In recent months, a sophisticated text message scam impersonating Citizens Bank has targeted thousands of consumers across the country. With careful social engineering and increasingly convincing tactics, these fraudsters aim to steal sensitive information, drain bank accounts, and commit identity theft. From fake “Quest Checking” alerts to “Private Client Checking” notifications, “TCB MOREHEAD” warnings, and “TCB ALERT” messages, these scams continue to evolve in their presentation. This comprehensive exposé reveals how these scams work, what to watch for, and how to protect yourself from becoming the next victim.

The Overview of the Citizens Bank Scam Text

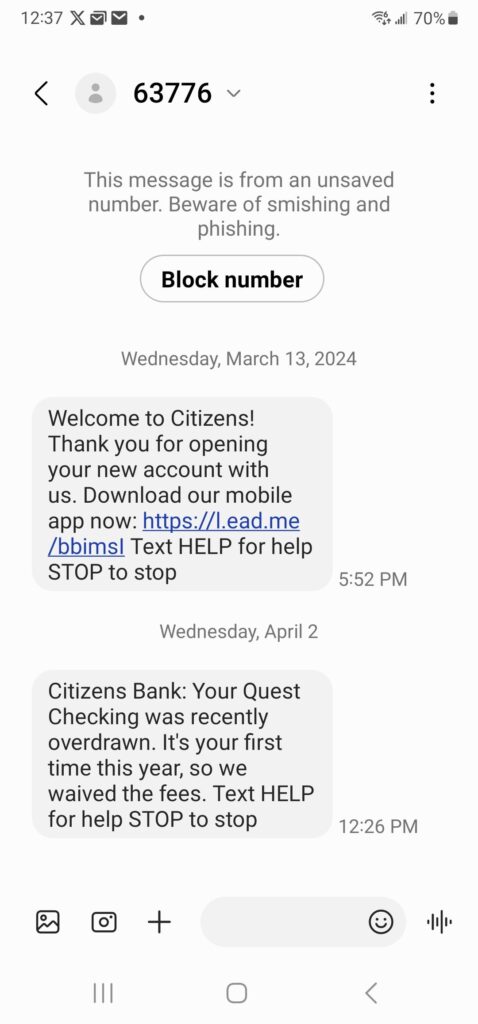

The Citizens Bank text message scam typically follows a calculated pattern designed to create urgency and fear. Fraudsters send texts claiming to be from Citizens Bank, often using phone numbers that appear legitimate or shortcodes like “63776” that mimic official bank communications.

These messages generally fall into several categories:

- Suspicious charge alerts – Messages with “TCB MOREHEAD” headers warning of large purchases (often $700-$800) at unfamiliar merchants like “Pay2Gate,” prompting immediate action

- Overdraft notifications – “Quest Checking” alerts about account overdrafts with “waived fees” as a first-time courtesy

- New account confirmations – Welcome messages for accounts you never opened, often followed by problem scenarios weeks later

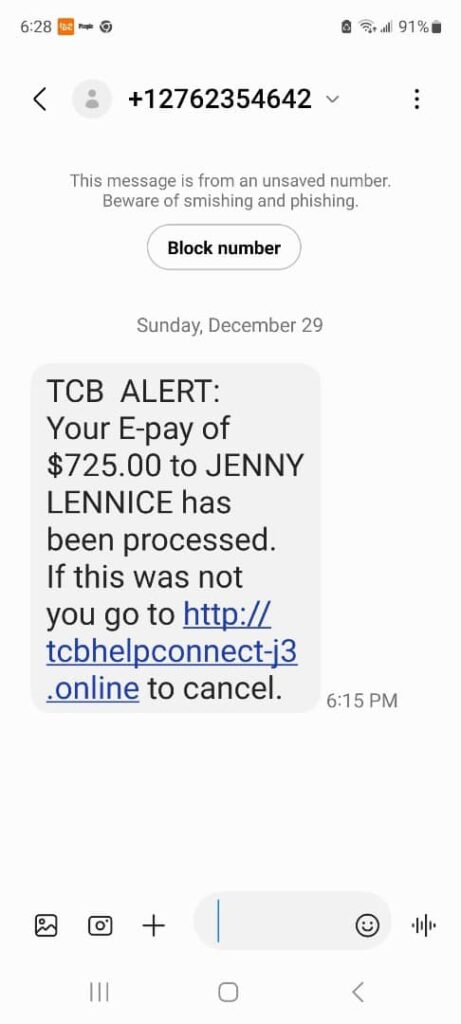

- Payment processing alerts – “TCB ALERT” notifications about payments supposedly sent to unfamiliar individuals like “JENNY LENNICE”

- Premium service notifications – “Private Client Checking” alerts suggesting unauthorized access to high-value banking services

Each message includes urgent language and suspicious links using domains like “mydigitalapptcb-1f.online” or “tcbhelpconnect-j3.online” – websites designed to steal your login credentials, personal information, and ultimately, your money.

What makes these scams particularly effective is their multi-stage approach. Rather than immediately requesting sensitive information, they first establish a scenario that requires your attention, then guide you toward compromising your security through seemingly helpful actions.

The Evolving Sophistication of Banking Scams

Banking scams have evolved dramatically from the crude phishing attempts of years past. Today’s fraudsters employ sophisticated psychological tactics and technology to create convincing deceptions.

“What we’re seeing is a dramatic evolution in how these scams are structured,” explains cybersecurity expert Miranda Chen. “Rather than immediately asking for sensitive information, scammers create a narrative that unfolds over days or even weeks, establishing credibility before making their move.”

The Citizens Bank scam exemplifies this evolution through several advanced tactics:

- Sequential messaging – Initial “welcome” texts followed by problem scenarios weeks later

- Emotional manipulation – Creating fear about unauthorized charges or relief about waived fees

- Official-looking domains – URLs that incorporate bank abbreviations and official-sounding terms

- Minimal action requests – Simply asking victims to text “HELP” rather than immediately requesting credentials

This evolution makes these scams significantly more dangerous than their predecessors. Even tech-savvy consumers can fall victim when the communication seems legitimate and the red flags are subtle.

Real-World Examples: Specific Scam Texts Claiming to Be from Citizens Bank in Circulation

Several specific variations of the Citizens Bank scam have been documented and reported by consumers. Understanding these real examples can help you identify similar attempts:

The “Quest Checking” Overdraft Scam

One of the most common variations presents itself as an overdraft notification:

Citizens Bank: Your Quest Checking was recently overdrawn. It’s your first time this year, so we waived the fees. Text HELP for help STOP to stop

This text appears helpful and non-threatening, which makes it particularly deceptive. If recipients text “HELP,” they often receive follow-up messages directing them to call a fraudulent number or visit a phishing website.

The “TCB MOREHEAD” Payment Alert

Another prevalent variant uses urgency to prompt immediate action:

TCB MOREHEAD: You’re about to make a $794 charge at Pay2Gate. If this is not you, please cancel here: http://mydigitalapptcb-1f.online

The inclusion of a specific dollar amount and merchant name lends credibility to the message, while the time-sensitive nature of the “about to” language creates panic.

The “TCB ALERT” Payment Processing Scam

This version claims a payment has already been processed:

TCB ALERT: Your E-pay of $725.00 to JENNY LENNICE has been processed. If this was not you go to http://tcbhelpconnect-j3.online to cancel.

By including a specific recipient name and exact dollar amount, scammers make the message appear more legitimate.

The “Private Client Checking” Premium Service Scam

A newer variation targets high-value customers with messages about exclusive banking services:

ALERT: Unusual login detected on your Private Client Checking privileges. If this wasn’t you, secure your account here: [malicious link]

This approach is particularly effective because it suggests the victim has premium banking status, appealing to their sense of status while creating alarm about unauthorized access.

How the Scam Progresses: From Text to Financial Loss

To understand the real-world consequences of these scams, consider how they typically progress from initial contact to financial loss:

- Initial contact – You receive a text message appearing to be from Citizens Bank about a suspicious charge, overdraft, or new account

- Engagement – You click the provided link or reply with “HELP” as prompted

- Credential theft – The link leads to a convincing but fake Citizens Bank login page where you enter your username and password

- Personal information harvesting – After logging in, you’re asked to “verify your identity” by providing additional information like your Social Security number, date of birth, or card details

- Account takeover – With this information, fraudsters access your real accounts, change passwords, and begin transferring funds

- Delay tactics – Sophisticated scammers might enable email forwarding to intercept bank communications, delaying your awareness of the theft

This progression can happen remarkably quickly. In many cases, victims lose thousands of dollars before realizing they’ve been scammed. Recovery options are often limited, making prevention crucial.

How to Identify Fraudulent Bank Communications

Recognizing the warning signs of fraudulent bank communications is your first line of defense. While scammers continuously refine their tactics, several red flags remain consistent:

Linguistic and Visual Cues

- Spelling and grammar errors – Though professional scammers have improved, unusual phrasing or errors often appear

- Mismatched branding – Slight differences in logos, colors, or formatting from official bank communications

- Generic greetings – Messages beginning with “Dear Customer” rather than your name

- Unusual sender information – Numbers or email addresses that don’t match official bank contact information

Content and Request Red Flags

- Urgent action required – Creating false time pressure to force hasty decisions

- Threats of negative consequences – Warnings about account freezes or penalties

- Requests for verification – Asking for information the bank already has

- Suspicious links – URLs that don’t match the official bank website

- Requesting sensitive information – Banks will never ask for complete account numbers, passwords, or one-time passcodes via text or email

As one Citizens Bank representative confirmed, “We will never ask customers to click on links through text messages or provide their account numbers through these channels. Any such request should be treated as suspicious.”

Case Study: The Multi-Stage “Quest Checking” Scam

One particularly sophisticated version of the Citizens Bank scam involves multiple messages over time:

Stage 1: Account Creation (March 13, 2025)

Welcome to Citizens! Thank you for opening your new account with us. Download our mobile app now: https://l.ead.me/bbimsl Text HELP for help STOP to stop

Stage 2: Problem Scenario (April 2, 2025)

Citizens Bank: Your Quest Checking was recently overdrawn. It’s your first time this year, so we waived the fees. Text HELP for help STOP to stop

This multi-week approach is particularly effective because:

- The time gap between messages makes it appear more legitimate

- The initial message establishes a foundation for the second message

- The second message creates a problem scenario that requires action

- The seeming generosity of “waiving fees” reduces suspicion

Many victims who received the first message but didn’t respond might believe the second message is legitimate since they remember receiving the first one—even if they never actually opened an account.

Protection Strategies: Safeguarding Your Financial Information

Protecting yourself from bank texting scams requires vigilance and following established security practices:

Immediate Steps If You Receive a Suspicious Message

- Don’t click links or reply – Even responding with “STOP” or “HELP” can confirm your number is active

- Contact your bank directly – Use the phone number on your card or from the official website, not numbers provided in the message

- Forward suspicious texts – Report phishing texts to your mobile carrier by forwarding to 7726 (SPAM)

- Report to authorities – File reports with the FTC at ReportFraud.ftc.gov and the FBI’s Internet Crime Complaint Center (IC3)

Preventative Measures

- Enable two-factor authentication – This adds an additional security layer to your accounts

- Set up bank alerts – Legitimate notifications for account activities help you spot unauthorized transactions

- Regularly monitor accounts – Check your transactions frequently to catch suspicious activity early

- Update contact information – Ensure your bank has your current phone number and email to contact you if they detect fraud

- Use unique passwords – Never reuse passwords across financial accounts

- Consider a password manager – These tools help maintain strong, unique passwords for all accounts

As cybersecurity expert Dr. James Rivera notes, “The most effective defense against these scams is a healthy skepticism combined with proper security hygiene. When in doubt, go directly to your bank through official channels rather than responding to inbound communications.”

What Banks Are Doing to Combat Text Scams

Financial institutions like Citizens Bank are actively working to combat the rising tide of text scams. Their approaches include:

- Customer education campaigns – Increasing awareness through website alerts, statement messages, and social media

- Enhanced authentication systems – Implementing additional security layers to prevent unauthorized access

- Fraud monitoring tools – Using AI to detect unusual patterns and potentially fraudulent activity

- Collaboration with law enforcement – Working with federal agencies to track and prosecute scammers

- Reporting mechanisms – Creating dedicated channels for customers to report suspicious communications

Many banks have also established specialized fraud response teams to assist customers who fall victim to scams. Citizens Bank, for example, encourages customers to contact them immediately at 1-800-922-9999 if they believe they’ve provided information to scammers.

The Future of Banking Security in an Age of Sophisticated Scams

As scammers continue to refine their tactics, the future of banking security will likely involve both technological advancements and increased customer vigilance.

“We’re entering an era where artificial intelligence will play a significant role on both sides of this equation,” explains fintech security analyst Dr. Priya Sharma. “Banks will deploy more sophisticated AI to detect fraud, while unfortunately, scammers will use similar technology to create more convincing deceptions.”

Future security measures may include:

- Behavioral biometrics – Authentication based on your typing patterns, device handling, and other unique behaviors

- Advanced fraud detection algorithms – Systems that can identify suspicious patterns across multiple accounts and institutions

- Blockchain verification – Using distributed ledger technology to verify communications authenticity

- Enhanced customer verification systems – More sophisticated but user-friendly ways to confirm identity

Until these advanced systems become standard, the most effective protection remains educated consumers who understand the risks and follow security best practices.

Conclusion: Vigilance as the Ultimate Defense

The Citizens Bank text scam represents just one example of the sophisticated fraud techniques targeting consumers today. As these scams continue to evolve, maintaining awareness and skepticism toward unexpected communications remains your best defense.

Remember the golden rule of financial security: legitimate banks will never ask you to provide sensitive information through unsolicited texts or emails. When in doubt, contact your financial institution directly through official channels you can verify independently.

By understanding the tactics fraudsters use, recognizing the warning signs, and following security best practices, you can significantly reduce your risk of becoming the next victim of increasingly sophisticated banking scams.