A wave of sophisticated transaction scams targeting Apple Pay users has resulted in millions of dollars in losses. Here’s how to identify and avoid becoming the next victim.

In 2023, the Federal Trade Commission (FTC) recorded approximately 5,000 cases of scammers impersonating Apple, resulting in $17 million in losses. As digital payment systems become increasingly popular, fraudsters are developing more sophisticated techniques to exploit Apple Pay users through fraudulent transaction messages, impersonation schemes, and phishing attempts.

These scams typically begin with an alarming text message claiming an unauthorized transaction has been made through your Apple Pay account, creating a false sense of urgency that pressures recipients into calling suspicious numbers or clicking malicious links.

Overview of Apple Pay Transaction Scam Texts

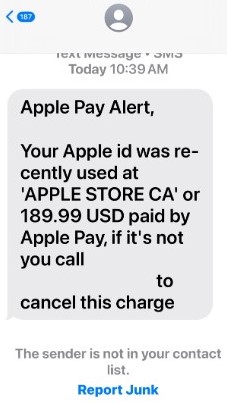

The most common entry point for these scams is a text message claiming to be from Apple, alerting you to a supposedly unauthorized transaction. These messages follow predictable patterns:

- Claims of an Apple Pay transaction you didn’t authorize (often between $143-$973)

- Urgent language suggesting immediate action is required

- Instructions to call an unfamiliar number to “resolve” the issue

- Poor grammar, unusual spacing, or spelling errors

- Incorrect placement of currency symbols (e.g., “973.24 $ was Char ged”)

One victim reported receiving a text stating: “Apple Pay Transation: A purchase of $143.95 has been made at the Apple Store. If you didnt authorize this, contact Support at 1(855)xxx-xxxx.” The misspelled “Transation” and lack of apostrophe in “didnt” are telltale signs of a fraudulent message.

Another variant observed on Reddit showed unusual spacing between letters (“Char ged”, “Or der”) – a deliberate tactic to bypass spam filters while maintaining readability for human recipients.

Six Common Type of Transaction Scams

Scammers deploy various tactics beyond the initial apple pay transaction text message. Understanding these schemes is crucial for protecting yourself:

1. Impersonation Pre Authorization Scam

In these scenarios, fraudsters pose as Apple representatives, claiming an issue with your account. They request sensitive information like your Apple ID, password, or two-factor authentication codes. Once obtained, they can take control of your Apple Pay account and make unauthorized purchases.

Example text message:

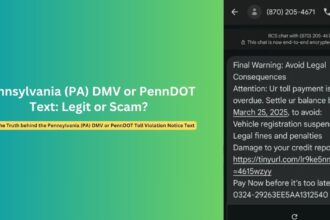

Apple Pay Transaction: We have noticed that your Apple iCloud id was recently used at ‘APPLE STORE – CA’ for $143.95, paid by Apple Pay Pre Authorization. Also some suspicious sign in request and apple pay activation request detected. That looks like suspicious to us. In order to maintain the security and privacy of your account we have placed those request on hold. Call +1 80874**** immediately to cancel this charge.

Apple Pay Alert, Your Apple id was re-cently used at ‘APPLE STORE CA’ or 189.99 USD paid by Apple Pay, if it’s not you call +1 80569**** to cancel this charge

2. Fake Payment Confirmation

These scams target sellers on platforms like Facebook Marketplace or Craigslist. The scammer shows a fake payment confirmation screenshot that appears legitimate. When you check your actual Apple Pay or bank account, no payment has been received, but you may have already shipped the item.

Example message from scammer:

I just sent $350 through Apple Pay for the phone. Here’s the confirmation screenshot. I’ll arrange pickup tomorrow. Can you mark it as sold now? Thanks!

3. Overpayment Schemes

A scammer claims to buy something you’re selling and “accidentally” sends more money than agreed. They then request a refund for the difference. In reality, they used stolen payment details, and when the bank flags the original transaction as fraudulent, the entire payment is reversed, leaving you without both your item and the money you “refunded.”

Example message from scammer:

Hi, I just sent $750 through Apple Pay for the laptop, but I meant to send $550. It was a mistake – I entered the wrong amount. Could you please send me back the extra $200? I really need it for my rent this week. Thanks for understanding!

4. Phishing Link

These involve sending fake links via text or email, claiming you need to confirm a payment, resolve a security issue, or verify your account. These links lead to phishing websites designed to steal your login credentials or financial information.

Example text message:

APPLE PAY ALERT: We’ve detected unusual activity on your account. A transaction of $892.50 is pending approval. If this wasn’t you, click here to secure your account: apple-id-verify.com/secure

5. Trust-Based Refund

Here, a scammer claims they accidentally sent you money via Apple Pay and asks you to return the funds. In reality, no money was sent, and they trick you into sending them your own money.

Example text message:

Hi, I accidentally sent you $400 through Apple Pay. It was meant for someone else – wrong number. Could you please send it back to me? I’m really sorry for the mix-up. My Apple Cash is linked to this number.

6. Prize and Lottery Scams

You receive a message claiming you’ve won a prize or lottery, but to claim it, you must pay a “processing fee” through Apple Pay. After sending money, the scammer disappears, and no prize materializes.

Example text message:

CONGRATULATIONS! You’ve been selected as an Apple Pay Loyalty Program winner! You’ve won a new iPhone 15 Pro and $5,000! To claim your prize, send a $99.50 processing fee via Apple Pay to this number within 24 hours. Don’t miss this limited opportunity!

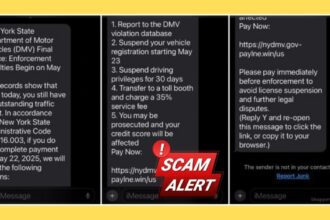

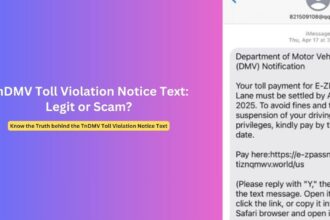

Red Flags: How to Identify Fake Apple Pay Messages

Knowledge is your first line of defense. Here are key indicators that a message is fraudulent:

1. Verification

- Legitimate: Messages come from official Apple domains or short codes

- Fraudulent: Random phone numbers or email addresses resembling but not matching Apple’s official domains

2. Message Content

- Legitimate: Addresses you by name, includes specific transaction details

- Fraudulent: Generic greetings like “Dear Customer,” vague details about transactions

3. Language and Formatting

- Legitimate: Professional, error-free writing

- Fraudulent: Grammatical errors, unusual spacing within words, incorrect currency formatting

4. Action Requests

- Legitimate: Directs you to official Apple channels or apps

- Fraudulent: Requests sensitive information, urges calls to unfamiliar numbers

5. Conceptual Accuracy

- Legitimate: Uses correct terminology about Apple Pay

- Fraudulent: References “charging to Apple Pay” (which isn’t technically accurate—Apple Pay is a payment method, not an account)

Apple’s Official Position on Transaction Texts

Apple has clear policies regarding how they communicate with customers about transactions:

- Apple never sends unsolicited text messages about transactions

- Official Apple messages never request personal information via text

- Apple doesn’t use pressure tactics or urgency in communications

- Legitimate Apple communications direct you to apple.com or the official Apple Support app

The company states: “Apple will never ask you for your Apple ID password, iCloud credentials, or verification codes in order to provide you with support.” Any message requesting such information should be treated as fraudulent.

Protecting Yourself: Prevention Strategies

Implementing these protective measures significantly reduces your risk of falling victim:

1. Strengthen Your Security Foundation

- Use strong, unique passwords for your Apple ID

- Enable two-factor authentication for all accounts

- Update your iOS to the latest version to benefit from security patches

- Configure Face ID or Touch ID for Apple Pay transactions

2. Adopt Cautious Verification Habits

- Never click links in unsolicited texts or emails

- Always verify transactions directly through the official Apple Wallet app

- Contact Apple or your bank through official channels when concerned

- Google suspicious phone numbers before calling them

3. Know Apple’s Communication Practices

- Familiarize yourself with how Apple actually communicates with customers

- Remember that Apple will never ask for your password or verification codes

- Understand that Apple does not use text messages as primary alerts for unauthorized charges

What to Do If You Receive a Suspicious Apple Pay Transaction Text

If you receive a text claiming to be about an Apple Pay transaction:

- Do not respond to the message or call any provided numbers

- Check your Apple Pay account directly through the official Apple Wallet app

- Report the message as spam to your mobile carrier

- Block the sender’s number

- Forward suspicious texts to 7726 (SPAM) to help carriers identify scammers

- Report phishing attempts to [email protected]

If You’ve Already Been Scammed

If you believe you’ve fallen victim to an Apple Pay scam:

- Contact your bank immediately to freeze cards and dispute unauthorized transactions

- Change your Apple ID password and all connected account passwords

- Enable additional security features on your Apple account and banking apps

- Monitor your accounts closely for unusual activity

- Report the fraud to:

- Your local police department

- The Federal Trade Commission at ReportFraud.ftc.gov

- The FBI’s Internet Crime Complaint Center (IC3)

Unfortunately, Apple Pay itself doesn’t offer buyer protection for transaction text scams, though your credit card company might provide some recourse through chargeback procedures, especially if you act quickly.

The Future of Digital Payment Scams

As digital payment systems evolve, so do scammer tactics. Experts predict several emerging trends:

- Increased use of AI to create more convincing fake messages

- Voice deepfakes for more persuasive phone scams

- QR code scams linked to fake Apple Pay verification sites

- More sophisticated social engineering based on personal data from data breaches

Security researchers emphasize that the psychological tactics behind these scams remain consistent: creating urgency, exploiting trust, and manipulating emotions to bypass rational thinking.

The Bottom Line

The convenience of Apple Pay comes with responsibility. By understanding common scam patterns, recognizing red flags, and implementing basic security practices, you can continue to enjoy the benefits of digital payments while minimizing risks.

Remember that legitimate financial institutions never pressure you into immediate action. When in doubt, pause, verify through official channels, and protect your digital financial ecosystem with vigilance and skepticism toward unsolicited communications.

Apple Pay remains one of the most secure payment methods available when used properly. The key to protecting yourself lies not in avoiding the technology but in recognizing the human manipulation tactics that exploit it.