Top 10 Best Banks in India : The banking system handles all the finances of any country together with credit and cash flow. However, India has a well-built banking and financial industry and this is one of the most dominant sectors in India’s economy. India’s banking sector has been revealed to the world’s market after the economic liberalization in 1991. At that time, a lot of major changes happened in Indian Banking history. The use of computers driven to the initiation of online Internet banking in India.

Now, the Banking of India has been changed a lot and it is changing day by day to secure their customer’s cash and privacy. However, in this in-depth article, we will discuss the Top 10 Largest & Best Banks in India.

Top 10 Best Banks in India (2020)

India has a total of 12 public sector banks (reduced from 27) & 22 private sector banks. Moreover, it has 3 Local area banks, 10 Small Finance Banks, 6 Digital Payments Banks, 45 Regional Rural Banks (RRBs), 33 State Co-operative Banks (SCBs) & 54 Urban Co-operative Banks (UCBs). We have listed below all the top 10 best & largest banks in India.

- State Bank of India (SBI)

- HDFC Bank Limited

- Bank of Baroda

- ICICI Bank

- Axis Bank

- Punjab National Bank (PNB)

- Kotak Mahindra Bank

- Bandhan Bank

- Canara Bank

- Indian Bank

1. State Bank of India (SBI)

The State Bank of India (SBI) is one of the best service and largest public sector banks (PSB) in India. It is a government-owned no.1 bank in India that was formerly known as the Imperial Bank of India. SBI holds 236th rank in the Global 500 list of world’s largest corporations in 2019. Its chairperson is Rajnish Kumar.

SBI has almost every kind of product which a banking or financial corporation holds. It has Retail banking, corporate / industrial banking, mortgage loans, investment banking, private banking, credit cards, finance & insurance, and wealth management.

SBI has a total asset of ₹36.80914 trillion (US$520 billion) (2019). In response to its total asset, we have listed SBI as the largest and best banks in India. In the financial year 2018-19, it had a net income of ₹8.62 billion (US$120 million) and had an operating income of ₹554.36 billion (US$7.8 billion). SBI has over 24000 branches in India and 257,252 employees are working with SBI (before March 2019).

2. HDFC (The Housing Development Finance Corporation) Bank Limited

HDFC Bank Limited is the largest and best service private sector bank in India by assets and the largest bank in India by its market capitalization beginning in March 2020. It was founded in August 1994 with the tagline of [wpsm_highlight color=”yellow”]”We understand your world”[/wpsm_highlight]. HDFC holds 60th ranks on BrandZ Top 100 Most Valuable Global Brands in 2019. Its non-exe chairperson is Shyamala Gopinath and the managing director is Aditya Puri.

HDFC has almost every kind of product which a banking or financial corporation offers. Therefore, It has Retail banking, Credit cards, wholesale banking, finance and insurance, auto loans, two-wheeler loans, personal loans, mortgage loans, private banking, investment banking, wealth management, consumer durable loan, lifestyle loan, private equity, etc.

HDFC has a total asset of ₹1,189,432 crores (US$170 billion) (2019). In response to its total asset, we have listed SBI as the 2nd largest and the second best banks in India. In the financial year 2018-19, it had a net income of ₹21,078 crores (US$3.0 billion) and had an operating income of ₹23,263 crores (US$3.3 billion). HDFC has over 5500 branches over 2,764 cities in India and 104,154 employees are working with HDFC (as of June 30, 2019).

3. Bank of Baroda (BOB)

Bank of Baroda the second largest and best service public sector bank in India which is owned by the Government of India. It was founded by Sayajirao Gaekwad III on 20 July 1908. It holds 1145 ranks on Forbes Global 2000 list in 2019. Its chairperson is Hasmukh Adhia. However, Sanjiv Chada holds the rank of the managing director and CEO in Bank of Baroda.

Bank of Baroda has almost every kind of facilities which a banking or financial sector offers. Therefore, It has Consumer banking, finance & insurance, corporate banking, investment banking, property against loans, private banking, private equity, savings & Securities, asset management, wealth management, etc.

BOB has a total asset of ₹719,999 crores (US$100 billion) (2019) and equity of ₹530 crores (US$74 million). In the financial year 2018-19, it had a net income of ₹-2,431 crore (US$−340 million) and had an operating income of ₹1,664 crores (US$230 million). Therefore, a total revenue comes ₹50,305 crores (US$7.1 billion) from BOB in 2019. BOB has over 9583 branches in India and outside India and 10442 ATMs are running as of July 2017. However, 85,135 employees are working with Bank of Baroda (as of 2019).

4. ICICI Bank (Industrial Credit and Investment Corporation of India)

ICICI Bank is the second largest and best service private sector bank in India by its assets and market capitalization. It was founded on 5 January 1994. It has 5,275 branches and 15,589 ATMs over India and has a presence in 16 other countries outside India. However, 84,922 employees are working with ICICI Bank (as of 2019). Its chairperson is Girish Chandra Chaturvedi. However, Sandeep Bakhshi holds the rank of the managing director and CEO of ICICI Bank.

ICICI Bank has almost every kind of facilities which a banking or financial sector must have. Therefore, It has Consumer banking, wholesale banking, investment banking, property against loans, wealth management, private banking, finance & insurance, credit cards, etc.

ICICI has a total asset of ₹1,007,068 crores (US$140 billion) (as of 2019). In the financial year 2018-19, it had a net income of ₹6,709 crores (US$940 million) and had an operating income of ₹20,711 crores (US$2.9 billion). Therefore, a total revenue comes ₹67,803 crores (US$9.5 billion) from ICICI in 2019.

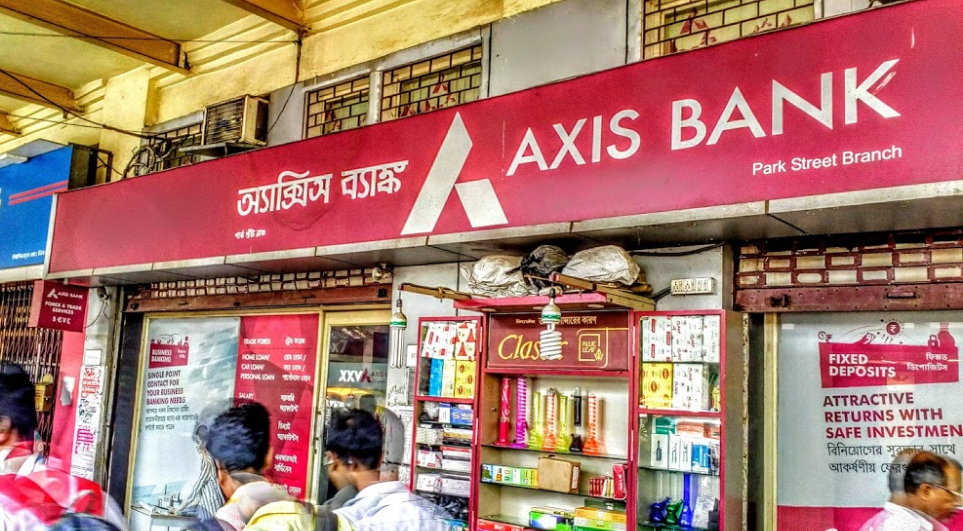

5. Axis Bank

Axis Bank is the third-largest private sector bank in India that provides financial services to large and mid-size corporates, SME and retail businesses. It was founded in 1993. It has 4,050 branches, 11,801 ATMs and 4,917 cash recyclers over India as of 31 March 2019 and has a presence of 9 international offices. However, over 72000 employees are serving for Axis Bank (as of 2019). Its chairperson is Shri Rakesh Makhija. However, Amitabh Chaudhry holds the rank of the managing director and CEO of Axis Bank.

Axis Bank has almost every kind of product which a banking or financial sector offers. Therefore, It has Retail Banking, Corporate Banking, property against loans, investment banking, International banking, asset management, finance & insurance, card services, savings, wealth management, Home Loans, wholesale banking, private banking, credit cards, etc.

Axis Bank has a total asset of ₹8.00997 trillion (US$110 billion) (as of 2019). In the financial year 2018-19, it had a net income of ₹46.77 billion (US$660 million) and had an operating income of ₹190.05 billion (US$2.7 billion).

6. Punjab National Bank (PNB)

Punjab National Bank (PNB) is going to be the second-largest public sector bank in India after merging the United Bank of India (UBI) and Oriental Bank of Commerce in 2020. It provides all the major financial services to large and mid-size corporates, SME and retail businesses. It was founded on 19 May 1894 by Dyal Singh Majithia and Lala Lajpat Rai. Punjab National Bank has a total of 11.5 crores customers, 7,037 branches, and 9,071 ATMs over India as of June 2019. However, over 70,810 employees are serving for Punjab National Bank (as of 2019). Its chairperson is Sunil Mehta. However, S. S. Mallikarjuna Rao holds the rank of the managing director and CEO of PNB.

Punjab National Bank has almost every kind of product which a banking or financial sector offers. Therefore, It has Retail Banking, Credit cards, commercial banking, finance and insurance, investment banking, loans against property, private banking, private equity (PE), wealth management, etc.

PNB has a total asset of ₹774,949 crores (US$110 billion) (as of 2019). In the financial year 2018-19, it had a net income of ₹-9,975 crore (US$−1.4 billion) and had an operating income of ₹12,995 crores (US$1.8 billion). Therefore, a total revenue comes ₹58,688 crores (US$8.2 billion) from PNB in 2019.

7. Kotak Mahindra Bank

Kotak Mahindra Bank is the second-largest and best service private sector bank in India by market capitalization. It was founded in February 2003 by Uday Kotak. Its chairperson is Prakash Apte. However, Uday Kotak holds the rank of the managing director and CEO of Kotak Mahindra Bank. It has over 1,261 branches, across India as of 2015. However, over 33,013 employees are serving for Kotak Mahindra Bank (as of 2017).

Kotak Mahindra Bank has almost every kind of product which a banking or financial sector provides. Therefore, It has personal finance, general insurance, investment banking, life insurance, wealth management, etc.

Kotak has a total asset of 31 billion US dollars (as of 2019). In the financial year 2018-19, it had a net income of 560 million US dollars and had an operating income of 1.2 billion US dollars. Therefore, a total revenue comes 4.1 billion US dollars from Kotak Mahindra Bank in 2019.

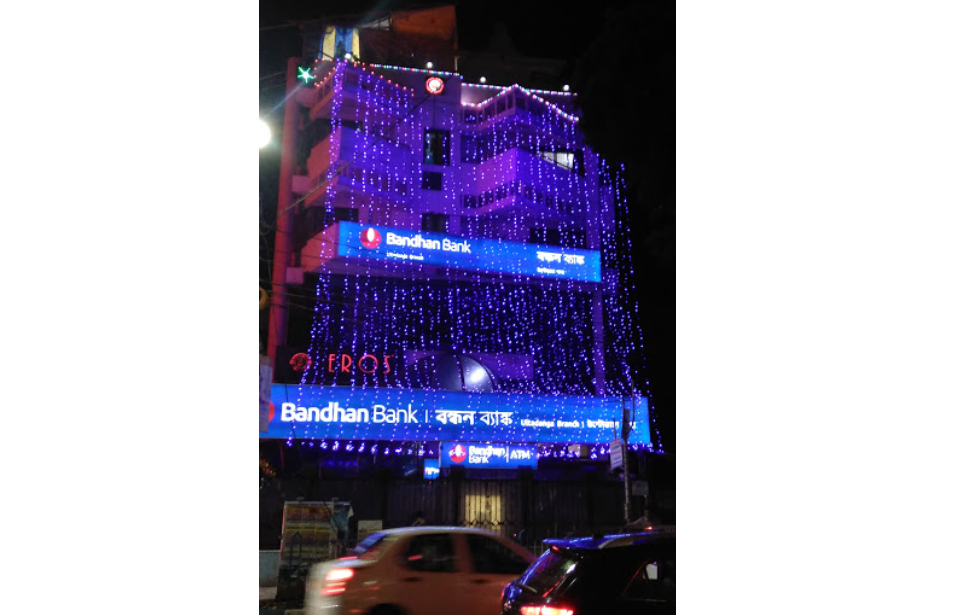

8. Bandhan Bank

Bandhan Bank is one of the best private service bank in India. It was founded on 23 August 2015 by Chandra Shekhar Ghosh with the slogan of [wpsm_highlight color=”yellow”]”Aapka Bhala, Sabki Bhalai”[/wpsm_highlight]. Its chairperson is Dr. Anup Kumar Sinha. However, Chandra Shekhar Ghosh holds the rank of the managing director and CEO of Bandhan Bank. It has over 1.9 crore customers, 1,009 branches, 3,084 Doorstep Service Centres, across India. However, over 37,331 employees are serving for Bandhan Bank (as of 2019).

Bandhan Bank has almost every kind of product which a banking or financial sector must-have. Therefore, It has personal finance, loans, investment banking, life insurance, retail banking, wealth management, etc.

Bandhan Bank has a total asset of ₹30,236.09 crores (US$4.2 billion) (as of 2017). In the financial year 2016-17, it had a net income of ₹1,111.95 crores (US$160 million) and had an operating income of ₹1,704.47 crores (US$240 million).

9. Canara Bank

Canara Bank is one of the best public service government nationalized bank in India. It was founded in 1906 with the slogan of [wpsm_highlight color=”yellow”]”Together We Can”[/wpsm_highlight]. Its chairperson is T. N. Manoharan. However, Lingam Venkat Prabhakar holds the rank of the managing director and CEO of Canara Bank. It has over 6310 branches and more than 8851 ATMs across India. However, over 58,350 employees are serving for Canara Bank (as of March 2019).

Canara Bank has almost every kind of product which a banking or financial sector offers. Therefore, It has Investment Banking, Retail Banking Corporate Banking, Consumer Banking, Private Banking, Wealth Management, Pensions, Mortgages Loans, Credit Cards, etc.

Canara Bank has a total asset of ₹711,782 crores (US$100 billion) (as of 2019). In the financial year 2018-19, it had a net income of ₹547 crores (US$77 million) and had an operating income of ₹10,461 crores (US$1.5 billion). Therefore, a total revenue comes ₹54,269 crores (US$7.6 billion) from Canara Bank in 2019.

10. Indian Bank

Indian Bank is one of the best public service government nationalized banks in India. It was founded on 15 August 1907 by S. Rm. M. Ramaswami Chettiar. However, Ms. Padmaja Chunduru holds the rank of the managing director and CEO of the Indian Bank. It has over 2900 branches, over 2861 ATMs and 1014 cash deposit machines across India. However, over 20,924 employees are serving for Indian Bank (as of 2018).

Indian Bank has almost every kind of service which a banking or financial sector provides. Therefore, It has Retail Banking, Commercial Banking, Finance and Insurance, Mortgage Loans, Investment banking, Private banking, Private equity (PE), Savings, asset management, Merchant banking, Credit cards, etc.

Indian Bank has a total asset of ₹402,981 crores (US$56 billion) (as of 2018). In the financial year 2017-18, it had a net income of ₹1,356.10 crores (US$190 million) and had an operating income of ₹19,746.72 crores (US$2.8 billion). Therefore, a total revenue comes ₹21,689.67 crores (US$3.0 billion) from Indian Bank in 2018.

Also Read:

- Top 10 Best Wildcraft Backpacks in India For Students & Daily Travelers

- 10 Best Printer Under ₹10000 In India For Home & Office Use

We have covered all the top 10 best banks in India in this article. We have this article helped you by giving proper knowledge of Top 10 Best and largest banks in India. However, you can share your opinion about the best bank in India. Still, if you’re facing any problem don’t hesitate to mail us [email protected]

SBI is one of my fav bank…