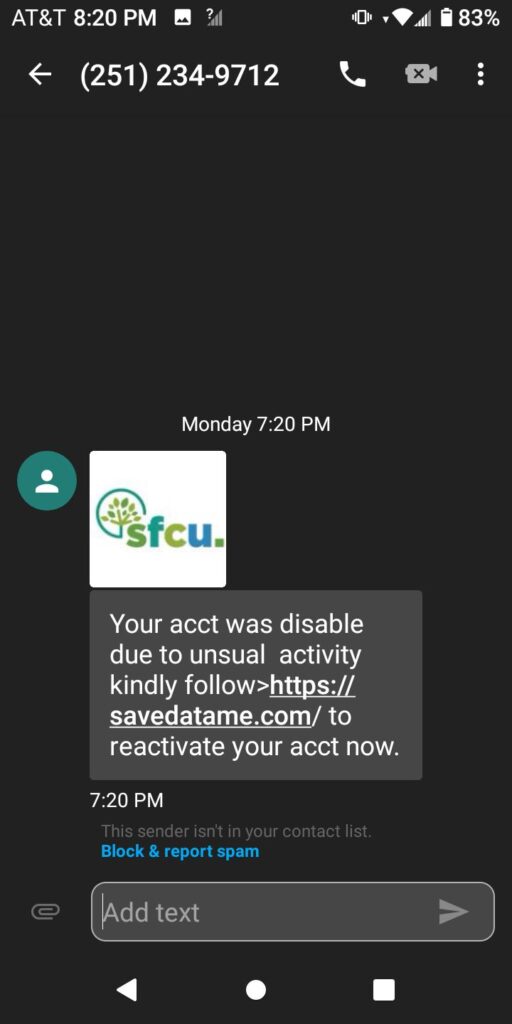

The scam operation appears well-coordinated, with multiple phone numbers being used to distribute similar messages. According to SFCU’s Facebook post, texts have originated from various area codes, including California (858) and Gulf Coast numbers (251, 601), suggesting the scammers are using VoIP services or burner phones to mask their true location.

Text Message Patterns and Variations

Several variations of the scam text have been identified by SFCU members. The most common formats include:

- Unauthorized transfer notifications: “Your checking acct was charge the sum of $543.44 If not aware review here > [fraudulent link] to cancel now.”

- Account suspension alerts: “Your acct was disable due to unsual activity kindly follow>[fraudulent link] to reactivate your acct now.”

- Member transfer confirmations: “Did you just schedule a member transfer of $733.77 to John? If not aware follow> [fraudulent link] to cancel now.”

- Large sum transfers: “A successful transfer of $1,750.63 was made on your account to ‘Katherine NuLLE’ Not you Visit here> [fraudulent link] to cancel.”

The scammers have shown persistence by modifying their approach when previous attempts are exposed. According to member comments on SFCU’s Facebook post, some recipients received multiple variations of these messages within a short timeframe, suggesting an aggressive campaign designed to maximize potential victims.

Red Flags That Expose the Scam

SFCU has outlined several telltale signs that distinguish these fraudulent messages from legitimate communications:

1. Incorrect Originating Numbers

Legitimate SFCU text messages do not come from California area codes like the 858 number used in one variation of the scam. The credit union maintains consistent communication channels, and out-of-state numbers should immediately raise suspicion.

2. Grammatical and Spelling Errors

The scam texts contain numerous linguistic errors that would not appear in official communications from a financial institution. Examples include:

- Using “was charge” instead of “was charged”

- Writing “disable” instead of “disabled”

- Including “unsual” instead of “unusual”

- Employing awkward phrasing like “kindly follow>” instead of standard business language

3. Suspicious URLs

Perhaps the most obvious red flag is the fraudulent websites linked in these messages. Instead of directing users to the official SFCU website (sfcuonline.org), the scammers use domains like:

https://s.id/sydneyfcu-com(misspelling “Sidney”)savedatame.com(completely unrelated to the credit union)

These websites are designed to mimic legitimate banking portals, but their sole purpose is to harvest login credentials and personal information.

4. Urgency and Pressure Tactics

The messages consistently employ urgency to pressure recipients into immediate action without verification. Phrases like “cancel now” and references to specific dollar amounts are designed to trigger emotional rather than rational responses.

SFCU’s Official Response

Sidney Federal Credit Union has taken a proactive approach to addressing the scam. Their official statement acknowledges the situation while providing clear guidance to affected members:

“We’re aware of scam text messages some members may have received. If you clicked the link & shared any account info, please contact us. If you did not respond, you may delete the message. Your security is our priority. We appreciate your patience.”

The credit union has also published educational materials on their Facebook page and website to help members identify fraudulent communications. Their informational graphics highlight the specific indicators that reveal the messages as scams, empowering customers to protect themselves from future attempts.

When contacted for comment, an SFCU representative emphasized that the credit union never requests sensitive information like Social Security numbers, complete card details, online passwords, or PINs via text message or email.

Protecting Yourself From Text Scams

In light of the ongoing scam, security experts recommend several preventative measures to avoid falling victim to similar phishing attempts:

1. Enable Multi-Factor Authentication

SFCU and cybersecurity professionals strongly recommend enabling multi-factor authentication (MFA) on all financial accounts. This additional security layer ensures that even if login credentials are compromised, unauthorized access remains difficult.

2. Regularly Monitor Your Accounts

Frequent account monitoring through official channels like SFCU’s online banking portal or mobile app provides early detection of suspicious activity. The credit union encourages members to review monthly statements thoroughly and report any unauthorized transactions immediately.

3. Verify Through Official Channels

When receiving unexpected communications about your accounts, contact your financial institution directly through their official phone number—not the number used in the suspicious message. SFCU provides 24/7 assistance for fraud concerns at 877.642.7328.

4. Utilize Available Security Tools

SFCU offers several free security tools to members, including:

- Credit score monitoring with fraud alerts

- Card Control features to turn cards on/off

- Security alerts via text or email (accessible through legitimate online banking)

- Personalized spending limits based on location, merchant, and transaction type

5. Practice Digital Hygiene

Creating unique, complex passwords for different accounts significantly reduces vulnerability. Security experts recommend using a combination of uppercase and lowercase letters, numbers, and special characters, or employing a trusted password manager.

What To Do If You’ve Been Targeted by Fake SFCU Texts

If you believe you’ve been targeted by the SFCU text scam or similar phishing attempts, experts recommend taking the following steps:

1. If You Haven’t Responded

Simply delete the message and block the sender. No further action is necessary, though reporting the number to your mobile carrier as spam can help protect others.

2. If You Clicked the Link But Didn’t Enter Information

Run a security scan on your device to check for malware that might have been downloaded automatically. As a precaution, change passwords for your financial accounts from a different, secure device.

3. If You Shared Account Information

- Contact SFCU immediately at 877.642.7328 (their 24/7 support line)

- Change all compromised passwords from a secure device

- Enable extra security features on your accounts

- Monitor your credit reports for suspicious activity

- Visit IdentityTheft.gov to report identity theft and access recovery tools

- Consider placing a fraud alert or credit freeze with major credit bureaus

Community Response and Awareness

The SFCU community has demonstrated notable vigilance in response to the scam. Members have actively shared information about the fraudulent texts on social media, helping to warn others. Many reported recognizing the scam due to previous educational efforts by the credit union.

“I noted the Cali area code but never even noticed the misspelling,” commented one member on Facebook, highlighting how even aware consumers can miss certain red flags. Another member pointed out that “non-account holders received them as well,” indicating the scammers may be using broad targeting rather than a specific SFCU customer database.

This community awareness represents an important line of defense against such scams, as informed consumers are significantly less likely to fall victim to phishing attempts.

The Broader Context: Financial Scams on the Rise

The SFCU text scam is part of a troubling trend of increasing financial fraud attempts nationwide. According to the Federal Trade Commission (FTC), Americans reported losing more than $5.8 billion to fraud in recent years, with text message scams among the fastest-growing methods.

Financial institutions across the country are strengthening their security measures and educational efforts in response. SFCU’s partnership with the Zogo app, which rewards users for learning about fraud prevention, exemplifies this proactive approach to customer protection.

As scammers continue to refine their tactics, the partnership between financial institutions and vigilant consumers remains the most effective defense. By staying informed about the latest scam techniques and following security best practices, SFCU members and all consumers can significantly reduce their vulnerability to financial fraud.

For more information on fraud prevention, visit SFCU’s security resources at sfcuonline.org or contact their customer service team at 877.642.7328.