A wave of sophisticated scam attempts targeting Arrowhead Credit Union members has prompted widespread concern across Southern California. Members report receiving alarming text messages and phone calls claiming to be from the credit union’s fraud department, leaving many wondering: “Is this communication legitimate or am I being targeted by scammers?”

As fraudsters deploy increasingly convincing tactics, understanding how to distinguish between authentic credit union communications and scam attempts has become essential for protecting your financial security.

Overview of the Arrowhead Credit Union Text Scam

Fraudsters are deploying a multi-pronged approach to target Arrowhead Credit Union members through spoofed phone calls and deceptive text messages. The scam typically begins with an urgent message about suspicious activity on your account, creating immediate anxiety that can cloud judgment.

One victim recently received this message:

Arrowhead Credit Union: Did you attempt to charge $675.00 at Apple Store if not you visit- https://validtddobile.com to cancel

This message follows a classic pattern: creating urgency about a fake transaction and providing a suspicious link that leads to a phishing website designed to capture your personal information. The scammers have refined their approach to seem increasingly legitimate, even “spoofing” the credit union’s official phone number ((800) 743-7228) to make their calls appear genuine.

According to cybersecurity experts, these scammers are executing what’s known as social engineering – manipulating people into breaking normal security procedures by exploiting our natural tendency to trust and respond to apparent emergencies.

Message Patterns: Recognizing the Warning Signs

Scam messages targeting Arrowhead Credit Union members follow several identifiable patterns:

- Urgent Transaction Alerts: Messages about unauthorized purchases, often mentioning specific dollar amounts and well-known retailers like Apple, Amazon, or Walmart

- Account Security Threats: Warnings about account lockouts or security breaches requiring immediate action

- Authentication Requests: Requests for verification codes or personal information to “confirm your identity”

- Suspicious Links: URLs that look similar to legitimate websites but contain slight misspellings or unusual domains (like “

validtddobile.com” instead of a legitimate Arrowhead domain)

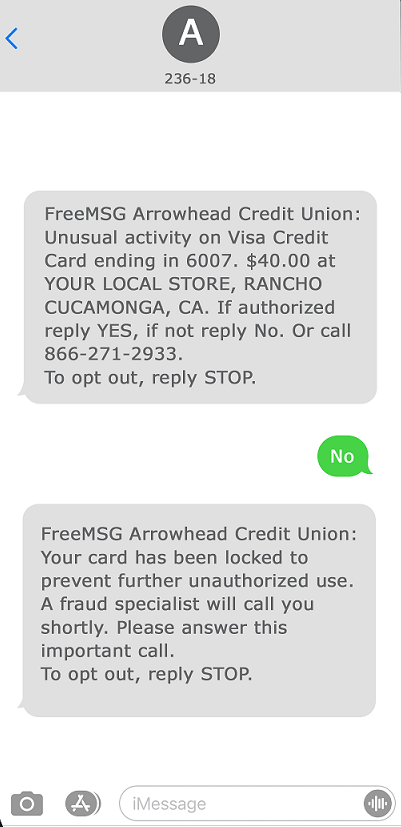

Fake Arrowhead Credit Union Text should look like:

FreeMSG Arrowhead Credit Union: Unusual activity on Visa Credit Card ending in 6007. $40.00 at YOUR LOCAL STORE, RANCHO CUCAMONGA, CA. If authorized reply YES, if not reply No. Or call 866-271-2933.

To opt out, reply STOP.

The messages are deliberately designed to create panic, prompting recipients to act quickly without careful consideration. The language typically contains a sense of urgency with phrases like “immediate action required,” “account suspension,” or “unauthorized transaction.”

Victims Share Their Experiences

“I received a call that looked like it was coming directly from Arrowhead’s official number,” reports Michael Sanchez, a longtime Arrowhead member. “The caller knew my name and said there was suspicious activity on my account. They only asked for the verification code that was sent to my phone – which seemed reasonable at the time.”

Sanchez later discovered that the scammers had used this code to access his account and transfer funds using Zelle. “I never thought I would fall for something like this, but they were so convincing. They knew enough about me to sound legitimate.”

Another victim, Rebecca Torres, received a text message claiming a $675 purchase had been made at an Apple Store using her Arrowhead debit card. “The text provided a link to ‘cancel’ the transaction. Fortunately, I remembered reading about these scams and called the credit union directly instead of clicking the link.”

These stories highlight a critical pattern: the scammers need only minimal information – often just a one-time verification code – to gain access to accounts. By creating a false sense of urgency, they manipulate victims into providing this crucial piece of information.

Official Statement from Arrowhead Credit Union

Arrowhead Credit Union has responded to the surge in scam attempts with an official statement and comprehensive educational resources for members.

“We take the security of our members’ accounts extremely seriously,” said a representative from Arrowhead’s security department. “We want to emphasize that Arrowhead Credit Union will never contact members requesting personal information, account numbers, banking or credit card numbers, PINs, or log-on credentials through email links, social media, or by any unsecured means.”

The credit union confirmed that legitimate fraud alerts from Arrowhead will always come from the number 23618 with “Arrowhead Credit Union” in the message. These alerts only ask “yes” or “no” questions and never request personal or account information.

For members concerned about potential fraud, the credit union recommends calling their official number at (800) 743-7228 during operating hours (Monday-Friday, 8am-6pm and Saturday, 9am-2pm) to verify any suspicious communications.

Red Flags: How to Identify Scam Attempts

Protecting yourself begins with recognizing the warning signs of fraudulent communications. Here are key red flags that indicate a message or call might be a scam:

- Urgent requests for immediate action

- Legitimate financial institutions rarely create extreme urgency

- Be suspicious of messages conveying that failure to act will result in financial loss

- Requests for verification codes or personal information

- Arrowhead will never ask for your PIN, password, or full Social Security number

- Legitimate text alerts only ask yes/no questions

- Suspicious links and callback numbers

- Official Arrowhead texts come from 23618

- Links should lead to arrowheadcu.org, not similar-looking domains

- Calls from spoofed phone numbers

- Even if caller ID shows Arrowhead’s number, be cautious

- When in doubt, hang up and call back using the official number

- Messages outside business hours

- Be extra cautious about urgent messages received outside Arrowhead’s operating hours

- Scammers often send messages at odd hours when verification is difficult

One community member reported, “I knew it was a scam when they texted me at 11 PM claiming to be from the fraud department. Arrowhead had previously informed us that their fraud team doesn’t operate that late.”

Protecting Yourself: A Comprehensive Defense Strategy

Taking proactive steps can significantly reduce your risk of falling victim to these sophisticated scams:

Immediate Actions If You Receive a Suspicious Message

- Never click links in unexpected texts or emails

- Don’t return calls to numbers provided in suspicious messages

- Contact Arrowhead directly using the number from their official website

- Report suspicious messages to Arrowhead and to your mobile carrier

Strengthening Your Account Security

- Enable multi-factor authentication on all financial accounts

- Set up fraud text alerts through Arrowhead’s official channels

- Register for account activity notifications to quickly identify unauthorized transactions

- Regularly monitor your accounts for suspicious activity

If You Think You’ve Been Compromised

If you suspect you’ve shared information with scammers:

- Contact Arrowhead immediately at (800) 743-7228

- Change your passwords for all financial accounts

- Place a fraud alert on your credit reports

- Monitor your accounts for unauthorized activity

- File a report with the Federal Trade Commission at IdentityTheft.gov

The Evolution of Financial Scams

“What makes these scams particularly effective is how they evolve with technology and current events,” explains Dr. Eleanor Chen, a cybersecurity expert at California State University. “They adapt their tactics based on what’s working and what’s not, creating increasingly convincing impersonations.”

The “Pay Yourself” scam represents one of the newest evolutions, where scammers convince victims they need to send money to themselves through Zelle to reverse fraudulent charges. In reality, the victims are unknowingly sending money directly to the scammers.

Another emerging threat is the “Phantom Hacker” scam, which unfolds in three phases with scammers impersonating tech support, financial institution representatives, and finally government officials – each phase designed to extract more money from the victim.

Community Vigilance: The First Line of Defense

Perhaps the most effective protection against these scams is community awareness and vigilance. By sharing information about scam attempts, credit union members create a network of educated consumers who can recognize and report fraud.

“After I nearly fell for a scam text, I made sure to tell everyone in my family about it,” says Arrowhead member James Martinez. “My sister got a similar message the following week but recognized it as a scam immediately because of our conversation.”

Community forums and social media groups have become valuable resources for sharing information about new scam attempts targeting Arrowhead members. These grassroots efforts complement the credit union’s official communications and help spread awareness faster than institutional updates alone.

Conclusion: Staying One Step Ahead

As scammers continue to refine their tactics, staying informed remains your best defense. Arrowhead Credit Union has implemented robust security measures and educational resources, but ultimately, each member’s awareness and caution provide the strongest protection against fraud.

Remember the golden rule of financial security: when in doubt, hang up and call the credit union directly using the number from their official website. A few minutes of verification can save thousands of dollars and countless hours of remediation efforts.

By understanding scammers’ tactics, recognizing red flags, and knowing how legitimate communications from Arrowhead should appear, you can protect yourself from becoming the next victim of these increasingly sophisticated scams.

For the latest information on scam prevention, visit Arrowhead Credit Union’s official website at arrowheadcu.org.