A sophisticated phishing campaign targeting Charles Schwab customers has emerged, leaving financial security experts concerned about its effectiveness and reach. The scam uses text messages that appear to come from Schwab’s fraud department, creating a false sense of urgency that has already cost victims thousands of dollars in fraudulent wire transfers. As these attacks become increasingly convincing, both customers and financial institutions must remain vigilant.

The Overview of the Schwab Text Scam

The scam begins with a seemingly legitimate text message claiming to be from “Charles Schwab Bank Fraud Department” or “Schwab Secure Services.” These messages alert recipients about alleged suspicious activity on their accounts, typically involving unauthorized transfers ranging from $2,500 to nearly $4,000. The messages create immediate anxiety by suggesting the recipient’s account has been compromised or that action is required to prevent account restrictions.

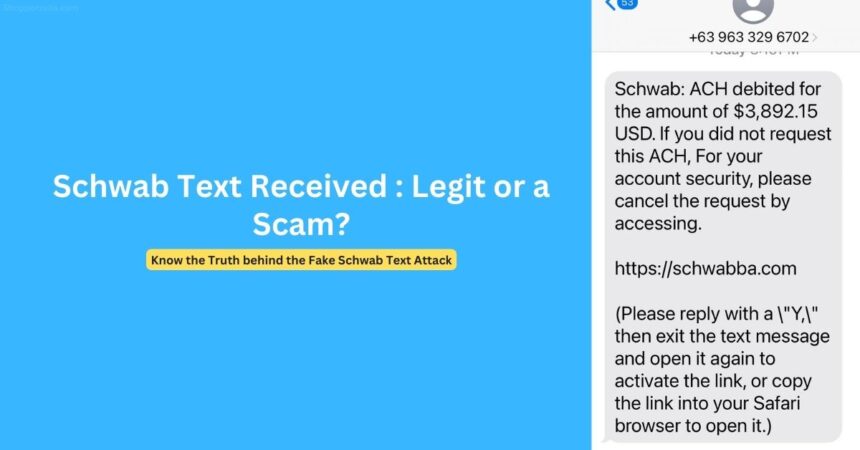

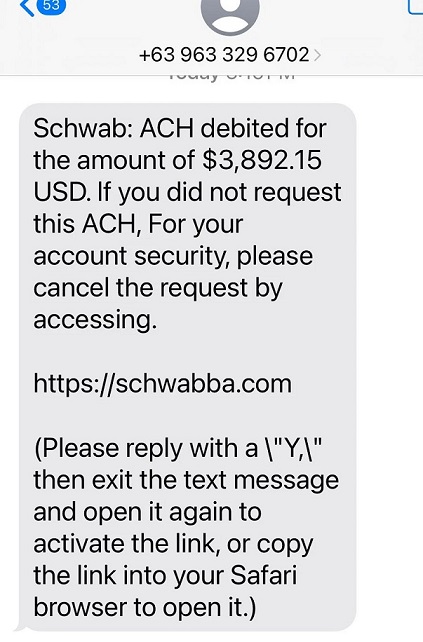

In one documented case, a victim received a text stating:

Schwab: ACH debited for the amount of $3,892.15 USD. If you did not request this ACH, For your account security, please cancel the request by accessing.

[Malicious Link]

(Please reply with a \”Y,\” then exit the text message and open it again to activate the link, or copy the link into your Safari browser to open it.)

another one received:

Charles Schwab Bank Fraud Dept: [Victim’s Name] Did You Make A Scheduled Transfer For $3,500.00 To Sophia Aarons Reply Yes or No. CA 345768/ To Opt Out Reply STOP

What makes this scam particularly effective is the personalization—scammers often include the victim’s actual name, making the message appear more legitimate. When victims respond “No,” the scammers quickly follow up with a phone call, posing as Schwab representatives who then guide victims through supposed “security measures” that actually result in fraudulent wire transfers.

Message Patterns, Fake Links and Variations

Security researchers have identified several common patterns in these fraudulent messages:

- Transaction Alert Pattern: Messages claim a suspicious ACH debit (often thousands of dollars) has occurred and prompt immediate action.

- Account Security Pattern: Texts warn that the recipient’s account requires “verification” or “security updates” to avoid restrictions.

- Confirmation Request Pattern: Messages ask the recipient to confirm or deny a transaction they didn’t make, establishing a pretext for further communication.

- Urgent Action Pattern: All messages create a sense of urgency, pushing recipients to act quickly rather than think critically.

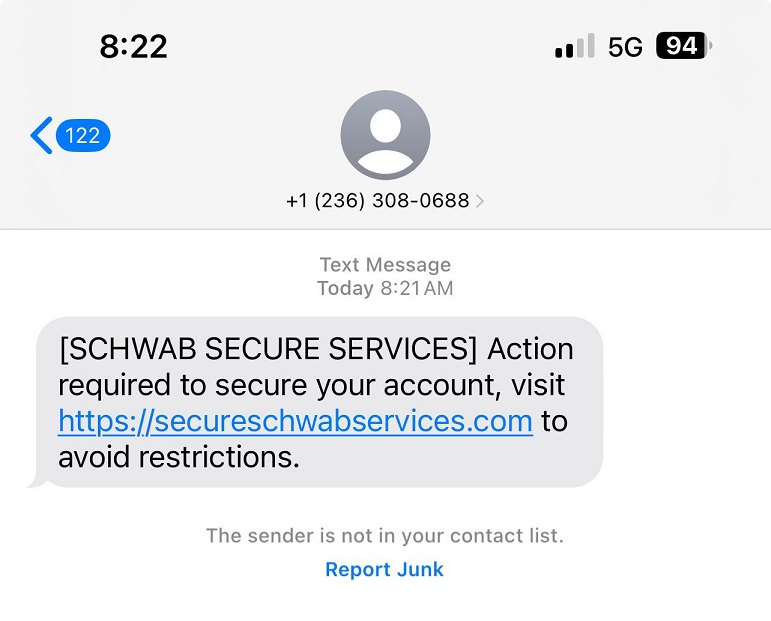

An example of fake Schwab message is like:

[SCHWAB SECURE SERVICES] Action required to secure your account, visit [Malicious Link] to avoid restrictions.

The malicious links included in these texts use deceptively similar domain names to Schwab’s official website. Examples include:

secureschwabservices.comschwbba.comschwabd.comschwbab.comschwabba.com

These domains are specifically designed to appear legitimate at first glance but contain subtle misspellings or additions that most users might overlook.

Official Statements from Charles Schwab

Charles Schwab has issued multiple security alerts regarding these scams. The company has explicitly stated that it:

- Does not notify clients via text message about completed transactions

- Does not send text messages from international numbers

- Will never ask customers to wire money to resolve fraud issues

- Never requires payment to correct fraudulent transactions

In a recent statement, a Schwab spokesperson emphasized: “Any text message claiming to be from Schwab that asks you to reply, click a link, or provide account information should be treated with extreme caution. When in doubt, don’t respond to the message and instead contact Schwab directly through our official channels.”

The company encourages customers to forward suspicious texts to [email protected] and report them immediately to their fraud department.

Red Flags: How to Identify Schwab Phishing Text Messages

Identifying these scams requires attention to several key warning signs:

Communication Method

- Text messages about account transactions – Schwab does not use text messages for transaction notifications

- Messages from international numbers – Schwab does not text from international numbers

- Unexpected calls following text messages – Legitimate institutions rarely follow this pattern

Message Content

- Unusual urgency – Creating pressure to act immediately

- Generic greetings – Even when they include your name, they lack account-specific details

- Grammatical errors – Look for unusual capitalization, punctuation, or phrasing

- Request to reply with “Y” or “Yes/No” – Legitimate companies rarely use this format

Links and Domains

- Non-Schwab domains – Legitimate Schwab communications use subdomains of schwab.com

- Similar but incorrect URLs – Look for extra words or subtle misspellings

- Shortened URLs – These can mask the actual destination

Request Types

- Requests for wire transfers – Particularly alarming red flag

- Requests to “verify” personal information – Legitimate institutions rarely request this via text

- Instructions to download apps or software – Another tactic to install malware

How to Protect Yourself from Phishing Scams

Taking proactive measures can significantly reduce your risk of falling victim to these sophisticated scams:

Implement Personal Security Measures

- Silence unknown callers on your cell phone

- Never click links in text messages claiming to be from financial institutions

- Use official apps rather than links for accessing financial accounts

- Set up account alerts for transactions over certain amounts

- Enable two-factor authentication on all financial accounts

Verify Communications

- Contact Schwab directly using numbers from official sources (statements, back of card, official website)

- Ask for case ID numbers for any suspicious alerts

- Verify the actual sender’s address or number by checking carefully

- Question urgency – Legitimate security issues allow time for proper verification

Respond Appropriately to Suspected Scams

- Do not respond to suspicious texts or emails

- Document the communication with screenshots (including sender information)

- Report to Schwab by forwarding to [email protected]

- File reports with:

- Federal Trade Commission (reportfraud.ftc.gov)

- FBI’s Internet Crime Complaint Center (www.ic3.gov)

- Your local police department

If You’ve Already Responded

- Contact Schwab immediately at their official fraud number

- Change your passwords for all financial accounts

- Place a credit freeze with major credit bureaus

- Run antivirus and anti-malware scans on your devices

The Broader Threat Landscape

The Schwab text scams represent just one facet of a growing trend in financial fraud. These attacks are increasingly sophisticated, using social engineering tactics that exploit human psychology rather than technical vulnerabilities. The scammers understand that creating emotional responses—fear, urgency, concern about financial security—short-circuits critical thinking.

“These scammers are employing what we call ‘spray and pray’ tactics,” explains cybersecurity expert Maya Johnson. “They send thousands of messages without knowing if recipients have Schwab accounts. But when they find someone who does, the scam suddenly seems eerily legitimate.”

Financial institutions across the industry are seeing similar patterns. The scams typically increase during tax season and other predictable financial events when consumers might be more likely to expect legitimate communications about their accounts.

The Technology Behind the Scams

The technological sophistication of these scams continues to evolve. Modern scammers use:

- Spoofed phone numbers that appear to be from legitimate area codes

- AI-generated text that mimics official communication styles

- Domain registration services in countries with limited oversight

- Temporary hosting solutions that disappear shortly after the scam

These technical elements make tracing and shutting down the operations increasingly difficult for law enforcement.

Impact on Fake Schwab Text Victims

The financial and emotional impact of these scams can be devastating. Victims have reported losses ranging from $2,500 to over $11,000 in recent cases. Unlike some other forms of fraud, wire transfers are particularly difficult to reverse once completed.

Beyond the financial loss, victims often experience emotional distress, embarrassment, and damaged trust in financial institutions. Mental health professionals who work with scam victims report that the psychological impact can be significant, particularly for older adults who may already feel vulnerable to technological threats.

Looking Forward: The Evolution of Security

As scammers evolve their tactics, both financial institutions and consumers must adapt their security practices. Schwab and other financial services companies are increasingly investing in:

- Advanced behavioral analytics to detect unusual account activity

- Improved customer education about emerging threats

- Enhanced authentication processes that don’t rely solely on personal information

- Cross-industry collaboration to identify and respond to new scam patterns

For consumers, developing “digital skepticism” remains the most powerful defense. Adopting a verification-first mentality with all unexpected communications—regardless of how legitimate they appear—is essential in today’s threat landscape.

Remember: When in doubt, hang up or delete the message and contact your financial institution directly through verified channels. No legitimate financial institution will ever pressure you to act immediately without proper verification.